Morning Brief: Disney beats expectations, reveals name of new streaming service

Friday, November 9, 2018

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

What to watch today

At 8:30am ET, we’ll get the October producer price index (PPI), which is expected to have increased by 0.2% month-over-month or 2.5% year-over-year. Excluding food and energy, core PPI is expected to have climbed by 0.2% and 2.3%, respectively. Meanwhile, the University of Michigan’s consumer sentiment index is expected to have slipped to 98 in November from 98.6 a month ago.

Media behemoth Disney (DIS) reported earnings after the bell on Thursday and posted a big beat on both the top and bottom lines. Shares were up around 2% in after-hours trade on Thursday.

Top news

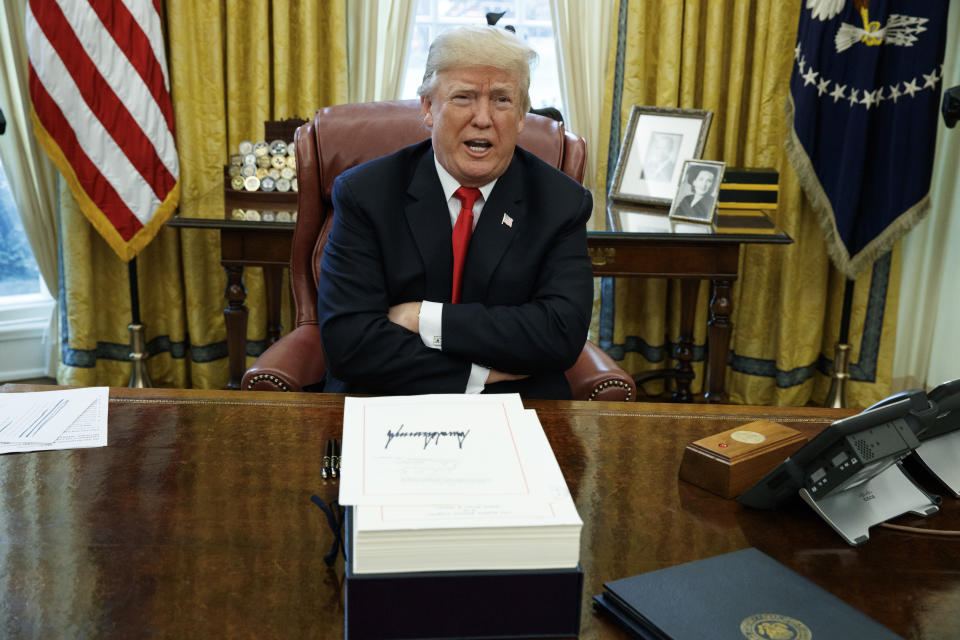

A big fight is coming over Trump’s tax returns: Democrats seem to think a door has opened that will allow them to walk into the Internal Revenue Service, ask politely for President Trump’s tax returns, and walk out with a huge pile of documents Trump will no longer be able to keep private. Fat chance. [Yahoo Finance]

It’s the end of an era for Fed communications: On Thursday, the Federal Reserve kept interest rates unchanged in a range of 2%-2.25%. Following this policy announcement, Fed Chair Jay Powell did not meet with reporters to answer questions on the thinking behind the Fed’s decision. Markets, ultimately, were little-changed. There was little for investors to glean from Thursday’s news. But this era — where some Fed meetings come and go with little fanfare because of limited communication from the central bank — comes to an end. [Yahoo Finance]

U.S. crude oil enters bear market: Oil prices are on the decline. U.S. West Texas Intermediate crude (CL=F) fell for the ninth straight session Thursday, the longest sequential decline since July 2014. Prices for the WTI December 18 futures contract fell 1.62% to $60.67 Thursday, or the lowest closing price since March. Domestic crude closed in bear market territory, down more than 20% from an October 3 closing high of about $76 per barrel. [Yahoo Finance]

P&G restructures operations: Procter & Gamble Co. (PG) on Thursday announced the creation of six business units for its largest geographic markets, its biggest organizational change in the last 20 years that will be effective from July next year. [Reuters]

SEC to review corporate democracy rules: The U.S. Securities and Exchange Commission is set to review this month rules on corporate democracy, setting it up for a clash with investors who worry the agency will side with companies to diminish voting rights on charged issues like climate change and gun violence. [Reuters]

More from Yahoo Finance

Netflix is shoring up its defenses for when it loses Disney content

E-scooter company Lime confirms it’s ‘going into electric cars’

Pinterest CEO: We have a different goal from Snapchat and Facebook

We entered the multi-million dollar business behind your Amazon returns

—

The Morning Brief provides a quick rundown on what to watch in the markets, top news stories, and the best of Yahoo Finance Originals.

Yahoo Finance

Yahoo Finance