NetEase (NTES) Q3 Earnings Top Estimates, Revenues Rise Y/Y

NetEase, Inc. NTES reported third-quarter 2020 non-GAAP earnings per American Depositary Share (ADS) of 64 cents per share that beat the Zacks Consensus Estimate by 146.2% but declined 31.9% year over year.

Also, revenues of $2.74 billion beat the consensus mark by 3.9%.

In local currency, revenues of RMB18.6 billion increased 27.5% from the year-ago quarter, driven by steady performance of online game services and Youdao business.

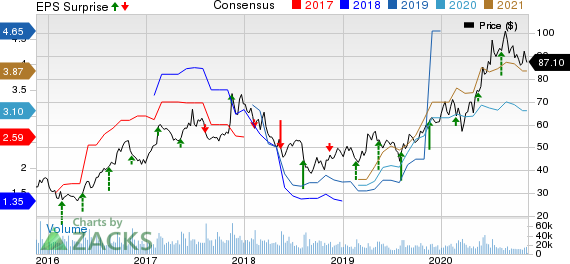

NetEase, Inc. Price, Consensus and EPS Surprise

NetEase, Inc. price-consensus-eps-surprise-chart | NetEase, Inc. Quote

Top-Line Details

Online game services net revenues (74.3% of total revenues) rose 20.2% year over year to RMB13.8 billion ($2.04 billion) driven by strength in flagship PC titles such as the Fantasy Westward Journey Online, New Westward Journey Online II and Justice and newer titles including Onmyoji: Yokai Koya, PES Club Manager, King of Hunters and For All Time, EVE Echoes and MARVEL Duel, which maintained their popularity as users remain confined due to the pandemic.

Innovative Business and Other net revenues (20.9% of total revenues) rose 41.6% year over year to RMB3.9 billion ($574.4 million).

Youdao business net revenues (4.8% of total revenues) soared 159% year over year to RMB896 million ($131.9 million) driven by Youdao’s learning services and products, which grew 200% year over year.

Operating Details

Gross profit was up 25.6% year over year to RMB9.8 billion ($1.4 billion). Gross margin contracted 80 basis points (bps) on a year-over-year basis to 53%.

Online games services gross profit was up 19.8% year over year to RMB8.8 billion ($1.29 billion), primarily due to increased net revenues from self-developed games including Fantasy Westward Journey 3D, Fantasy Westward Journey mobile game, Fantasy Westward Journey Online and New Westward Journey Online II, as well as certain licensed games. Gross margin contracted 300 bps on a year-over-year basis to 47.3%.

Youdao gross profit was up 361.2% year over year to RMB411.6 million ($60.6 million) driven by improved economies of scale and faculty compensation structure optimization for its learning services and products. Gross margin expanded 160 bps year over year to 2.2%.

Innovative Business and Other gross profit was up 56.7% year over year to RMB656.4 million ($96.6 million) due to increased net revenues from NetEase Cloud Music. Gross margin expanded 70 bps year over year to 3.5%.

Selling and marketing expenses increased 112.6% year over year to RMB3.4 billion ($507 million). Meanwhile, general and administrative expenses increased 4% year over year to RMB783.8 million ($115.4 million). Research and development expenses increased 29% year over year to RMB2.78 billion ($410.7 million).

Total operating expenses (37.6% of total revenues) increased 54.7% year over year to RMB7.01 billion ($1.03 Billion) due to increased marketing expenditures, higher research and development investments as well as higher staff-related costs.

Balance Sheet & Cash Flow

As of Sep 30, 2020, the company’s total cash and cash equivalents, current and non-current time deposits and short-term investments balance totaled RMB1.02 billion ($15.1 billion), compared with RMB1.02 billion ($14.5 billion) as of Jun 30, 2020.

The board of directors approved a dividend of $0.1950 per ADS for the third quarter of 2020, which is expected to be paid to shareholders of record as of the close of business on Dec 4, 2020.

Cash flow generated from operating activities was RMB5.4 billion ($795.5 million) for the third quarter of 2020, compared with RMB4.7 billion ($675.5 million) in the previous quarter.

On Feb 26, 2020, the company announced that its board of directors had approved a share repurchase program of up to $1 billion of the outstanding ADSs for a period not to exceed 12 months beginning Mar 2, 2020.

On May 19, 2020, the company announced that its board of directors approved an amendment to such a program to increase the total authorized repurchase amount to $2 billion. As of Sep 30, 2020, over 15.3 million ADSs had been repurchased under this program for a total cost of $1.1 billion.

Zacks Rank and Stocks to Consider

Currently, NetEase has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector include Arrow Electronics ARW, Texas Instruments TXN and STMicroelectronics N.V. STM, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term earnings growth rate for Arrow Electronics, Texas Instruments and STMicroelectronics is currently pegged at 8.5%, 9.3%, and 5%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance