Netflix's The Irishman Becomes an Instant Hit in the U.S.

Netflix’s NFLX mob drama, The Irishman attracted 17.1 million unique viewers in its first five days of availability, according to TV-ratings firm Nielsen, per a Reuters report.

The Irishman examines organized crime in mid-century America. The movie directed by Martin Scorsese has Robert De Niro and Al Pacino starring as leads.

Released on Nov 27, the 3.5-hour long mafia epic attracted 3.9 million unique viewers in the United States on the first day, with 20% of the audience comprising men in the 50-64 years age bracket.

Nielsen says 751,000 people finished the movie on premiere day with 930,000 reporting the highest for the weekend.

Moreover, per Nielsen SVOD Content Ratings Data, the movie registered average minute audience of 13.2 million in the United States between Nov 27 and Dec 1.

The audience age decreased over the five-day period, according to Nielsen, settling to average of 49, similar to the audience makeup for Season 2 of The Crown.

Per The Hollywood Reporter, The Irishman drew a wider five-day audience than Breaking Bad follow-up El Camino that reported 8.2 million viewers.

However, the movie fell behind Netflix’s best-performing original film released in December 2018, Bird Box, which per a Variety report, recorded nearly 26 million U.S. viewers in its first seven days of availability on Netflix.

According to the Jakarta Post, The Irishman’s cast and crew are expected to be nominated for multiple Golden Globe awards when nominations are announced in Los Angeles on Dec 9. Notably, Oscar nominations will be announced on Jan 13.

Diverse Content to Strengthen Competitive Position

The impressive viewership of The Irishman reflects Netflix’s content portfolio strength.

However, Netflix has been severely affected by negative headlines related to increasing competition in the streaming space. Notably, Apple AAPL launched its much-anticipated Apple TV+ on Nov 1, which was followed by Disney’s DIS Disney+. Other notable upcoming services include NBCUniversal’s Peacock and HBO max.

Moreover, Amazon AMZN has been taking initiatives to fortify its presence in the streaming space through its Prime video service.

However, Netflix plans to counter rising competition on the back of robust content portfolio and binge viewing.

The content slate for the fourth quarter includes shows and movies like The Crown, The Witcher, The Irishman from Martin Scorsese and action movie 6 Underground, directed by Michael Bay and starring Ryan Reynolds.

Other notable releases include Marriage Story (starring Scarlett Johansson and Adam Driver), The Two Popes (featuring Anthony Hopkins and Jonathan Pryce), Dolemite is My Name (starring Eddie Murphy and Da’Vine Joy Randolph), Steven Soderbergh’s The Laundromat (starring Meryl Streep and Gary Oldman) and The King (starring Timothee Chalamet, Lily-Rose Depp and Joel Edgerton). The slate also includes animated movies Klaus and I Lost My Body.

Netflix’s Expensive Content Strategy Concerns

Netflix is set to produce more original shows, in a bid to retain its market share amid declining subscriber base and stiff competition, which, in turn, is likely to escalate its content cost in the near term.

Netflix is estimated to spend $15 billion this year on content compared with $12 billion spent in 2018. Notably, the company spent $159 million on The Irishman.

Notably, the company last borrowed $2.24 billion of junk bonds in April, 2019. Per a recent Bloomberg report, the company is set to offer $2 billion worth of bonds between euros and dollars for general corporate purposes, which may include content acquisitions, production and development and potential acquisitions.

As Netflix continues to finance its original content, investors can expect the new projects to weigh on the company’s bottom line.

The streaming service provider expects its operations and investments to burn $3.5 billion in cash in 2019. Notably, Netflix reported free cash outflow of $551 million in third-quarter 2019.

Meanwhile, Netflix recently struck a multi-year deal with Viacom’s division Nickelodeon to produce original animated movies and series for the streaming giant based on kids television network's library of characters as well as new IP.

Moreover, as Netflix continues to make huge investments for programming, it also has massively increased marketing spending largely to promote the originals. Marketing expenses (10.6% of revenues) increased 8.5% year over year to $553.8 million in third-quarter 2019.

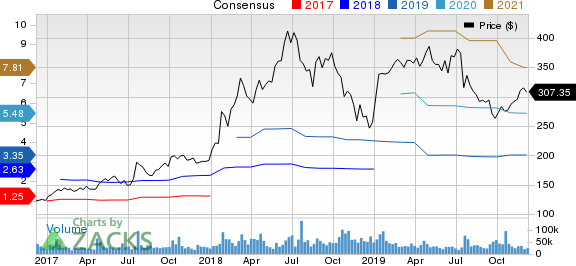

Netflix currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Click to get this free report The Walt Disney Company (DIS) : Free Stock Analysis Report Amazon.com, Inc. (AMZN) : Free Stock Analysis Report Netflix, Inc. (NFLX) : Free Stock Analysis Report Apple Inc. (AAPL) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance