Is Natera's (NASDAQ:NTRA) Share Price Gain Of 104% Well Earned?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. To wit, the Natera, Inc. (NASDAQ:NTRA) share price has flown 104% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 37% gain in the last three months.

View our latest analysis for Natera

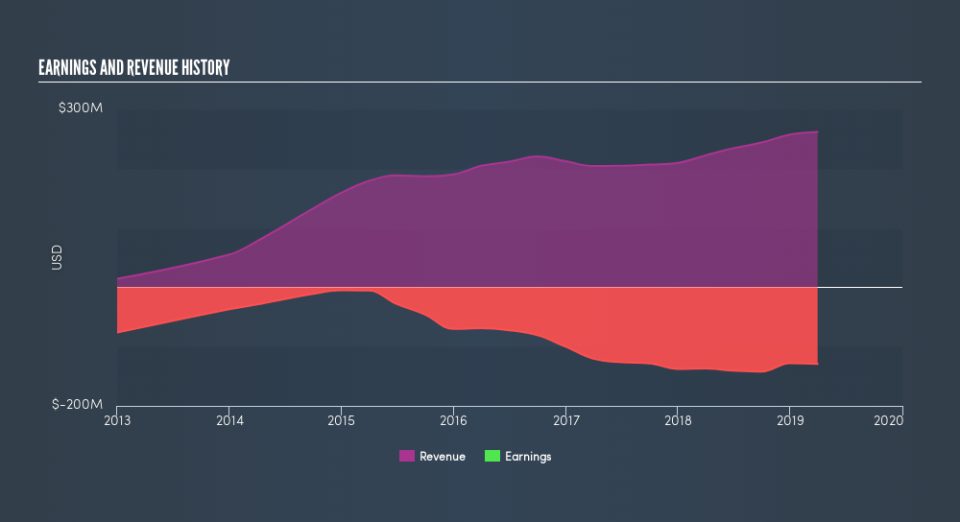

Given that Natera didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years Natera saw its revenue grow at 7.6% per year. That's not a very high growth rate considering it doesn't make profits. In contrast, the stock has popped 27% per year in that time - an impressive result. We'd need to take a closer look at the revenue and profit trends to see whether the improvements might justify that sort of increase. It seems likely that the market is pretty optimistic about Natera, given it is losing money.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's nice to see that Natera shareholders have gained 12% (in total) over the last year. The TSR has been even better over three years, coming in at 27% per year. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance