Marriott (MAR) Q3 Earnings Beat Estimates, Increase Y/Y

Marriott International, Inc. MAR reported solid third-quarter 2021 results, with earnings and revenues beating the Zacks Consensus Estimate as well as increasing on a year-over-year basis.

During the quarter, the company witnessed solid demand in Europe owing to the opening of key international borders. It reported sequential improvements in revenue per available room (RevPAR), occupancy and average daily rate (ADR) on account of solid leisure demand. Although the Delta variant had negatively impacted business transient demand (during the second half of the quarter), demand is stated to have picked up in October. With global trends improving, the company expects the recovery momentum to continue in the upcoming periods as well.

Earnings & Revenues Discussion

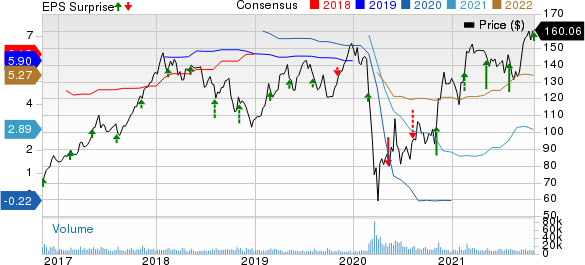

Marriott International, Inc. Price, Consensus and EPS Surprise

Marriott International, Inc. price-consensus-eps-surprise-chart | Marriott International, Inc. Quote

In the quarter under review, Marriott’s adjusted earnings per share were 99 cents, which surpassed the Zacks Consensus Estimate of 97 cents. In the prior-year quarter, the company had reported adjusted earnings of 13 cents per share.

Quarterly revenues of $3,946 million surpassed the consensus mark of $3,468 million. Moreover, the top line surged 75% on a year-over-year basis. During the quarter, revenues from Base management and Franchise fee came in at $190 million and $533 million compared with $87 million and $279 million reported in the prior-year quarter.

RevPAR & Margins

In the quarter under review, RevPAR for worldwide comparable system-wide properties fell 25.8% (in constant dollars) compared with 2019 levels. The decline was primarily driven by a fall in occupancy and ADR. Occupancy and ADR declined 16.8% and 4.4%, respectively, from 2019 levels. These metrics were impacted by the coronavirus pandemic.

Comparable system-wide RevPAR in Asia Pacific (excluding China) fell 63.9% (in constant dollars) from 2019 levels. Notably, occupancy and ADR had fallen 37.9% and 26%, respectively, from 2019 levels. Comparable system-wide RevPAR in Greater China fell 27.4% from 2019 levels.

On a constant-dollar basis, international comparable system-wide RevPAR fell 40.7% compared with 2019 levels. Occupancy and ADR dropped 25.4% and 7.9%, respectively, from 2019 levels. Comparable system-wide RevPAR in Europe as well as Caribbean & Latin America declined 43.5% and 17.8%, respectively, from 2019 levels.

Total expenses during the quarter increased 69.9% year over year to $3,401 million, primarily owing to a rise in Reimbursed expenses.

During the third quarter, adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to $683 million compared with $327 million in the prior-year quarter.

Balance sheet

At the end of the third quarter, Marriott's total debt amounted to $9 billion compared with $9.5 billion in the previous quarter.

Unit Developments

At the end of third-quarter 2021, Marriott's development pipeline totaled nearly 2,769 hotels, with approximately 477,000 rooms. Nearly 206,000 rooms were under construction.

During the quarter, the company added 114 new properties (17,456 rooms) to its worldwide lodging portfolio.

Zacks Rank & Key Picks

Marriott currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Consumer Discretionary sector include Golden Entertainment, Inc. GDEN, Wyndham Hotels & Resorts, Inc. WH and Choice Hotels International, Inc. CHH. Golden Entertainment sports a Zacks Rank #1, while Wyndham Hotels and Choice Hotels carry a Zacks Rank #2 (Buy).

Golden Entertainment’s 2021 earnings are expected to surge 232.1%.

Wyndham Hotels has a trailing four-quarter earnings surprise of 61.9%, on average.

Choice Hotels has three-five-year earnings per share growth rate of 35.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Choice Hotels International, Inc. (CHH) : Free Stock Analysis Report

Golden Entertainment, Inc. (GDEN) : Free Stock Analysis Report

Wyndham Hotels & Resorts (WH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance