MKS Instruments (MKSI) Q2 Earnings & Revenues Beat Estimates

MKS Instruments MKSI reported second-quarter 2018 adjusted earnings of $2.33 per share, which beat the Zacks Consensus Estimate of $2.22 and surged 65% year over year.

Revenues of $573 million surpassed the Zacks Consensus Estimate of $570 million and came in 19% higher than the year-ago figure.

Quarter Details

Products revenues (89% of total revenues) were $510 million, up approximately 20% from the year-ago quarter. Services revenues (11%) increased 16% year over year to $63 million.

Sales to semiconductor customers increased 19% year over year to $336 million. Sales to advanced markets were $237 million, up 19% from the year-ago quarter.

The company’s Vacuum and Analysis segment reported sales of $368 million, an increase of 19% year over year. Sales from the Light and Motion Division were $205 million, up 20% from the prior-year period.

Operating Details

MKS Instruments’ gross profit margin for the quarter came in at approximately 48%, expanding 210 basis points (bps) year over year.

Research & development and sales, general & administrative expenses as a percentage of revenues declined 64 bps and 168 bps, respectively year over year.

The company reported non-GAAP operating income of $162.2 million in the quarter, up 40.4% from the year-ago quarter.

Adjusted operating margin in the reported quarter was 28.3%, which expanded 430 bps on a year-over-year basis.

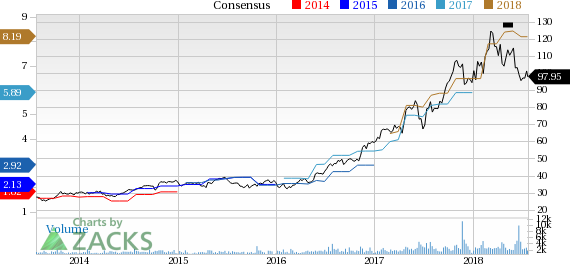

MKS Instruments, Inc. Price and Consensus

MKS Instruments, Inc. Price and Consensus | MKS Instruments, Inc. Quote

Balance Sheet & Cash Flow

MKS Instruments exited the quarter with cash and cash equivalents of $427.43 compared with $340.89 million as of Mar 31, 2018.

Long-term debt was $342.09 million, up from $341.3 million as of Mar 31, 2018.

As of Jun 30, 2018, cash from operating activities was $109.61 million compared with $72.77 million in the previous quarter.

Outlook

MKS Instruments anticipates to report revenues in the range of $470-$510 million and adjusted earnings in the range of $1.60-$1.86 per share for third-quarter 2018.

Zacks Rank & Stocks to Consider

Currently, MKS Instruments carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Micron MU, Intel INTC and Entegris ENTG. All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Long-term earnings growth rate for Micron, Intel and Entegris is projected to be 8%, 8.4% and 11.3%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MKS Instruments, Inc. (MKSI) : Free Stock Analysis Report

Entegris, Inc. (ENTG) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance