Why Microsoft should really be company of the year

Yahoo Finance has named Target (TGT) its 2019 Company of the Year. And while the big-box retailer is certainly worthy of praise with its stunning turnaround and drastically improved online sales, I can't help but feel as though Microsoft (MSFT) should have taken home the title.

Why? Well, there's the astronomical growth of the tech giant's Azure cloud business, which has made Microsoft one of the world's leading cloud computing services. There’s also the continued expansion of the company's Office 365 service, its Windows 10 adoption rates, and its plans to roll out a new game console and game streaming service in 2020.

Oh, and there's the little matter of Microsoft beating out Amazon's AWS for a 10-year, $10-billion military contract that will drag the Department of Defense into the cloud computing era.

Taken together, it's hard to argue against Microsoft's outstanding 2019.

By the numbers

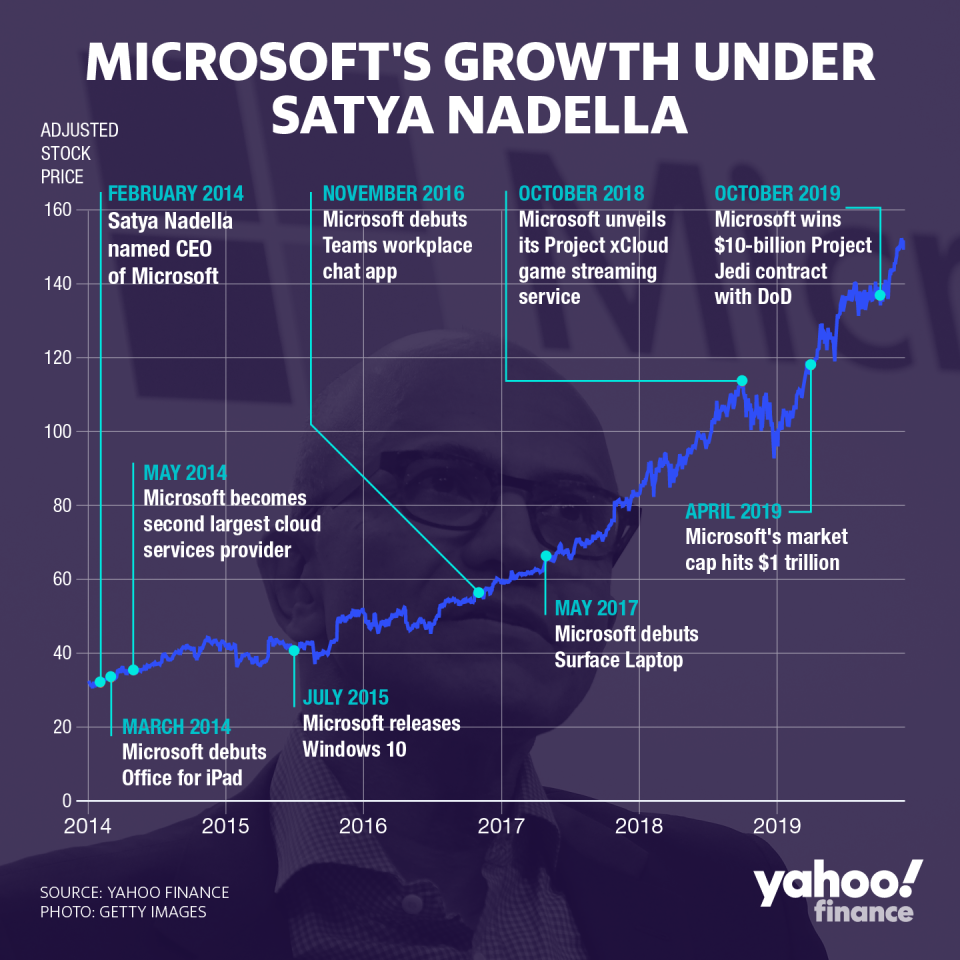

Microsoft's breakout 2019 was years in the making. It began when Satya Nadella took over as CEO from longtime Microsoft chief executive Steve Ballmer in February 2014. Nadella led an increased emphasis on cloud computing and support, pushing the company away from its reliance on the sale of Windows enterprise and commercial products, in favor of the recurrent revenue associated with subscription cloud services.

"I think what really sums up what's going on with Microsoft, and what differentiates the Nadella years from the [Steve] Ballmer years, is how Satya has taken Microsoft completely in the direction of cloud," said Forrester Research’s research director Glenn O'Donnell.

Of course, Ballmer laid the groundwork for much of the company’s cloud ambitions including Office 365 and Azure, but it’s been Nadella who has delivered on the execution.

Since Nadella took over, the tech giant's stock price has jumped more than 290%. That's better than contemporaries like Apple (AAPL), which saw its stock price increase 252%, and Facebook (FB), which had an increase of 191% in the same period. The wider S&P 500, for its part, grew 67%.

And Microsoft has continued that growth this year. Year to date, the company's stock price price has increased by 48%. The S&P 500, meanwhile, increased by 24%.

Microsoft's revenue in the 12 months prior to September was up 13%, while gross profit margin was up 66% in the same period. For a company pulling in nearly $130 billion a year, that kind of growth is truly impressive.

Microsoft breaks its business down into three major units: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. And each of those divisions reported revenue of more than $10 billion during the company's fiscal Q1 2020, the most recently reported quarter.

This success has come from a company that at one point was faced with the prospect of being split into two competing companies by the Justice Department. Then known as the "Evil Empire," Microsoft was accused of having a stranglehold on the PC market in the 1990s thanks to its Windows operating system. Microsoft won a challenge to the decision to carve up the company, leaving it intact. However, it was required to share code with third-party developers, which helped pave the way for the current generation of tech giants like Google and Facebook.

It was partly due to Microsoft's focus on its antitrust trial that it missed the boat on the explosive growth of the early smartphone era, putting it far behind rivals like Apple and Google (GOOG, GOOGL). The failure of the Windows Phone experiment, which will be unceremoniously killed Dec. 10, left Microsoft to lick its wounds and figure out a new means to rejoin the ranks of the elite, fast growth tech companies.

Since then, Microsoft has become a star of the tech industry. What's more, the company has avoided the scrutiny that its contemporaries, including Facebook, Google, Amazon (AMZN), and Apple, have faced from lawmakers and consumer advocacy groups over both allegedly anticompetitive behavior and collection of user data. In fact, it is Microsoft's antitrust trial that is often referenced as a means to try to reel in American tech giants.

It's all about the cloud...and more

Microsoft's current growth story is inextricably linked to an outrageous increase in enterprise cloud computing. And with its Azure cloud platform, the company has become the second largest cloud provider in the world behind only Amazon.

"Nadella has had the golden touch in terms of the move to cloud," Wedbush analyst Dan Ives explained. "In my opinion, 20 years covering tech, it's one of the most transformational turnarounds I've ever seen."

It's important to note that Microsoft is still a distant second in terms of cloud market share, too. According to research firm Gartner, Microsoft claimed just 15.5% of the cloud market in 2018, while Amazon held a whopping 47.8%.

But according to Ives, Microsoft's second place standing in the cloud world might not hold for long.

"If you look at Microsoft, and you look back when Nadella took over as CEO, the company was nowhere when it came to cloud," Ives said. "Now today, they are in position to not just be the clear number two player, but, I think, ultimately down the road, contend with Amazon for the number one position."

Microsoft's Azure is easily the star of the company's product portfolio, but it's not the only cloud-enabled offering that's been pulling its weight. Office 365, Microsoft's subscription productivity suite, has also been a boon for the company.

As O'Donnell puts it, Microsoft's decision to move Office to a subscription service model, rather than relying on individual perpetual licenses, proves how much the company has changed.

Ives agreed with that notion, saying, "The main thing they did that was the genius move, was some of the combo deals between Office 365 and Azure. If you look, only 15% to 20% of the customer base has moved to cloud, so Microsoft has major runway here, and these are core enterprise customers as well as government customers."

A major piece of Office 365 also happens to be Microsoft's Teams chat software. While much of the hype in the messaging space this year went to Slack (WORK) and its IPO, Microsoft has slowly been building out its own platform. And in November, the company revealed it now has 20 million active Teams users. Slack, on the other hand, reported that it had 12 million active users in October.

Slack's stock price, meanwhile, has tumbled more than 40% since its IPO in June via direct listing.

Microsoft doesn't break out how many of those 20 million users pay for teams, versus those who use the company's free version of the service, but it's an important metric nonetheless.

And while the company's various cloud efforts are a major asset, Microsoft is still bringing in revenue from sales of its Windows platform to the likes of Dell, HP, Lenovo, and other laptop and desktop makers.

Then there's the gaming space, which Microsoft has been using to test its own cloud gaming offering codenamed Project XCloud. That service is expected to launch in 2020, and will rival Google's newly released Stadia platform.

Jedi is icing on the cake

Microsoft's 2019 peaked in October when the company won the Department of Defenses' 10-year, $10 billion Joint Enterprise Defense Initiative contract. The contract is a major win for Microsoft.

Not only does it secure an incredibly lucrative contract for the company, it all but ensures Microsoft’s cloud services will continue to have a connection to the federal government for the next decade.

Still, JEDI is the subject of major controversy, with Amazon claiming that President Trump interfered with the awarding process due to his distaste for Amazon CEO Jeffrey Bezos. The company has said it will protest the award.

Despite that, it certainly doesn't hurt Microsoft to be able to point to winning JEDI in marketing the platform to potential business partners.

Taken as a whole, between revenue, stock price, market cap, and the growth of its cloud services, Microsoft is poised for continued expansion for years to come.

More from Dan:

Got a tip? Email Daniel Howley at danielphowley@protonmail.com or dhowley@yahoofinance.com, and follow him on Twitter at @DanielHowley.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

Yahoo Finance

Yahoo Finance