Multifamily REIT Equity Residential: A Closer Look After Strong Q1

On May 12, Baird Equity Research released a note updating multifamily REIT stalwart Equity Residential (NYSE: EQR) after its Q1 earnings release and conference call.

Equity Residential owns or has interests in over 108,000 apartment units as of March 31, 2014 primarily located in core high barrier to entry urban markets on both U.S. coasts.

EQR multifamily peers covered by Baird include:

AvalonBay Communities Inc (NYSE: AVB) - Neutral, $21.7 billion cap, 3.1 percent yield.

Essex Property Trust Inc (NYSE: ESS) - Outperform, $14.3 billion cap, 2.6 percent yield.

UDR, Inc. (NYSE: UDR) - Outperform, $8.4 billion cap, 3.4 percent yield.

Equity Residential - Neutral, $27.8 billion cap, 3 percent yield.

Tale Of The Tape - Past Year

The Vanguard REIT Index ETF (NYSE: VNQ) is a good proxy for the broader REIT sector.

Related Link: Jefferies: West Coast Apartment REIT Essex Property Trust Hitting On All Cylinders

Essex operates exclusively in high barrier to entry West Coast markets, and has recently begun to outperform its more geographically diversified peer group, as shown on the chart above.

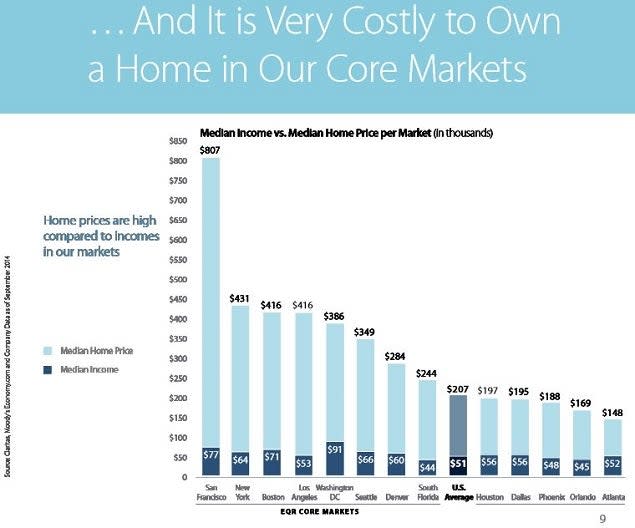

EQR Markets - High Cost Of Home Ownership

Since the Great Recession, home ownership in the U.S. has continued to decline, even though in many markets it is theoretically cheaper to rent than own. However, the EQR portfolio is skewed toward coastal urban markets where buying a home is simply out of reach for most renters.

Source: EQR - March 2015 Presentation

Even renters with relatively high incomes can find coming up with a hefty down payment a hurdle, which makes becoming a first time homebuyer daunting, if not impossible.

Additionally, many urban millennials simply prefer to rent as a lifestyle choice.

EQR - FY 2014 Performance By Market

EQR - New Development Pipeline

Source: EQR March 2015 - Presentation

Baird believes that "the REIT's $2.6B active development pipeline should continue to deliver brand new assets at stabilized yield close to 6%, assets which would likely price in the low-to-mid 4%s in today's transaction market."

Baird - Equity Residential: Maintain Neutral, $81 PT Unchanged

The Baird $81 price target represents a potential 10.4 percent upside from EQR's May 13, close of $73.40 per share.

Baird's $81 PT was derived 50 percent from its $73.80 NAV estimate (based on a 4.6 percent cap rate); and 50 percent from 23.6x EQR 2015 core FFO multiple, representing a 22.5 percent premium to the peer group's multiple of 19.3x.

Baird - EQR: Q1 Earnings Takeaways

Same Store NOI: EQR Q1 7 percent SSNOI growth hit the mark, but Baird cautioned that increased supply in Washington D.C. and Boston could become a headwind moving forward.

Strong Markets: West Coast and Manhattan markets will likely see continued same property NOI growth; Baird noted overall EQR SSNOI in FY 2015 and FY 2016 of 5.8 and 5.6 percent, respectively.

Development: Baird noted that new development leasing should help "to offset the net impact of equal acquisitions and dispositions at a 80-90bps yield spread this year;" however, the majority of the new development pipeline will not positively impact EQR FFO until after FY 2016.

Balance Sheet: Noting EQR solid balance sheet metrics, Baird expects little ATM activity in 2015, and EQR management has guided ~$950 million of new unsecured debt issuance; while the current EQR net debt and preferred to EV ratio is 28 percent.

FFO Guidance: Baird has raised estimates for FY 2015 from $3.40 to $3.42, and FY 2016 from $3.67 to $3.70 per share.

Baird - Bottom Line

Noting EQR's strong balance sheet gives it the ability to issued 10-Yr debt in the low-to-mid 3's and, an implied overall WACC in the low-to-mid 4's; Baird sees Equity Residential able to "acquire high quality, high growth properties in the 5% cap rate area while still generating immediate accretion."

This is in addition to accretive EQR new development yields of ~6 percent; however, it appears Baird sees this as already baked into its model.

Baird has currently has Outperform ratings on both Essex ($248 PT) and UDR ($37 PT), which represent potential price upside for investors of ~13 percent and 13.7 percent, respectively.

Latest Ratings for EQR

Apr 2015 | Barclays | Maintains | Equalweight | |

Apr 2015 | Janney Capital | Initiates Coverage on | Neutral | |

Apr 2015 | BMO Capital | Initiates Coverage on | Outperform |

View More Analyst Ratings for EQR

View the Latest Analyst Ratings

See more from Benzinga

Morgan Stanley Directs Multifamily Apartment REITs To Center Stage

How To Use The Rent-Buy Ratio To Measure Home Builder Health

© 2015 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance