Momo (MOMO) to Report Q2 Earnings: What's in the Cards?

Momo Inc. MOMO is set to report second-quarter 2019 results on Aug 27.

Notably, the company’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average positive surprise being 5%.

In first quarter 2019, Momo’s non-GAAP earnings of 62 cents per ADS beat the Zacks Consensus Estimate by 7 cents. However, the figure declined 4.8% from the year-ago quarter.

Revenues of $554.4 million also surpassed the consensus mark of $533 million and surged 35% on a year-over-year basis.

Notably, Monthly Active Users (MAUs) on Momo application were 114.4 million compared with 103.3 million in the year-ago quarter.

The Zacks Consensus Estimate for second-quarter earnings has remained steady at 74 cents over the past 30 days. The figure indicates an increase of 12.1% from the year-ago reported figure.

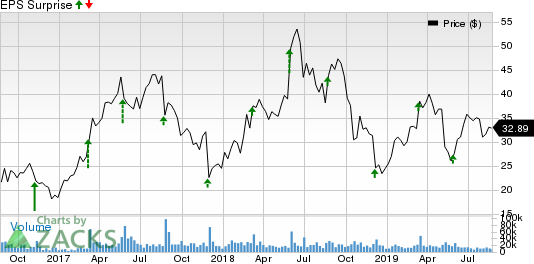

Momo Inc. Price and EPS Surprise

Momo Inc. price-eps-surprise | Momo Inc. Quote

Factors to Consider

Momo’s second-quarter revenues and user base are likely to witness a decline. On Apr 29, popular dating app, Tantan was removed from app stores in China on the orders of government authorities.

Momo had announced a one-month comprehensive self-inspection on the Tantan platform for the period May 11-Jun 11 as part of compliance and content screening efforts. The company also suspended the ability of users to post social news feed during the said period to strengthen its content review system.

These measures are expected to dent the company’s active user base and damage new user engagement.

In addition, in early May, Apple AAPL also suspended the in-app purchase services for the iOS version of Tantan. Most subscribers in China have auto-renewed subscription on a monthly basis. Momo expects a decline in the number of paying users due to the suspension of the payment service on iOS in the to-be reported quarter.

However, Momo expects steady growth from live broadcasting business backed by product innovation and operational efforts.

The company tested interactive tools, including a new gift card, Gold Miners, in the to-be-reported quarter. The company expects to enhance user experience and revenue growth via gifts cards like Penguin and Gold Miners. The focus is primarily on increasing user interaction through live game competitions.

Nevertheless, regulatory issues and Tantan’s removal from app stores are likely to affect top-line growth in the to-be reported quarter.

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Sell-rated stocks (Zacks Rank #4 or 5) are best avoided.

Momo has a Zacks Rank #3 and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some companies, which, per our model, have the right combination of elements to deliver earnings beat in their upcoming releases:

Smartsheet SMAR has an Earnings ESP of +11.11% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Verint Systems VRNT has an Earnings ESP of +3.49% and a Zacks Rank #3.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Momo Inc. (MOMO) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Verint Systems Inc. (VRNT) : Free Stock Analysis Report

Smartsheet Inc. (SMAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance