MORGAN STANLEY: We're slashing our oil price forecast by 50%

Fotos_von_Carlos on Flickr

Oil is one of the most traded commodities at the moment, and everyone has a view.

But the prevailing opinion now is that oil prices won't be returning to triple digits a barrel anytime soon.

On Monday, Ian Taylor, CEO of Vitol Group, said the price of oil would stay beneath $60 for as long as 10 years.

Now, Morgan Stanley has weighed in, slashing its 2016 oil forecasts from above $50 a barrel to less than $30.

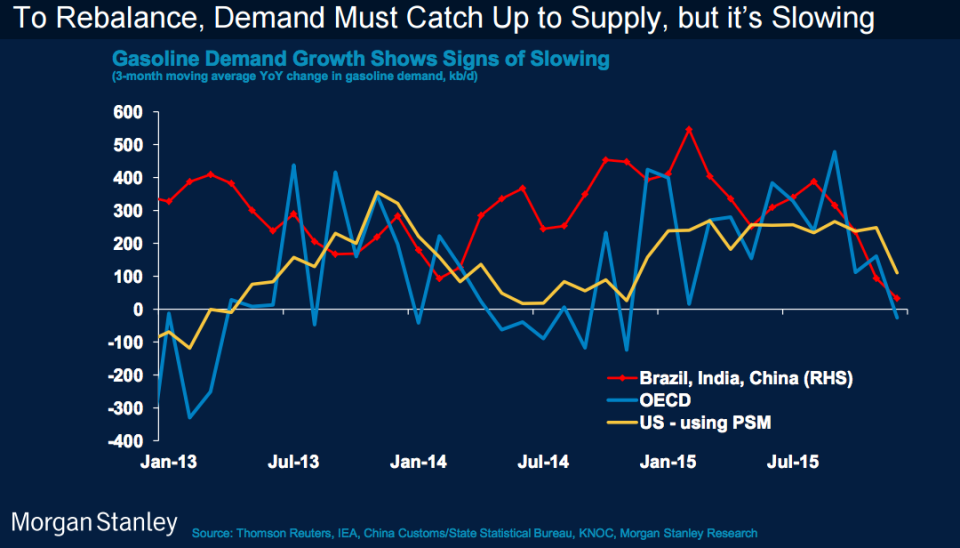

It's all about demand. With the OPEC oil-producing cartel refusing to cut production, it will take a lot of demand for the commodity to mop up the glut and return prices to normal.

Morgan Stanley analysts don't see any evidence of that happening soon:

We are pushing out our view of the recovery in oil by 6-12 months and cutting our oil forecast from the US$50s to high US$20s over the next year

Here's the chart:

Fotos_von_Carlos on Flickr

The price of Brent crude, the European benchmark, peaked at about $140 a barrel in 2008 before crashing as low as $45 in early 2009. It then recovered substantially, trading around the $100 mark from 2011 to 2014.

But now Brent and West Texas Intermediate, the US benchmark, are hovering between $32 and $35 a barrel thanks to oversupply amid an attempt by OPEC to knock out the US shale oil industry.

NOW WATCH: Watch Martin Shkreli laugh and refuse to answer questions during his testimony to Congress

See Also:

Just a fraction of the world's oil supply isn't profitable at $35 a barrel

3 reasons OPEC isn’t telling the oil market what it wants to hear

SEE ALSO: Oil prices may crash further because of oil producers' high debt levels

Yahoo Finance

Yahoo Finance