Marsh & McLennan (MMC) Focuses to Boost Hold in Australia

Marsh & McLennan Companies, Inc.’s MMC sub-unit from the Consulting segment, Mercer, undertook a couple of measures for expanding its capabilities across Australia.

The first move marks Mercer completing the integration of superannuation or pension accounts of the wealth management arm (BT) of Westpac Banking Corporation within the Mercer Super Trust.

This merger will form one of the most competitive funds in the superannuation market of Australia. Consequent to the integration, the Mercer Super Trust occupies a spot among the 15 largest funds of the country and cater to around 850,000 members. It also has assets under management of $63 billion as a result of the merger.

Members of the merged Mercer Super Trust will gain access to a varied array of investment options and entitled to robust market returns. Moreover, they will benefit from significant fee cuts, as well as superannuation-linked complimentary financial guidance.

Simultaneous with this merger, Mercer acquired Advance Asset Management Limited, one of the financial advisory units of Westpac. Inked in May 2022, the deal was completed within the targeted deadline of the first half of 2023. The buyout is likely to solidify the investment multi-manager capabilities of Mercer across Australia.

The merger initiative is expected to boost fees derived from assets under administration or management. Meanwhile, the buyout seems to be in line with the active acquisition strategy, usually followed by MMC within its different operating units. Such efforts have enabled MMC to delve into new geographies, expand within the existing locations, foray into new businesses and specialize within its current businesses.

The twin announcements also mark sincere efforts of Marsh & McLennan’s sub-part to bring about enhanced investment and retirement outcomes for its extensive customer base. For complementing the endeavor, Mercer leverages a widespread global network and credible team of around 2,000 worldwide investment professionals that has earned it the reputation of being one of the world’s most reputed retirement advisors and investment managers.

Conclusively, a well-performing Mercer business as a result of the recent initiatives is expected to provide an impetus to the Consulting segment. The segment, operating through Mercer and Oliver Wyman Group, contributed around 39% to revenues in 2022.

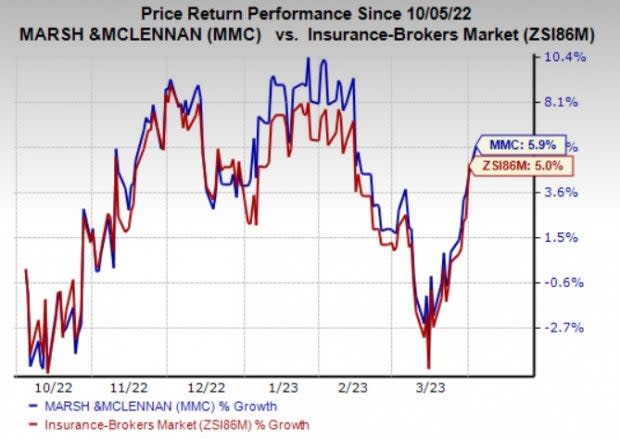

Shares of Marsh & McLennan have gained 5.9% in the past six months compared with the industry’s growth of 5%. MMC currently carries a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the insurance space are Brighthouse Financial, Inc. BHF, James River Group Holdings, Ltd. JRVR and CNA Financial Corporation CNA, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Brighthouse Financial’s earnings surpassed estimates in three of the trailing four quarters and missed the mark once, the average surprise being 2.07%. The Zacks Consensus Estimate for BHF’s 2023 earnings and revenues suggests year-over-year growth of 33.5% and 2.7%, respectively. The consensus mark for BHF’s 2023 earnings has moved 4.2% north in the past 60 days.

James River Group’s bottom line outpaced earnings estimates in each of the last four quarters, the average surprise being 17.20%. The Zacks Consensus Estimate for JRVR’s 2023 earnings and revenues suggests growth of 16.2% and 6%, respectively, from the prior-year’s reported figures. The consensus mark for JRVR’s 2023 earnings indicates a 4.9% improvement in the past 60 days.

CNA Financial’s earnings surpassed estimates in two of the trailing four quarters and missed the mark twice, the average surprise being 9.91%. The Zacks Consensus Estimate for CNA’s 2023 earnings and revenues suggests year-over-year growth of 10.4% and 5.9%, respectively. The consensus mark for CNA’s 2023 earnings has moved 3.9% north in the past 60 days.

The CNA Financial stock has inched up 1% in the past six months. However, shares of Brighthouse Financial and James River Group have lost 8.7% and 11%, respectively, in the same time frame.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

CNA Financial Corporation (CNA) : Free Stock Analysis Report

James River Group Holdings, Ltd. (JRVR) : Free Stock Analysis Report

Brighthouse Financial, Inc. (BHF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance