Mosaic (MOS) Earnings Miss, Sales Surpass Estimates in Q1

The Mosaic Company MOS slipped to a loss of $203 million or 54 cents per share in first-quarter 2020 from a profit of $130.8 million or 34 cents in the year-ago quarter. The bottom line in the reported quarter was affected by $295 million in non-cash foreign currency losses.

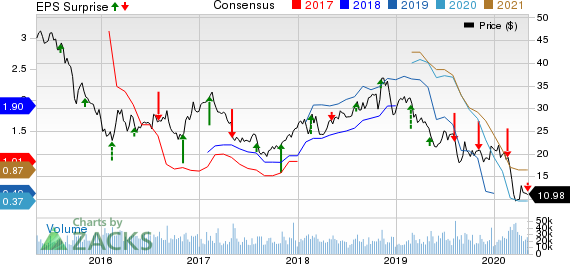

Barring one-time items, adjusted loss per share was 6 cents, wider than the Zacks Consensus Estimate of a loss of 5 cents.

Net sales fell 5.3% year over year to $1,798.1 million in the quarter, hurt by reduced sales prices. The figure, however, beat the Zacks Consensus Estimate of $1,641.3 million.

The Mosaic Company Price, Consensus and EPS Surprise

The Mosaic Company price-consensus-eps-surprise-chart | The Mosaic Company Quote

Segment Highlights

Net sales in the Phosphates segment were $619 million in the quarter, down 23.2% year over year due to lower sales prices. The segment’s gross margin slipped to a loss of $83 from profit of $55 million in the year-ago quarter as lower prices and the cost impacts of reduced operating rate were partly offset by improved raw material costs.

Potash division’s sales dropped 12.3% year over year to $442 million mainly due to lower prices. Gross margin in the quarter was $109 million, down 41% year over year, as lower prices more than offset lower costs.

Net sales in the Mosaic Fertilizantes segment were $731 million, up 4.7% year over year, despite a weaker pricing environment. Gross margin increased to $66 million from $52 million in the year-ago quarter due to enhanced volumes and margins in the distribution business as well as substantial currency tailwind.

Financials

Mosaic ended the quarter with cash and cash equivalents of $1,069.2 million, up 178% year over year. Long-term debt was essentially flat year over year at $4,525.2 million.

Net cash provided by operating activities was $189.9 million in the reported quarter. The company’s capital expenditure was $263.5 million in the first quarter.

Outlook

Mosaic expects depreciation, depletion and amortization of $910-$920 million for 2020. Moreover, it anticipates net interest expenses of $180-$190 million for 2020.

Also, the company anticipates capital expenditure of roughly $1.2 billion for 2020.

Mosaic also expects to receive cash proceeds of up to $170 million from tax refunds and unwinding of an interest rate swap in 2020. The company also noted that it expects to achieve $50 million in Mosaic Fertilizantes' transformational savings for 2020.

Price Performance

Shares of Mosaic have lost 56.6% over a year compared with the industry’s 34.3% decline.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Equinox Gold Corp. EQX, Franco-Nevada Corporation FNV and Kinross Gold Corporation KGC.

Equinox Gold currently sports a Zacks Rank #1 (Strong Buy) and has a projected earnings growth rate of 231% for 2020. The company’s shares have gained 52.3% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Franco-Nevada has a projected earnings growth rate of 22% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have rallied 101.3% in a year.

Kinross has a projected earnings growth rate of 52.9% for 2020. The company’s shares have surged 123.2% in a year. It currently has a Zacks Rank #2.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance