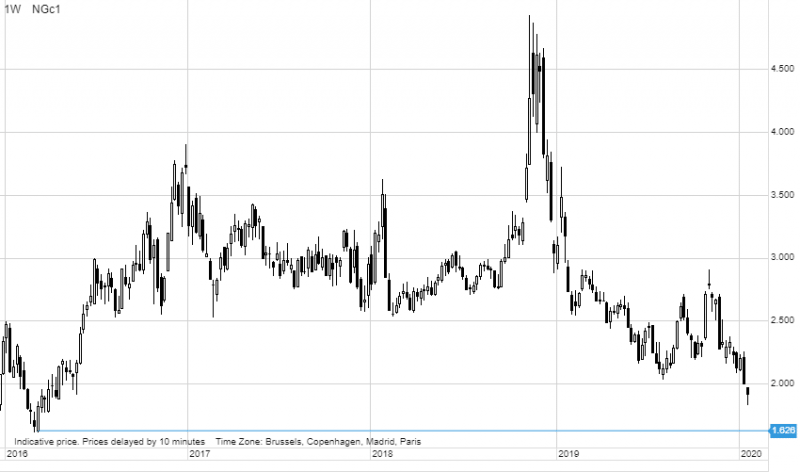

Natural Gas Drops Below $2

Natural gas slumped to $1.83/therm in early trading Monday. The lowest level in almost four years and the lowest seasonal price on record going back to 1990 has been driven by the continued absence of a cold U.S. winter weather to drive demand from utilities towards heating. Just like Europe the States are witnessing a weak demand season with producers being unable to shake off a supply glut amid rising production.

The below charts highlight some of the challenges that the natural gas market has been facing for several months now. Last year a frigid cold blast into February helped drive down gas stocks to a five-year low at 1.1 trillion cubic feet (Tcf). What followed was the strongest injection season since 2014 as consumers and exporters struggled to keep up with the deluge of supply. While December saw the tightest trading range on record going back to 1990, the mild December weather resulted in Natural gas inventories starting 2020 some 20% higher than the previous year (Source: EIA’s STEO)

Unless we see a pickup in demand or a slowdown in production the market will begin to worry that storage capacity could be reached towards the end the coming injection season which runs from late March to November. Weekly storage change data from the Department of Energy (DOE), released on Thursday’s at 15:30 GMT gives the market important information in this regard.

After peaking at 96 Bcf/day in late November natural gas production has since dropped to the current 91.7 Bcf. Pipeline deliveries to LNG terminals almost doubled during 2019 to reach 8 Bcf/day and LNG exports look set to continue to rise, not least due to expectations that China, as part of the trade deal, will boost demand for U.S. gas.

Despite the recent production slowdown and rising exports the price has nevertheless still slumped. On that basis the route to salvation for this very important fuel increasingly have to come from companies cutting production, either voluntary or involuntary. Peter Garnry will be taking a look at energy stocks in a separate article here on www.analysis.saxo

The already record short in natural gas expanded further by 7% to 267k lots in the week to January 14. Any sudden change in the late winter outlook or a colder-than-normal spring is needed to shake the shorts. The four contracts used in the chart below are all either swap or futures contracts based on a price for delivery at the Henry Hub in Louisiana.

Ole Hansen, Head of Commodity Strategy at Saxo Bank.

This article is provided by Saxo Capital Markets (Australia) Pty. Ltd, part of Saxo Bank Group through RSS feeds on FX Empire

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance