Mohawk's (MHK) Downtrend Continues: What's Hurting the Stock?

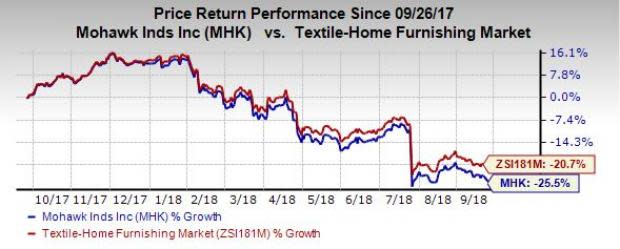

Despite undertaking several strategic measures to drive performance, Mohawk Industries, Inc. MHK failed to impress investors. The company’s shares have declined 26% in a year’s time compared with the industry’s decline of 20.7%. Let’s delve deeper and try to assess what’s taking this Zacks Rank #5 (Strong Sell) company down the hill.

Rising Costs Hurt Profit Margins

Mohawk is bearing the brunt of higher raw materials, labor, energy and fuel-related costs, which impacted its profitability. In the second quarter, the company’s earnings declined 6% year over year. In fact, rising material costs had the greatest impact on the company’s carpet business in the United States. Higher transportation costs and a stronger dollar further added to the woes.

Additionally, changing product mix, timing of price increases, lower production units and commencement of new projects played a major role in increasing the company’s expenditure. In fact, in the second quarter, selling, general and administrative expenses increased 3.7% to $436.2 million from the prior-year quarter and cost of sales rose 8.2% from the prior-year quarter due to inflation, product mix and start-up costs.

Estimates Trending Downward

In the past 60 days, the Zacks Consensus Estimate for earnings in 2018 and 2019 has declined by 5.8% and 5.2% to $13.7 and $15.27, respectively. Moreover, the consensus mark for third-quarter 2018 has also moved down 7.5% to $3.60.

Meanwhile, to combat the above-mentioned headwinds, the company plans to boost prices, expand in growing channels, introduce new products and foray into geographies. In the U.S. market, Mohawk expects to increase LVT production and sourcing, as LVT continues to gain market share.

Stiff Competition

The flooring industry is highly competitive with a number of players (large and small), including imports, offering products in the marketplace. The company needs to make significant investments in new products, distribution network and manufacturing facilities that could impact profitability.

Stocks to Consider

Some better-ranked stocks in the Consumer-Discretionary sector are Caleres, Inc. CAL, Glu Mobile Inc. GLUU and Carter's, Inc. CRI, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Caleres has an expected current-year earnings growth rate of 15.7%.

Glu Mobile has an expected current-year earnings growth rate of 156.8%.

Carter’s reported better-than-expected earnings in the last four quarters, the average beat being 15.3%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carter's, Inc. (CRI) : Free Stock Analysis Report

Caleres, Inc. (CAL) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

Glu Mobile Inc. (GLUU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance