National Access Cannabis (CVE:META) Is Making Moderate Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that National Access Cannabis Corp. (CVE:META) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for National Access Cannabis

How Much Debt Does National Access Cannabis Carry?

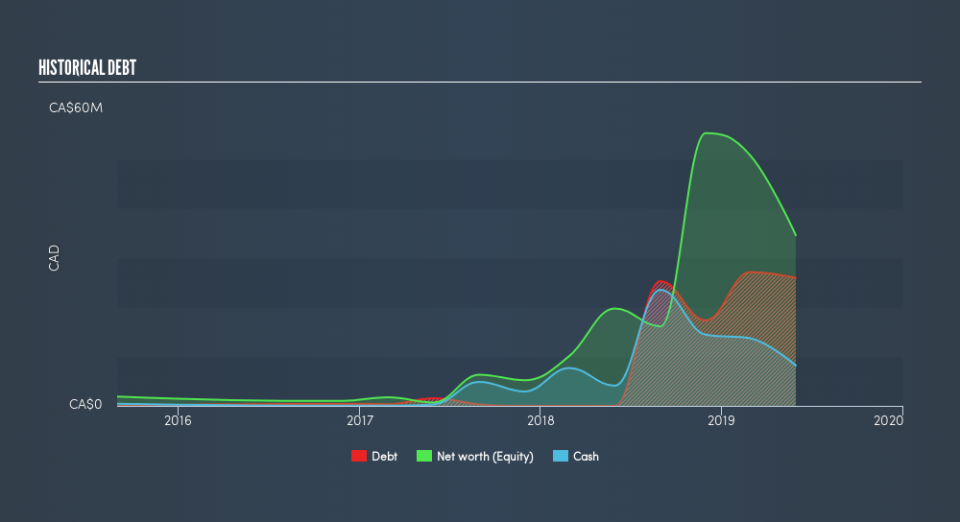

You can click the graphic below for the historical numbers, but it shows that as of May 2019 National Access Cannabis had CA$25.9m of debt, an increase on none, over one year. However, it does have CA$8.18m in cash offsetting this, leading to net debt of about CA$17.7m.

A Look At National Access Cannabis's Liabilities

We can see from the most recent balance sheet that National Access Cannabis had liabilities of CA$23.2m falling due within a year, and liabilities of CA$27.9m due beyond that. On the other hand, it had cash of CA$8.18m and CA$1.53m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$41.4m.

While this might seem like a lot, it is not so bad since National Access Cannabis has a market capitalization of CA$84.1m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since National Access Cannabis will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year National Access Cannabis managed to grow its revenue by 1935%, to CA$38m. That's virtually the hole-in-one of revenue growth!

Caveat Emptor

Even though National Access Cannabis managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. Its EBIT loss was a whopping CA$18m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through CA$38m of cash over the last year. So suffice it to say we consider the stock very risky. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting National Access Cannabis insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance