Mobile banking is more important than ever (WFC, JPM)

BI Intelligence

This story was delivered to BI Intelligence "Payments Briefing" subscribers hours before appearing on Business Insider. To be the first to know, please click here.

JPMorgan Chase and Wells Fargo, two of the largest US banks, announced their earnings before market open on Friday.

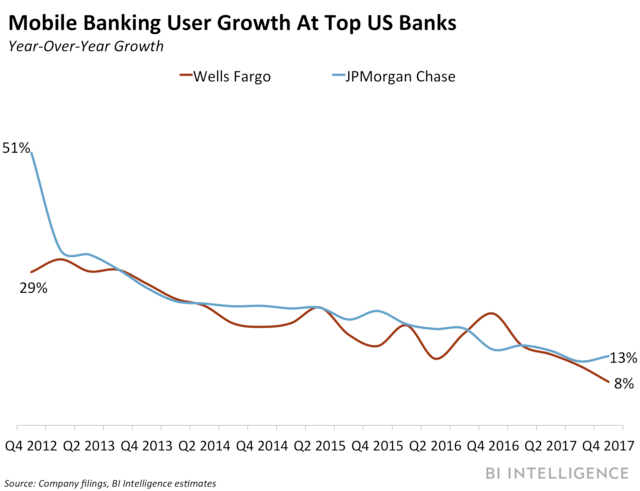

As we’ve seen for the past few quarters, mobile banking is continuing to rise, but the rate of growth is decelerating as offerings mature.

JPMorgan Chase has 30.1 million active mobile customers, up 13% from the 26.5 million that the bank counted in Q4 2016, and representing a gain of just 800,000 sequentially. That continues the slowing growth the bank has seen in recent quarters.

Wells Fargo counts 28.1 million total active digital users, 21.2 million of which use mobile banking. Since this May, the firm’s active mobile users have surpassed active desktop users, according to the bank. That represents exceptionally slow growth — just 3% annually — but solid for the bank, which saw a plateau and slight decline in digital active users for the past few quarters as it recovered from its scandal last year.

As digital banking matures, banks need to work to find new ways to engage users.

The mobile banking market is approaching saturation. A BI Intelligence study found that 83% of respondents use mobile banking, indicating that the plateau isn’t because of declining interest, but rather near ubiquity, where growth is coming more from customers new to banks rather than those new to mobile offerings.

But it’s more important to customers than ever before. Customers are using digital banking more than ever — last year, Wells Fargo counted 5.9 million digital customer interactions, up from 3.8 million in 2013, while physical interactions declined overall. As a result, firms need to shift their approach to mobile banking, and focus on how they can best use it as a relationship-building tool, since all their customers have it, rather than dismissing it as a baseline necessity. The best way to do this is to hone in on value-added tools and services that consumers want — right now, the most popular are card controls and peer-to-peer (P2P) transfer functionality — and use those to grow customer engagement and increase loyalty, which in turn will improve competitive positioning and lifetime customer value.

Banks are going to new lengths to attract and retain customers with mobile features.

In BI Intelligence's Mobile Banking Competitive Edge study, 83% of respondents said they use mobile banking. And banks are investing in mobile banking capabilities at unprecedented levels: Bank of America tripled its 2015 mobile banking budget in 2016, and maintained it through 2017, for example. Cutting-edge banking services are “table-stakes to attract and retain customers,” according to Michelle Moore, Head of Digital at Bank of America.

BI Intelligence’s first Mobile Banking Competitive Edge Report identifies which mobile banking and emerging features are most important to consumers when choosing a bank. The study ranks the largest 15 banks and credit unions in the US by whether they offer the mobile features that customers say they care most about. The report helps channel strategists choose which features they should focus their attention on, and lets them see how they compare to rival banks in offering those features.

This study uses exclusive data from the BI Insiders Panel (BIIP), an exclusive online community of 17,000 of our readers from all over the world. Designed to be a leading-edge indicator of what’s next in digital, BIIP members tend to be affluent, tech-savvy early adopters. This means that the BIIP community is an especially sensitive indicator of what consumers will buy and adopt, as well as what behaviors, devices, and platforms will be the winners in digital disruption.

Here are some of the key takeaways from the report:

Wells Fargo leads the pack. The bank offers in-demand mobile transfer capabilities, along with competitive features related to security and mobile wallets. USAA follows closely behind in second. Bank of America and Citi are tied for third, and Capital One rounds out the top five.

Mobile transfers are the most in-demand mobile features. Transfers are the most important category of features to consumers when choosing a bank, according to our study. The most in-demand feature in this study, instant transfers, is in this category. Transfers also include bill pay, international transfers, and peer-to-peer (P2P) payments.

Post-Equifax, consumer interest in security tools is high. Security and control was the second most popular category in the study. Gen Xers value several features in this category — such as setting travel notifications and mobile access to ATMs — more than millennials.

Interest in advanced mobile banking account access is poised to jump. The account access section, the third most popular in this study, includes features like biometrics and account aggregation. With Face ID giving customers a new way to log in to banking, interest in the group of features will likely rise.

In spite of lagging adoption, interest in mobile wallets is still healthy. This category weighs not only whether banks support provisioning their cards in each of the popular wallets, but if they offer their own bank-branded wallets. Our study shows consumers rank support of third-party wallets as much more important than banking solutions.

Conversational features have the lowest demand in the study. The voice- or chatbot-based banking tools in the category are desired by only a small fraction of consumers. Instead of using the features to attract new customers, banks are exploring offloading costly transitional conversations with live support staff to AI.

In full, the report:

Shows how 32 mobile features stack up according to how important consumers say they are for choosing a new bank.

Ranks the top 15 banks on whether they offer each of those features.

Analyzes how demographics effect demand for different mobile features.

Provides strategies for banks to best attract and retain customers with mobile features.

The full report is available to BI Intelligence enterprise clients. To learn more about this report, email Senior Account Executive Chris Roth (croth@businessinsider.com). BI Intelligence's Mobile Banking Competitive Edge study includes: Bank of America, BB&T, Capital One, Chase, Citibank, Fifth Third, HSBC, Key Bank, Navy Federal Credit Union, PNC, SunTrust, TD, US Bank, and USAA.

See Also:

Yahoo Finance

Yahoo Finance