Medifast (MED) Q2 Earnings Top Estimates on OPTAVIA Strength

Medifast, Inc. MED delivered robust second-quarter 2020 results, wherein both top and bottom lines grew year over year and came ahead of the Zacks Consensus Estimate. Solid demand and engagement among OPTAVIA coaches as well as clients boosted results. The company notified that its number of active earning coaches were the highest in the quarter, with productivity increasing significantly from the last quarter. Consumers’ rising inclination toward health and fitness has been clearly working well for Medifast.

Management remains impressed with OPTAVIA’s relevance even amid the pandemic. In fact, all business operations of the company operated without any major hurdle throughout the COVID-19-led lockdown. However, on account of pandemic-related uncertainties, the company did not offer any guidance. Nonetheless, management said that, in July, the company saw trends that were in line with or better than those in the second quarter. Further, the company remains committed to cost control for the remainder of 2020.

Q2 Highlights

The company posted adjusted earnings of $1.96 per share, which surpassed the Zacks Consensus Estimate of $1.84. Moreover, the bottom line grew 12% year over year.

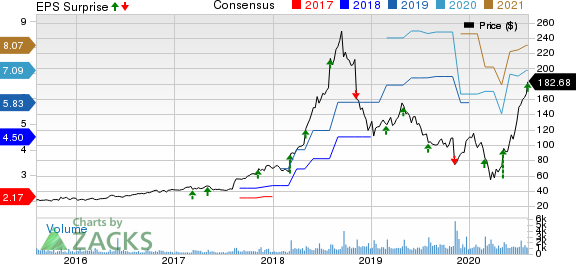

MEDIFAST INC Price, Consensus and EPS Surprise

MEDIFAST INC price-consensus-eps-surprise-chart | MEDIFAST INC Quote

Net revenues of $220 million advanced 17.6% year over year and beat the Zacks Consensus Estimate of $195 million. Markedly, OPTAVIA-branded products formed 83% of consumable units sold in the quarter, up from 75% in the year-ago period. Incidentally, total active earning OPTAVIA coaches jumped 19.3% to 36,500. However, average revenue per active earning OPTAVIA coach came in at $5,851, down from $5,863 in the same period last year.

Management noted that while OPTAVIA’S productivity remained in line with the year-ago period, it rose 9.7% on a quarter-over-quarter basis.

Gross profit grew 13.2% to $159.3 million, though the gross margin contracted 280 basis points (bps) year over year to 72.4%. Gross margin was affected by increased promotional activity and elevated production costs.

Moving on, adjusted SG&A expenses increased 14.5% to $129.8 million in the quarter, mainly accountable to escalated OPTAVIA commission costs, stemming from higher OPTAVIA sales, and greater coach incentives. As a percentage of revenues, adjusted SG&A expenses declined 160 bps to 59%. Adjusted income from operations rose 8.1% to $29.5 million, thanks to higher gross profit, partially offset by a rise in SG&A expenses. However, the operating margin contracted 120 bps to 13.4%.

Other Financial Updates

The company concluded the quarter with cash and cash equivalents of $130.8 million and total shareholders’ equity of $116.7 million. Notably, management did not have any interest-bearing debt on its balance sheet as of Jun 30, 2020.

Concurrently, management announced a quarterly cash dividend of $1.13 per share, which is payable on Aug 6, 2020. Additionally, the company repurchased 46,075 shares during the second quarter of 2020 and has roughly 2,323,000 shares remaining under its buyback plan. The company anticipates maintaining its quarterly dividend payment practice.

Other Developments

During the second quarter, Medifast introduced a key initiative, which ran from March to May and fueled major increases in the company’s core growth metrics — new client acquisitions and co-sponsorships. Early results of the initiative underscore OPTAVIA’s relevance even amid the pandemic, along with the company’s ability to respond to the changing consumer environment. The company remains focused on driving demand for its products and services in the third quarter.

To keep pace with the changing scenario, management has largely altered its programs for the second half of 2020 — including the development of a digital-first approach. To this end, the company’s high-profile virtual event, Optavia together live (from Jul 24-26), is noteworthy. Apart from these, Medifast remains impressed with its supply-chain investments.

This Zacks Rank #2 (Buy) stock has almost doubled in the past three months compared with the industry’s growth of 11.9%.

Looking for More Solid Food Stocks? Check These

Kraft Heinz KHC, which currently carries a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Campbell Soup CPB, with a Zacks Rank #2, has a long-term earnings growth rate of 8.3%.

TreeHouse Foods THS, with a Zacks Rank #2, has a long-term earnings growth rate of 6.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance