Is Mullen Group (TSE:MTL) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Mullen Group Ltd. (TSE:MTL) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Mullen Group

How Much Debt Does Mullen Group Carry?

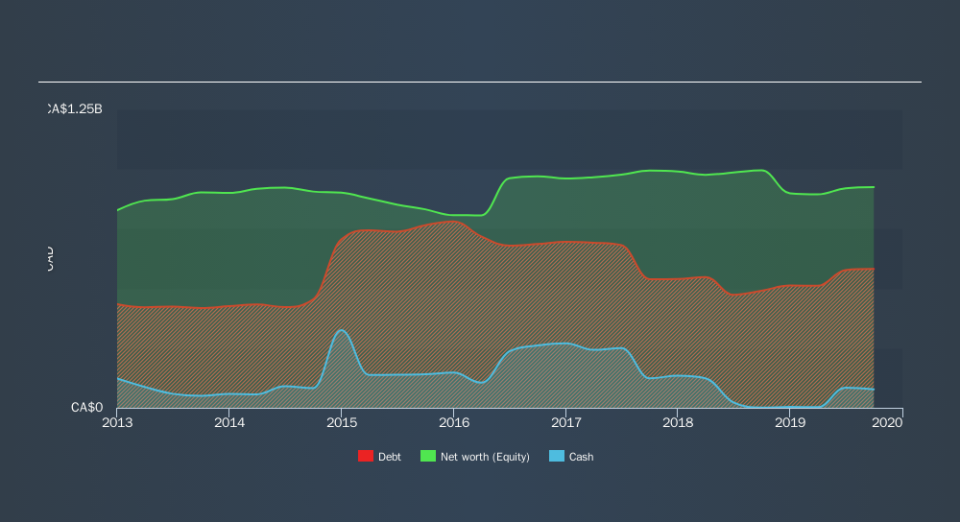

The image below, which you can click on for greater detail, shows that at September 2019 Mullen Group had debt of CA$581.4m, up from CA$490.2m in one year. However, because it has a cash reserve of CA$77.6m, its net debt is less, at about CA$503.8m.

A Look At Mullen Group's Liabilities

We can see from the most recent balance sheet that Mullen Group had liabilities of CA$125.1m falling due within a year, and liabilities of CA$734.6m due beyond that. On the other hand, it had cash of CA$77.6m and CA$236.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$545.2m.

This is a mountain of leverage relative to its market capitalization of CA$894.2m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Mullen Group has a debt to EBITDA ratio of 2.6 and its EBIT covered its interest expense 4.7 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. One way Mullen Group could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 12%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Mullen Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Mullen Group recorded free cash flow worth a fulsome 89% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

When it comes to the balance sheet, the standout positive for Mullen Group was the fact that it seems able to convert EBIT to free cash flow confidently. However, our other observations weren't so heartening. For instance it seems like it has to struggle a bit to handle its total liabilities. When we consider all the elements mentioned above, it seems to us that Mullen Group is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. We'd be motivated to research the stock further if we found out that Mullen Group insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance