Myriad Genetics (MYGN) Lags Q1 Earnings and Revenue Estimates

Myriad Genetics, Inc. MYGN reported adjusted earnings per share (EPS) of 8 cents in the first quarter of fiscal 2020, reflecting an 81.4% slash year over year. Adjusted EPS also lagged the Zacks Consensus Estimate by 75.8%.

On a reported basis, loss per share was 28 cents, wider than the prior-year loss of a penny.

Revenues

Total revenues dropped 7.9% year over year to $186.3 million in the quarter under review. The figure also missed the Zacks Consensus Estimate by 8.2%.

Quarter in Detail

Segment-wise, Molecular diagnostic tests recorded total revenues of $172 million, down 9% year over year.

Within this segment, Hereditary Cancer testing revenues were down 10% year over year to $104.5 million. EndoPredict testing revenues fell 4% year over year to $2.3 million in the quarter under review. Vectra testing revenues were $11 million, down 15% year over year while other testing revenues declined 40.7% to $1.6 million.

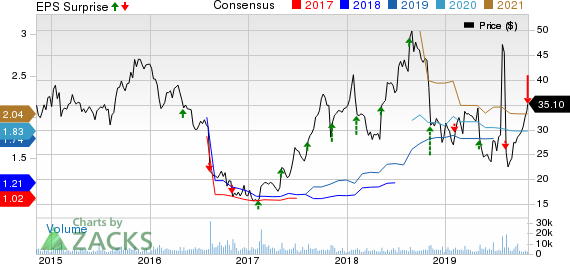

Myriad Genetics, Inc. Price, Consensus and EPS Surprise

Myriad Genetics, Inc. price-consensus-eps-surprise-chart | Myriad Genetics, Inc. Quote

Further, GeneSight testing revenues fell 22% year over year to $22.7 million in the reported quarter. Prolaris tests raked in revenues of $6.5 million, up 5% year over year. Prenatal testing revenues came in at $23.5 million, up 30%.

Pharmaceutical and clinical service revenues in the quarter under review totaled $14.3 million, reflecting a year-over-year increase of 8%.

Margin Trends

Gross margin in the quarter under review contracted 211 basis points (bps) to 73.3%. Research and development (R&D) expenses rose 0.9% year over year to $21.3 million along with a 4.3% increase in selling, general and administrative (SG&A) expenses to $135.5 million in the reported quarter. Adjusted operating loss was $20.2 million against adjusted operating profit of $1.6 million in the year-ago period.

Financial Position

Myriad Genetics exited first-quarter fiscal 2020 with cash and cash equivalents of $89.9 million compared with $93.2 million at the end of the preceding year. At the end of the first quarter, net cash provided by operating activities was $15.8 million compared with $7.8 million at the end of the year-ago period.

2020 Guidance

Myriad Genetics has lowered the guidance for fiscal 2020 revenues. The company expects fiscal 2020 revenues within $800-810 million, compared to the earlier band of $865-$875 million. The Zacks Consensus Estimate for the metric is pegged at $874.3 million, above the company’s projection.

On the bottom-line front, the company lowered adjusted EPS to the band of $1.00-$1.10, compared to the earlier projection of $1.80-$1.90. The current consensus estimate for the metric is $1.83, which lies above the current projection.

Management has also provided the guidance for the second quarter of fiscal 2020. The company estimates adjusted EPS in the range of 30-32 cents and total revenues of $210-$212 million. The Zacks Consensus Estimate for adjusted EPS stands at $48, above the company’s guided figure. Our consensus estimate for revenues is $219.8 million, above the company’s guided figure.

Our View

Myriad Genetics exited first-quarter fiscal 2020 on a dismal note. The company saw a decline in Hereditary Cancer, GeneSight, Vectra, as well as Other testing revenues. The company incurred operating loss incurred during the quarter. The lowered fiscal 2020 guidance is indicative of the continuation of this sluggish trend.

However, the company observed strong year-over-year revenue growth in Prenatal and Prolaris segments. Pharmaceutical and clinical service segments also witnessed an upside in revenues. We are upbeat about the FDA approval attained by the company for myChoice CDx as a companion diagnostic.

Earnings of Other MedTech Majors at a Glance

Myriad Genetics carries a Zacks Rank #3 (Hold).

Some better-ranked companies, which posted solid results this earnings season, are Edwards Lifesciences EW, Thermo Fisher Scientific TMO and ResMed RMD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Edwards Lifesciences delivered third-quarter 2019 adjusted EPS of $1.41, outpacing the Zacks Consensus Estimate by 15.6%. Net sales of $1.09 billion surpassed the Zacks Consensus Estimate by 5.5%.

Thermo Fisher delivered third-quarter 2019 adjusted EPS of $2.94, which surpassed the Zacks Consensus Estimate by 2.1%. Revenues of $6.27 billion outpaced the consensus estimate by 1.3%.

ResMed reported first-quarter fiscal 2020 adjusted EPS of 93 cents, which beat the Zacks Consensus Estimate of 87 cents by 6.9%. Revenues were $681.1 million, surpassing the Zacks Consensus Estimate by 3.6%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance