Medifast (MED) Moves 12.1% Higher: Will This Strength Last?

Medifast (MED) shares soared 12.1% in the last trading session to close at $252.28. The move was backed by solid volume with far more shares changing hands than in a normal session. This compares to the stock's 0.6% gain over the past four weeks.

Medifast’s shares got a boost from the company’s splendid first-quarter 2021 results, wherein both earnings and sales saw significant year-over-year growth. Also, both metrics cruised past their respective Zacks Consensus Estimate. Strength in OPTAVIA remained a strong driver, with average revenue per active earning OPTAVIA coach increasing year over year.

The first quarter witnessed exceptional growth and productivity, thanks to strength in its independent OPTAVIA Coaches as well as employees. To this end, OPTAVIA Coaches are focused on utilizing technology, such as the company’s own app-based platforms, along with social media channels and field-led training platforms. We note that consumers’ increased inclination toward health, together with a solid OPTAVIA coach-based model, has been helping Medifast draw new clients. Notably, the company remains committed to making further investments to improve its infrastructure in order to aid growth.

The company posted first-quarter earnings of $3.46 per share, which crushed the Zacks Consensus Estimate of $2.72 and surged a whopping 121.8% on a year-over-year basis. Net revenues of $340.7 million soared 90.9% year over year and beat the Zacks Consensus Estimate of $287 million. Markedly, OPTAVIA-branded products formed 88.9% of consumable units sold in the quarter, up from 79% in the preceding quarter. Incidentally, total active earning OPTAVIA coaches jumped 61% to 52,500.

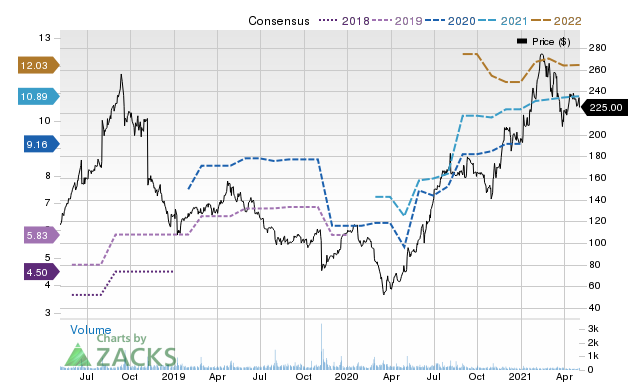

Price and Consensus

This weight-loss company is expected to post quarterly earnings of $2.87 per share in its upcoming report, which represents a year-over-year change of +46.4%. Revenues are expected to be $299.7 million, up 36.2% from the year-ago quarter.

While earnings and revenue growth expectations are important in evaluating the potential strength in a stock, empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

For Medifast, the consensus EPS estimate for the quarter has been revised 0.5% higher over the last 30 days to the current level. And a positive trend in earnings estimate revision usually translates into price appreciation. So, make sure to keep an eye on MED going forward to see if this recent jump can turn into more strength down the road.

The stock currently carries a Zacks Rank 2 (Buy). You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here >>>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance