Micron Technology, Inc. (MU) Stock: Don’t Give in to the Fear Trade!

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Profitable investors are almost always worried about the “second act.” Once a company, particularly an embattled one, has a breakout year, those that are still long face inevitable doubts. Should I stay the course, or dump out? What happens if others lose the faith? These and many other questions are dogging Micron Technology, Inc. (NASDAQ:MU).

Source: Shutterstock

So far, the signs are favorable towards MU stock. While several other companies in the semiconductor sector have been victimized by extreme volatility, Micron has held strong.

Year-to-date, the company is up a very robust 44%, comparing quite nicely with last year’s 58.5% return. More importantly, MU looks significantly better than Intel Corporation (NASDAQ:INTC), and it has far more stability than Advanced Micro Devices, Inc. (NASDAQ:AMD).

However, trouble might be looming, according to Barron’s Tiernan Ray. While acknowledging the tremendous demand spike for memory chips, Ray worries that the party may soon come to an end. Because the laws of supply and demand dictates whether Micron stock lives or dies, a bubble burst could be cataclysmic for MU.

Historical performance doesn’t provide much confidence, either. Since the 2000 tech bubble collapse, MU stock has pushed in and out between profitability and despair. Micron has never been able to string together more than two years of positive returns in the present timeframe.

Considering many uncertainties in the broader markets, is now a proper time to jump ship from Micron stock?

Micron Can Weather a Storm If It Comes!

Before people scamper to hit the “sell” button, I think there’s something to be said about MU beating its sector rivals. For instance, Market Vectors Semiconductor ETF (NYSEARCA:SMH) is up a respectable 19% YTD. However, MU stock exceeds that by more than a two-fold margin, which is no small feat.

Furthermore, bears tend to look closely at semiconductor trends and not enough at individual attributes. While Micron stock certainly had a rough go throughout all of 2015, and half of 2016, it’s in the past. Fundamentally, the tech company is riding eight consecutive earnings beats, with a strong return to profitability in fiscal 2017. I believe Micron has learned from its past mistakes and is a much more acutely aware organization.

One giant lesson learned is diversification. Focusing too intently on a memory chip bubble burst ignores the fact that MU stock is levered to other businesses. As InvestorPlace contributor Luke Lango states, Micron is a “cloud growth story,” and they’re gaining tremendous momentum. In their most recent third-quarter report, the company’s ” … revenue from cloud customers was more than four times higher year-over-year.”

In addition, while MU’s bread and butter remains memory chip production, that demand is shifting rapidly away from PCs and towards smart mobile devices. While I made the argument that companies like Apple Inc. (NASDAQ:AAPL) must contend with “peak smartphone,” this won’t impact Micron. Apple and the litany of competitors will have to duke it out for ever-decreasing return on investment.

However, consumers are still very much hungry for smart devices, and their needs will be met. Peak smartphone is something the producers will have to figure out. In the meantime, Micron is all too happy to sell the memory components.

Strong Technical Setup for MU Stock

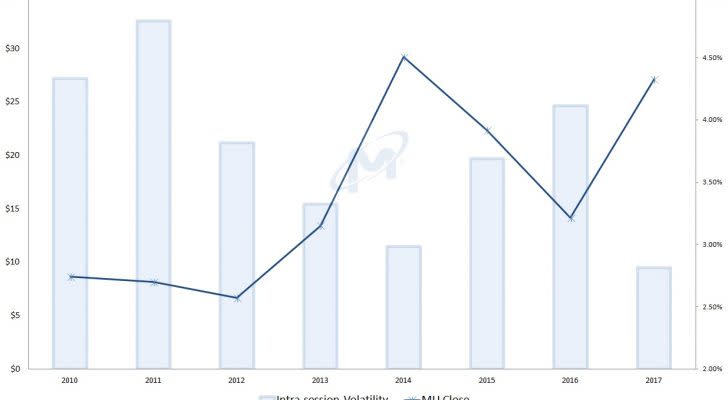

Finally, technical developments in MU stock are encouraging for present and would-be investors. Since the beginning of this decade, intrasession volatility, or the spread between the highs and lows of a session, is declining considerably. In 2011, intrasession volatility hit nearly 5%. So far this year, we’re looking at 2.8%.

This dynamic is significant for two reasons. Number one, it tells us that Micron stock is entering a period of stabilization. Granted, as a semiconductor, wild swings are an inevitability. Nevertheless, these instances are becoming rarer.

But the other noteworthy point is that lower volatility in MU stock tends to be favorable for future upside moves. Since the start of 2010, volatility and Micron’s average price shared an inverse correlation of nearly -80%. Essentially, as volatility decreases, the market value of MU increases.

Of course, I wouldn’t pin everything on one statistical relationship. Instead, I would look at the whole opportunity. And whether we’re talking about Micron’s fundamental strengths, its business diversification, or its technical setup, the signs are very positive for MU stock. I’m more inclined to focus on these arguments rather than fears of a bubble that may or may not collapse.

As of this writing, Josh Enomoto did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Micron Technology, Inc. (MU) Stock: Don’t Give in to the Fear Trade! appeared first on InvestorPlace.

Yahoo Finance

Yahoo Finance