Netflix’s ‘Bird Box’ and ‘You’ prove to be key to its dominance — and survival

Netflix CEO Reed Hastings took a bit of a victory lap in the company’s latest earnings report Thursday.

Despite missing revenue expectations for the quarter, Netflix’s latest originals took center stage because of its mainstream success. As the company gears up to face an onslaught of new streaming competitors in Disney, Comcast, and the merged AT&T and Time Warner (just to name a few) there’s a big reason why: its survival depends on it.

First, there’s a caveat. The term “Netflix original” has been stretched by the company to also include repurposed content available for streaming on Netflix. As you can see with the success enjoyed by acquired titles like “You,” which first premiered on Lifetime before Netflix bought the rights, it played a crucial part in how Netflix is presenting itself.

Comments throughout its latest earnings report reveal a shift in what Netflix wants to be. No longer is it just another streaming service gearing up for battle with other streaming services, but rather a content-creating powerhouse rivaled only in power by its platform’s reach.

The company that normally holds show data close to its chest broke from that trend by announcing the biggest success Netflix had ever seen in its 12 years with the Sandra Bullock-led original “Bird Box” racking up 45 million subscriber views in just its first week. As a yardstick, if it were released in theaters that would have amounted to a strong $400 million showing in box-office earnings. By its fourth week, Netflix estimated the number will swell to about 80 million subscriber views.

“When you see a big number like ‘Bird Box’ and ‘You,’ these shows are playing incredibly globally,” Netflix Chief Content Officer Ted Sarandos said on the latest Netflix earnings call. “It’s an interesting thing when you get tapped into the global Zeitgeist with something, which gets me very excited about the potential scale of the content business when the world is excited about something.”

Netflix: The social kingmaker

But it wouldn’t be too much of a leap to think that the unusual release of “Bird Box” viewership numbers may have also been a purposeful attempt to prove that Netflix itself has become today’s zeitgeist arbiter. That same message is also evidenced by this being the second consecutive earnings report featuring a graph charting the Instagram follower gains sustained by the accounts of previously unknown stars in Netflix originals.

Last quarter’s earnings report boasted how “Stranger Things” stars Millie Bobby Brown and Finn Wolfhard went from 0 Instagram followers to having more than 10 million each. The same point was reiterated this quarter with the stars of the Spain original drama “Elite,” Ester Exposito and Aron Piper, now being the latest beneficiaries of newfound Netflix fame.

But if any doubt remained in Netflix’s power, the attention it brought to “You” answered that. In just four weeks, the thriller that failed to make more than little noise as a Lifetime series racked up 40 million views by subscribers.

“We feel great about our content investment,” newly minted Netflix CFO Spencer Neumann said on the call. “Those viewing numbers and characteristics — that speaks to, at some degree, the return on those content investments, the return on that capital.”

And that return on capital will only become more important as content becomes more expensive. Not only is Netflix paying more for shows (as evidenced by Netflix agreeing to pay nearly $100 million for rights to “Friends” after previously paying just $30 million) but it’s also paying for content creators. The streaming giant reportedly signed “Grey’s Anatomy” creator Shonda Rhimes to a $150 million exclusive development deal.

However, if Netflix is able to prove it’s not only powerful enough to bring attention to failed shows, like “You,” and make them overnight successes — but also powerful enough to create overnight celebrities — it could lead to paying less for both. A strong showing at the Academy Awards in February after a strong showing at the Golden Globes will only cement that.

Risk of spending too much on originals

That would of course be crucial for a company that has seen its long-term debt balloon amidst higher content spend. The company reiterated projections for 2019 to match 2018’s negative $3 billion in free cash flow, and ended the year with more than $10 billion in long-term debt. As licensed shows get more expensive, the ability to fund originals that keep subscribers engaged and happy becomes the paramount question for Netflix.

Sarandos made it a point to remind investors on the call that this was something the company saw coming and has prepared for over the past six years as it has invested more in original production. Rather than go the way of Blockbuster, a company many credit Netflix for driving into bankruptcy, Netflix has turned to its own originals to avoid the same fate at the hands of studios.

“Our early investment in doing original content more than six years ago was betting that this would be — [that] there would come a day when the studios and networks may opt not to license us content in favor of maybe creating their own services,” he said on the call. “That’s a corner that I’m glad we saw around a few years ago and today, I’d say the vast majority of the content that is watched on Netflix are our original content brands.”

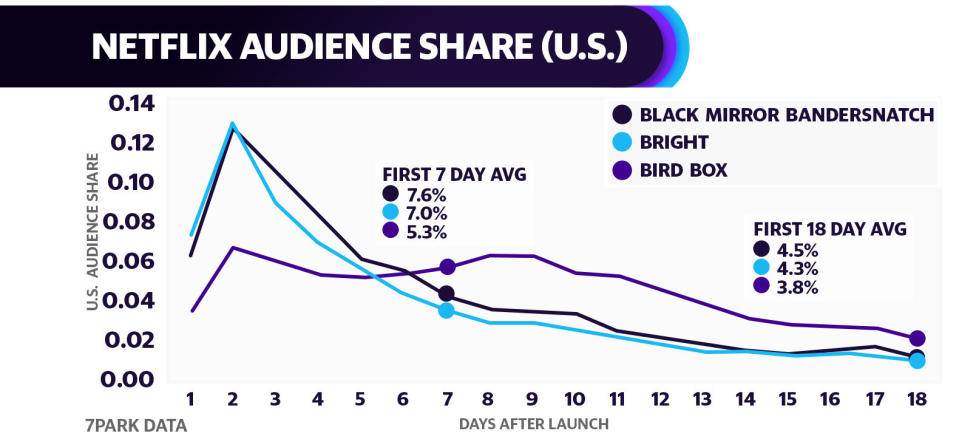

Ahead of Netflix’s earnings call, Yahoo Finance exclusively reported on the rising trend of Netflix originals, with streaming data from 7Park Data showing a significant decline in the share of licensed content on the platform. And if Netflix’s decision to hike prices 13%-18% ahead of the launch of rival streaming platforms signals anything, it’s that the company is confident in its new original offerings being able to maintain subscribers and attract new customers.

RBC analyst Mark Mahaney calculated the price hike would amount to a $2.6 billion boost to Netflix’s operating profit in 2019, which might help stem concerns about Netflix’s growing debt load and original content spend moving forward. If not, a Piper Jaffray survey of Netflix subscribers showed that the company could still boost prices by an additional 20% before impacting subscriber totals. BTIG media analyst Rich Greenfield added that as more people re-appropriate savings from cutting television subscriptions, “There’s no ‘ceiling’ for Netflix in terms of how much someone will spend.”

To see whether there was any material impact of the latest price hike on subscriber growth, investors will have to stay tuned for future earnings calls, where you can be sure the theme of hyping up Netflix originals will no doubt continue to take center stage — just as they have center screen.

Zack Guzman is a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Why Netflix is poised to survive the new ‘TV bubble’

Exclusive Netflix streaming data shows why investors shouldn’t worry

Yahoo Finance

Yahoo Finance