Near an All-Time Low, Is Venator Materials Stock a Buy?

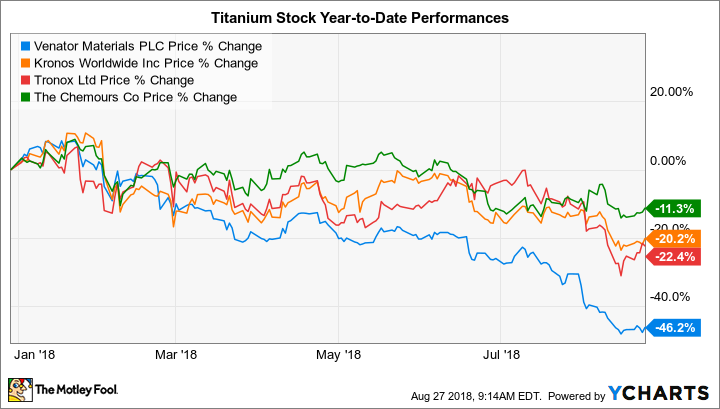

Selling prices for titanium dioxide have continued to soar in 2018, but the share price of almost every major global producer has dropped by double digits. The market for the white pigment, used in everything from paint to sunscreen to food, remains strong. But that hasn't stopped Wall Street from adjusting this batch of titanium stocks to multiyear low valuations relative to sales, earnings, and debt.

None have fared worse than Venator Materials (NYSE: VNTR), which has seen its stock price fall a whopping 46% since the beginning of the year. The titanium stock has only been publicly traded for a little over a year, so it's currently trading close to all-time lows. While there's one major source of uncertainty facing the business, management recently announced a plan to significantly reduce the sting.

Is Venator Materials stock a buy?

Image source: Getty Images.

A terrible, horrible, no good, very bad start

One factor contributing to the awful start to life as a publicly traded company is simply timing. Venator Materials stock listed on public exchanges just in time to catch the last few months of a multiyear bonanza for titanium dioxide stocks. Shares of Kronos Worldwide, Chemours, and Tronox Ltd (NYSE: TROX) all jumped by triple digits in the three-year period ending in 2017. That helped to soften the blow from their double-digit declines suffered so far in 2018, but the newcomer has no such history to hang its hat on.

Wall Street's concern that the historically cyclical industry is due for a slowdown has been the primary reason for these stocks to pull back, although Chemours CEO Mark Vergnano recently brushed those concerns aside, saying the cycle will continue for at least a few more years thanks to a 200,000 metric ton per year market shortage. It hasn't helped to lift titanium stocks.

The comparisons are even worse when investors look at total returns (share performance plus dividends) for titanium stocks, as Venator Materials is the only major producer that doesn't send regular income to shareholders. Dividends are not the most pressing concern for investors right now, though.

That's because the company is still saddled with an out-of-commission facility in Pori, Finland, which was severely damaged by a fire in January 2017. At 130,000 metric tons per year, the plant represented 17% of the company's total production capacity, 10% of Europe's total capacity, and 2% of global production capacity. Venator Materials has brought 20% of the capacity back online and focused it on high-margin, specialty products. It has been going back and forth with plans to rebuild the rest of the facility, but cost estimates keep rising.

The first $500 million in damages -- including construction costs and "business interruption" expenses -- are covered by an insurance policy. The company is on the hook for expenses above and beyond that level. The first estimate pegged the excess at around $150 million. But that soon surged to a range of $325 million to $375 million for a complete rebuild of the Pori facility. Now the cost is expected to be even higher, although management didn't provide a specific number or range, and the timeline is even longer.

The ballooning cost of the rebuild threatens to undermine the business's ability to clean up its balance sheet, which was the intended use for growing levels of free cash flow. That uncertainty isn't something investors can overlook, but a recent pivot may provide more flexibility for Venator Materials regarding the rebuild.

Image source: Getty Images.

Will this transaction be a win-win?

While timing has played a role in the poor performance of Venator Materials stock, timing may also help to improve the business's fortunes. That's because Tronox is attempting to acquire the titanium dioxide business of Saudi Arabian company Cristal. It has received regulatory approvals from all but one required global authority: the U.S. Federal Trade Commission. The hang-up is a worry that the combined company will have too much market power.

In an effort to appease European regulators, Tronox put its paper laminate business in the Netherlands up for sale, and Venator Materials was all too eager to swoop in for the assets. More may be required to win over U.S. regulators. That's why the pair have also agreed to terms that could see a massive titanium dioxide production facility in Ohio change hands. Venator Materials has the option to purchase the facility for $1.1 billion, or $900 million if Tronox drags its feet past a certain deadline this fall. Venator Materials would also receive a $75 million "break fee" if the transactions don't occur.

If both transactions proceed, then Venator Materials says it can be more strategic about rebuilding Pori. Considering both deals are expected to close before the end of 2018 (if they do at all), the acquisitions would be a significant catalyst for the business by providing significant additional earnings and cash flow. That's especially true given the growing strength of operations.

Metric | First Half 2018 | First Half 2017 | Change (YOY) |

|---|---|---|---|

Total revenue | $1.25 billion | $1.10 billion | 14% |

Total segment adjusted EBITDA | $337 million | $183 million | 84% |

Operating income | $359 million | $44 million | 715% |

Net income | $278 million | $21 million | 1,223% |

Operating cash flow | $305 million | ($29 million) | N/A |

Data source: SEC filings. YOY = year over year.

As the table above shows, while Wall Street isn't misguided to fret over the financial risk presented by the rebuild of Pori, as it would eat up a huge chunk of the company's cash flow, the business is comfortably profitable. In fact, aside from not paying a dividend to shareholders, Venator Materials stock compares pretty favorably to its closest peers.

Metric | Venator Materials | Tronox | Kronos Worldwide |

|---|---|---|---|

Market cap | $1.3 billion | $2.0 billion | $2.4 billion |

Dividend yield | N/A | 1.1% | 3.4% |

Forward P/E | 5.3 | 8.0 | 7.8 |

Price to book | 0.96 | 2.7 | 2.8 |

EV to EBITDA | 5.2 | 8.9 | 5.0 |

Data source: Yahoo! Finance.

If the acquisitions of Tronox's paper laminate business in the Netherlands and titanium dioxide production facility in Ohio proceed as planned -- and deliver as expected -- then Wall Street may be forced to more appropriately value Venator Materials stock in 2019. Even if valuation metrics don't fall in line with those of peers, there's still considerable upside.

This titanium stock is risky, but it could be a buy

The newest titanium stock has stumbled since the beginning of the year due to an industrywide drop in stock prices and the business's unique financial risk posed by the pending rebuild of a major titanium dioxide facility in Finland. Wall Street has accounted for the risk by keeping Venator Materials stock priced well below its closest peers, but management may soon deliver more operating flexibility by securing two major production assets from Tronox, which is facing pressure to appease regulators to get its merger with Cristal approved.

Although there's no overlooking the above-average risk of owning Venator Materials stock given the lingering uncertainty, investors with an appetite for risk may find a long-term opportunity at current prices. For most other investors, it may be best to await the details of the proposed transactions, which are sure to increase the company's debt levels.

More From The Motley Fool

Maxx Chatsko has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance