National Vision (EYE) Q1 Earnings Top Estimates, Margin Falls

National Vision Holdings Inc EYE delivered adjusted earnings per share (EPS) of 28 cents in the first quarter of 2020, down 9.7% year over year. However, the figure was way ahead of the Zacks Consensus Estimate of a loss of 9 cents.

The adjustment excludes the impact of certain non-recurring charges like asset impairment, litigation settlement and, amortization of acquisition intangibles and deferred financing costs, among others.

GAAP EPS for the quarter was 12 cents a share, marking a 42.9% decline from the year-earlier figure.

Revenues in Detail

Revenues in the first quarter totaled $469.7 million, beating the Zacks Consensus Estimate by 9.2%. The top line edged up 1.8% from the year-ago number. However, the company noted that this year-over-year improvement includes a six-percentage point benefit from unearned revenues.

The company usually experiences a surge in unearned revenues for sales in the last few days of each quarter. However, in the first quarter, stores were closed since Mar 19 due to coronavirus, keeping the company from realizing the full benefit.

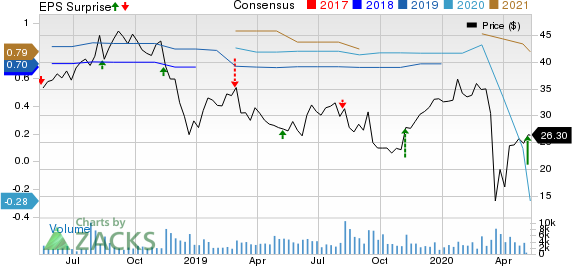

National Vision Holdings Inc Price, Consensus and EPS Surprise

National Vision Holdings Inc price-consensus-eps-surprise-chart | National Vision Holdings Inc Quote

Comparable store sales declined 2.9% in the reported quarter (adjusted comparable store sales growth was down 10.3%) due to the temporary closing down of stores. Notably, comparable store sales growth declined 18.8% and adjusted comparable store sales growth fell 41.5% in March.

However, for the first two months of the quarter, the company’s business was robust on continued sales momentum which picked up in the latter half of 2019. Accordingly, the comparable store sales growth was 5.6% and adjusted comparable store sales growth was 5.7% for January and February.

National Vision opened 23 new stores in first-quarter 2020 and closed one store, exiting the quarter with 1,173 stores.

Margins

Gross profit in the reported quarter was $251.2 million, up 0.8% from the prior-year quarter. However, gross margin of 53.5% contracted 57 basis points (bps). According to the company, this included roughly a 160-bp impact due to COVID-19-related safety and mitigation costs.

Meanwhile, the selling, general and administrative expenses contracted 0.1% to $193.7 million.

Adjusted operating profit totaled $57.4 million, reflecting a 3.7% rise from the prior-year quarter. Further, adjusted operating margin (without depreciation and amortization, asset impairment and certain other non-recurring expenses) in the first quarter expanded 22 bps to 12.2%.

Financial Position

National Vision exited the first quarter with cash and cash equivalents of $263.2 million compared with $39.3 million at the end of 2019.

At the end of the first quarter, cash flow from operating activities was $86.1 million compared with $83 million a year ago.

In the reported quarter, the company authorized 200,000 shares of common stock and issued 81,205 shares as of Mar 28, 2020. Total shares outstanding as of Mar 28, 2020, were 80,278.

2020 Guidance

National Vision, in the wake of uncertainties arising from the pandemic and its duration and impact on the United States, withdrew its 2020 financial outlook on Mar 27.

Our Take

National Vision exited the first quarter with better-than-expected results despite the coronavirus-led economic qualms. The company witnessed positive comparable growth on increased customer transaction in the first two months of the quarter.

The company’s contact lens revenue growth was robust, unlike eyeglasses, due to lesser impact of store closures on contact lens customer transactions. The contact lens category continued to see growth in average ticket resulting from increasing adoption of newer technology lenses at higher prices. This trend is expected to continue. Expansion of adjusted operating margin is also encouraging.

However, the pandemic impacted the company’s unearned revenue for sales. Its cost reduction methods in response to the outbreak are concerning. Further, the contraction in gross margin and withdrawal of financial guidance are discouraging factors.

Zacks Rank and Stocks to Consider

National Vision currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Aphria Inc. APHA, Biogen Inc. BIIB and Eli Lilly and Company LLY.

Aphria reported third-quarter fiscal 2020 adjusted EPS of 2 cents, comparing favorably with the Zacks Consensus Estimate of a loss of 4 cents. Net revenues of $64.4 million outpaced the consensus estimate by 14.6%. The company carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biogen currently carries a Zacks Rank #2. It reported first-quarter 2020 adjusted EPS of $9.14, surpassing the Zacks Consensus Estimate by 18.1%. Revenues of $3.53 billion outpaced the consensus mark by 3.2%.

Eli Lilly delivered first-quarter 2020 EPS of $1.75, outpacing the Zacks Consensus Estimate by 12.9%. Revenues of $145.3 million surpassed the consensus estimate by 6.3%. The company currently sports a Zacks Rank #1.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc (BIIB) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

National Vision Holdings Inc (EYE) : Free Stock Analysis Report

Aphria Inc (APHA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance