Mastercard (MA), UniCredit Expand Ties to Advance Payment Options

Mastercard Incorporated MA solidified its global payment partnership with the pan-European Commercial Bank, UniCredit. Both partners have shared a strong bond for many years, and devised digital solutions beneficial for people and businesses throughout Europe.

The recent tie-up aims to integrate the card payment expertise of Mastercard with UniCredit’s prowess to tap the combined power of 13 banks to fetch innovative payment choices to UniCredit cardholders. Additionally, the cardholders will also benefit from a comprehensive portfolio of in-app solutions that will ease core product propositions along with an advanced digital experience.

The robust Priceless brand platform of Mastercard and sponsorship marketing assets will help UniCredit infuse greater preference and loyalty within the consumer lifecycle. A solid digital arm built on partnerships with well-established organizations and significant investments makes MA the choice of several financial service providers in various countries.

The latest move reflects Mastercard’s continuous efforts to strengthen its footprint as a leading technology provider across the globe. It frequently resorts to partnerships with fintechs or undertakes significant investments across different parts of the globe in a bid to capture a sizeable share of the booming digital economy. Factors such as increased Internet penetration and higher usage of smartphones continue to drive worldwide digital growth.

In addition to launching innovative digital payment solutions, Mastercard always remains equipped with effective fraud prevention services to counter cybercrimes that are inevitable with the widespread adoption of digital means.

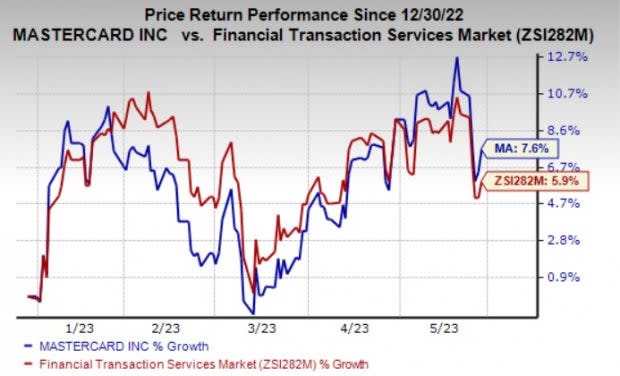

Shares of Mastercard have gained 7.6% year to date compared with the industry’s 5.9% growth. MA currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some top-ranked stocks in the Business Services space are The Interpublic Group of Companies, Inc. IPG, Huron Consulting Group Inc. HURN and SPS Commerce, Inc. SPSC. While Interpublic Group sports a Zacks Rank #1 (Strong Buy), Huron Consulting and SPS Commerce carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of Interpublic Group outpaced the Zacks Consensus Estimate in three of the last four quarters and matched the mark once, the average beat being 9.50%. The consensus estimate for IPG’s 2023 earnings is pegged at $2.96 per share, which suggest an improvement of 7.6% from the year-ago reported figure.

The Zacks Consensus Estimate for IPG’s 2023 earnings has moved 3.9% north in the past seven days. Shares of the company have gained 13.2% year to date.

The bottom line of Huron Consulting outpaced the consensus mark in each of the trailing four quarters, the average surprise being 13.49%. The consensus estimates for HURN’s 2023 earnings and revenues indicate growth of 20.4% and 11.5%, respectively, from the year-ago reported figure.

The Zacks Consensus Estimate for HURN’s 2023 earnings has moved 2.5% north in the past seven days. Shares of the company have rallied 12.5% year to date.

SPS Commerce’s earnings outpaced the consensus estimate in each of the last four quarters, the average surprise being 16.43%. The consensus estimates for SPSC’s 2023 earnings and revenues indicate growth of 14% and 16.9%, respectively, from the year-ago reported figure.

The Zacks Consensus Estimate for SPSC’s 2023 earnings has moved 0.8% north in the past 60 days. Shares of the company have gained 26.4% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Huron Consulting Group Inc. (HURN) : Free Stock Analysis Report

SPS Commerce, Inc. (SPSC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance