Medtronic's (MDT) Q4 Earnings Beat Estimates, Margins Up

Medtronic plc MDT reported fourth-quarter fiscal 2021 adjusted earnings per share (EPS) of $1.50, beating the Zacks Consensus Estimate by 5.6%. Adjusted earnings also showed a stupendous improvement from the year-ago figure of 58 cents per share. Currency-adjusted EPS came in at $1.54 for the quarter.

Without certain one-time adjustments — including restructuring, acquisition, amortization expenses and certain litigation charges — GAAP EPS was $1, reflecting a 108% surge from the year-ago reported figure.

For the full year, adjusted earnings came in at $4.44, a 3.3% drop from the year-ago period.

Total Revenues

Worldwide revenues in the reported quarter grossed $8.19 billion, up 32% on an organic basis (excluding the impacts of currency) and 36.5% on a reported basis. The top line exceeded the Zacks Consensus Estimate by 0.6%.

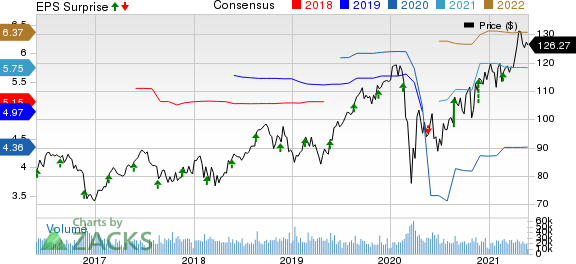

Medtronic PLC Price, Consensus and EPS Surprise

Medtronic PLC price-consensus-eps-surprise-chart | Medtronic PLC Quote

Fiscal 2021 revenues were $30.1 billion, up 2% on an organic basis (adjusting for the impact of foreign currency translation, the inorganic benefit of Titan Spine, and the estimated benefit of an extra week)and marked a 4.2% reported improvement from the year-ago figure. It also edged past the Zacks Consensus Estimate by 0.1%.

Q4 in Details

In the quarter under review, U.S. sales (51% of total revenues) rose 47% year over year on a reported basis (same on an organic basis) to $4.18 billion. Non-U.S. developed market revenues totaled $2.67 billion (33% of total revenues), depicting a 20% improvement on a reported basis (up 11% on an organic basis).

Emerging market revenues (16% of total revenues) amounted to $1.33 billion, up 44% on a reported basis (up 41% organically).

Segment Details

The company currently generates revenues from four major segments, namely Cardiovascular Portfolio, Medical Surgical Portfolio, Neuroscience Portfolio and Diabetes.

Cardiovascular Portfolio comprises Cardiac Rhythm & Heart Failure (CRHF), Structural Heart & Aortic (SHA), and Coronary & Peripheral Vascular (CPV). Medical Surgical includes Surgical Innovations (SI), and Respiratory, Gastrointestinal & Renal (RGR) divisions. Neuroscience consists of Cranial & Spinal Technologies (CST), Specialty Therapies and Neuromodulation divisions.

In the fiscal fourth quarter, Cardiovascular revenues surged 41% at CER to $2.91 billion, reflecting high-fifties organic growth in CRHF and mid-twenties organic growth in both SHA and CPV. CRHF sales totaled $1.54 billion, up 58.5% year over year at CER. Revenues from SHA were up 25.1% at CER to $744 million. CPV revenues were up 24.1% at CER to $624 million.

In Medical Surgical, worldwide sales totaled $2.34 billion, marking a 17% year-over-year improvement at CERwith high-twenties organic growth in SI and low-single digit organic growth in RGR. SI rose 27.4% while RGR registered an improvement of 0.9% both at CER.

In Neuroscience, worldwide revenues of $2.29 billion were up 51% year over year at CER, driven by high-forties growth in CST, low-fifties growth in Specialty Therapies, and low-sixties growth in Neuromodulation. Cranial and Spinal Technologies reported 46.7% rise at CER. Sales in Specialty Therapies improved 51.7% while Neuromodulation sales were up 61.4% year over year at CER.

Revenues at the Diabetes group increased 9% at CER to $647 million. The quarter registered low-sixties growth in durable pumps on the continued launches of the MiniMed 780G system in international markets and the MiniMed 770G system in the United States. This growth was however offset by high-single digit declines in consumables. Continuous glucose monitoring (CGM) sales increased in mid-single digits.

Margins

Gross margin in the reported quarter expanded 536 basis points (bps) to 67.6% on a 48.3% rise in gross profit to $5.54 billion. Adjusted operating margin expanded 1476 bps year over year to 28.2%. Selling, general and administrative expenses rose 9.9% to $2.59 billion. Research and development expenses increased 11.5% to $632 million.

Guidance

Medtronic has initiated its fiscal 2022 financial guidance.

The company expects to report organic revenue growth of approximate 9% from fiscal 2021. Considering current foreign exchange rate, fiscal 2022 revenues are expected to be positively impacted by $400 to $500 million.The Zacks Consensus Estimate for the company’s fiscal 2022 worldwide revenues is pegged at $32.64 billion.

Full-year adjusted EPS is projected in the range of $5.60 to $5.75, including an estimated 10 to 15 cents positive impact from foreign exchange. The Zacks Consensus Estimate for the year’s adjusted earnings is $5.75.

Our Take

Medtronic’s fourth-quarter fiscal 2021 earnings and revenues both were ahead of the respective Zacks Consensus Estimate. Each and every operating segment and geography registered strong year-over-year growth on an organic basis.

The company's fourth-quarter results reflect a strong recovery from the impact of the COVID-19 pandemic on elective procedures that the company experienced in April 2020. The quarter’s gross and operating margins showed stupendous improvement on a year-over-year basis. Fiscal 2022 EPS and revenue guidance indicating strong growth buoys optimism.

Zacks Rank & Recent Releases

Medtronic currently has a Zacks Rank #3 (Hold).

Companies in the broader medical space that have already announced quarterly results include Owens & Minor, Inc. OMI, Henry Schein, Inc. HSIC and Avantor, Inc. AVTR, eachpresently carrying a Zacks Rank#2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Owens & Minor reported first-quarter 2021 adjusted EPS of $1.57, which surpassed the Zacks Consensus Estimate by 61.9%.

Henry Schein reported first-quarter 2021 adjusted EPS of $1.24, which surpassed the Zacks Consensus Estimate by 49.4%.

Avantor reported first-quarter 2021 adjusted EPS of 35 cents, which exceeded the Zacks Consensus Estimate by 25%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency have sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medtronic PLC (MDT) : Free Stock Analysis Report

Owens & Minor, Inc. (OMI) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Avantor, Inc. (AVTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance