Merck's (MRK) Co-formulation Therapy Fails Lung Cancer Study

Merck MRK provided an update on the open-label arm of the phase II KeyVibe-002 study, which evaluated an investigational co-formulation MK-7684A in patients with metastatic non-small cell lung cancer (NSCLC).

Data from the open-label arm of the study showed that treatment with MK-7684A alone failed to achieve the primary endpoint of progression-free survival (PFS) with statistical significance. The treatment was numerically less effective compared with docetaxel, a standard of care.

The KeyVibe-002 study is a randomized mid-stage study evaluating MK-7684A in metastatic NSCLC patients wherein participants were equally assigned to three separate study arms – an open-label arm wherein participants are administered only MK-7684A, a blinded arm wherein administering MK-7684A plus docetaxel and a placebo arm. The study has been designed to evaluate the efficacy of MK-7684A with or without docetaxel, to docetaxel alone.

Merck is currently notifying study investigators to switch participants being administered MK-7684A to a standard of care unless a patient is benefitting from treatment with the therapy.

Management continues to evaluate MK-7684A in the blinded arm of the study. Data from the same is expected at a future medical meeting once it is made available.

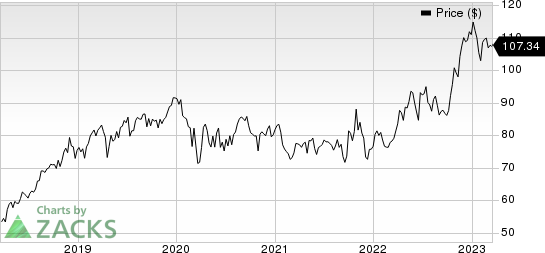

Shares of Merck have lost 3.2% in the year so far compared with the industry’s 7.6% fall.

Image Source: Zacks Investment Research

Apart from the KeyVibe-002 study, Merck is also evaluating the safety and efficacy of MK-7684A in multiple late-stage studies targeting lung cancer and melanoma indications. Per management, MK-7684A is being tested alone or in combination with other agents in over 4,000 patients.

MK-7684A co-formulates Merck’s blockbuster anti-PD-1 therapy Keytruda (pembrolizumab) and anti-TIGIT therapy vibostolimab.

Using these novel combinations and co-formulations, Merck aims to expand Keytruda’s label to treat more patients with cancer. The Keytruda development program is also progressing well and the drug is being studied in more than 1600 studiesacross various cancers and treatment settings.

Currently, Keytruda (either alone or in combination with other agents) is approved in five NSCLC indications by the FDA. The drug is a key driver of growth for Merck’s topline. In 2022, the drug generated $20.9 billion in product sales, contributing around 35% to the company’s total revenues.

Merck & Co., Inc. Price

Merck & Co., Inc. price | Merck & Co., Inc. Quote

Zacks Rank & Stocks to Consider

Merck currently carries a Zacks Rank #3 (Hold).Some better-ranked stocks in the overall healthcare sector include Adaptive Biotechnologies Corporation ADPT, Atara Biotherapeutics ATRA and AVITA Medical RCEL, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Adaptive Biotechnologies’ 2023 loss per share have narrowed from $1.30 to $1.15 in the past 30 days. During the same period, the loss per share estimates for 2024 have narrowed from 99 cents to 94 cents. Shares of Adaptive Biotechnologies have risen 7.6% year-to-date.

Earnings of Adaptive Biotechnologies beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 10.75%. In the last reported quarter, ADPT delivered an earnings surprise of 24.32%.

In the past 30 days, estimates for Atara Biotherapeutics’ 2023 loss per share have narrowed from $2.28 to $2.17. During the same period, the loss per share estimates for 2024 have narrowed from $1.81 to $1.62. Shares of Atara Biotherapeutics have risen 10.5% in the year-to-date period.

Earnings of Atara Biotherapeutics beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an earnings surprise of 13.50%, on average. In the last reported quarter, Atara Biotherapeutics’ earnings missed estimates by 18.03%.

In the past 30 days, estimates for AVITA Medical’s 2023 loss per share have narrowed from $1.26 to 99 cents. During the same period, the loss per share estimates for 2024 have narrowed from 92 cents to 79 cents. In the year so far, shares of AVITA Medical have declined 15.0%.

Earnings of AVITA Medical beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 22.16%, on average. In the last reported quarter, AVITA Medical’s earnings beat estimates by 34.38%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Adaptive Biotechnologies Corporation (ADPT) : Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA) : Free Stock Analysis Report

Avita Medical Inc. (RCEL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance