Micron (MU) Posts Earnings Beat, 'Secular Trends' Driving Growth

Micron Technology, Inc. (MU) just released its latest quarterly financial results, posting non-GAAP earnings of $2.82 per share and revenues of $7.35 billion.

Currently, MU is a Zacks Rank #1 (Strong Buy), but that could change based on today’s results. Micron shares have gained nearly 130% over the past year, including a 35% surge within the last four weeks. The stock has hovering near a 52-week high before slipping about 3.5% on Thursday.

The stock is currently down 2.0% to $57.72 per share in after-hours trading shortly after its earnings report was released.

Micron:

Beat earnings estimates. The company posted adjusted earnings of $2.82 per share, beating the Zacks Consensus Estimate of $2.76. Micron’s earnings estimates were trending higher in the two months ahead of today’s report.

Beat revenue estimates. The company saw revenue figures of $7.35 billion, beating our consensus estimate of $7.23 billion.

Total revenues were up 58% from the prior-year period. GAAP net income was $3.31 billion, or $2.67 per diluted share, up from $894 million, or $0.77 per diluted share, in the year-ago quarter. Micron ended the quarter with cash, marketable investments, and restricted cash of $8.68 billion.

“Our performance was accentuated by an ongoing shift to high-value solutions as we grew sales to our cloud, mobile and automotive customers and set new records for SSDs and graphics memory,” said CEO Sanjay Mehrotra. “Secular technology trends are driving robust demand for memory and storage, and Micron is well-positioned to address these growing opportunities.”

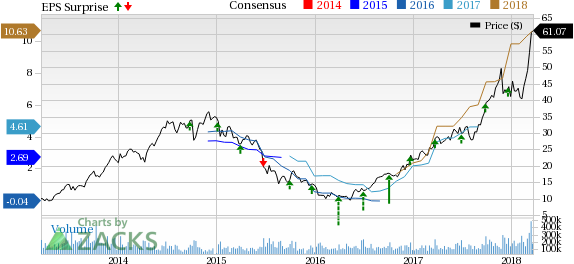

Here’s a graph that looks at Micron’s recent earnings performance:

Micron Technology, Inc. Price, Consensus and EPS Surprise

Micron Technology, Inc. Price, Consensus and EPS Surprise | Micron Technology, Inc. Quote

Micron Technology, Inc., is one of the world's leading providers of advanced semiconductor solutions. Through its worldwide operations, Micron manufactures and markets DRAMs, NAND flash memory, CMOS image sensors, other semiconductor components, and memory modules for use in leading-edge computing, consumer, networking, and mobile products.

Check back later for our full analysis on MU’s earnings report!

Want more market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance