Market Wrap: Bitcoin Price Finishes Higher for Third Consecutive Week

Price Action

BTC regains $24,000 after initially trading lower.

Bitcoin’s (BTC) price reclaimed $24,000 after falling earlier in the day. The largest cryptocurrency by market capitalization was recently trading sideways and just over this threshold. Bitcoin rose 3% over the last week, continuing recent momentum.

Ether’s (ETH) price increased 0.6%, surpassing $1,900 for the second time this week. ETH’s price has increased 9% over the past seven days as investors eagerly await the Ethereum Merge, which will shift the protocol from proof-of-work to the faster, more energy-efficient proof-of-stake model.

This article originally appeared in Market Wrap, CoinDesk’s daily newsletter diving into what happened in today's crypto markets. Subscribe to get it in your inbox every day.

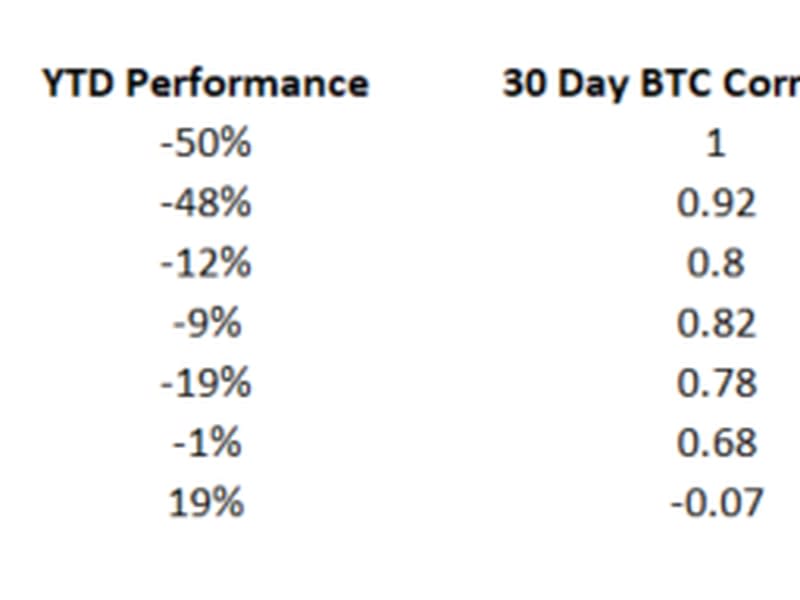

This year, BTC and ETH have fallen 50% and 48%, respectively, and have been tightly correlated with each other. Correlation coefficients range between 1 and -1, with the former indicating a direct relationship, while the latter implies a completely inverse relationship.

Traditional markets finished the week on an up note, with the Dow Jones Industrial Average (DJIA), S&P 500 and Nasdaq indexes up 0.61%, 1.12%, and 0.85% respectively.

The rally was broad-based, with about 70% of stocks listed on the New York Stock Exchange, Nasdaq, closing higher.

The price of crude oil declined 2.6% while natural gas fell 1.17%. The price of gold, a traditional safe-haven asset, increased 0.53%.

Latest Prices

●Bitcoin (BTC): $24,122 −0.3%

●Ether (ETH): $1,924 +1.4%

●S&P 500 daily close: 4,280.15 +1.7%

●Gold: $1,817 per troy ounce +1.5%

●Ten-year Treasury yield daily close: 2.85% −0.04

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Technical Take

BTC’s weekly RSI signals growing momentum in prices.

BTC’s weekly chart illustrates a continuing trend higher for bitcoin. After sliding 42% between March 28 and June 27, the price has increased 25% to above $24,000, albeit with a few switchbacks.

A spike in volume starting June 13 implied that sellers were increasingly motivated to exit BTC positions. A question for investors is whether the selling pressure was based on the perceived value of bitcoin or driven by market-wide contagion, leading to forced selling.

The slide in BTC prices during that week coincided with a pause in customer withdrawals by bankrupt crypto lender Celsius Network, and equally bankrupt crypto hedge fund Three Arrows Capital facing $400 million in liquidations.

Technically, the narrowing of weekly candles and the decline in BTC’s ATR (average true range) since June 13 implies both a decline in volatility and selling conviction. The Relative Strength Index (RSI), a widely regarded crypto markets indicator measuring price momentum on a range between “overbought” and “oversold,” underscored investors’ aversion to digital assets but also an opening for those willing to embrace risk.

While a reading of 70 implies that an asset is potentially overbought (i.e., overvalued), a reading of 30 implies that the asset is potentially undervalued. BTC’s RSI of 25.72 for the week starting June 27 coincided with a low last approached in 2015.

This RSI implies that BTC was the most oversold as it has been in almost seven years. Investors who used the chart to generate entry and exit positions saw this trend as an opportunity to add BTC,, triggering its move upward this summer.

Altcoin roundup

Netherlands Arrests Suspected Developer of Crypto-Mixing Service Tornado Cash: A 29-year-old developer suspected of being involved in the Tornado Cash protocol that has been sanctioned by the U.S. was arrested in Amsterdam on Friday. The country's Fiscal Information and Investigation Service hasn't ruled out making more arrests. Read more here.

Tornado Cash's Discord Appears to Go Dark: Many users are not able to access Tornado Cash's Discord channel, according to multiple tweets by users. The crypto mixer's website seems to be offline for some users as well. Read more here.

Relevant insight

Listen 🎧: Today’s "CoinDesk Markets Daily" podcast discusses the latest market movements, Ethereum’s upcoming Merge and Tornado Cash’s sanction.

Bitcoin $24K Breakout Elusive as Treasury Yields Balk at Peak Inflation Narrative: Traders of risk assets, including bitcoin, might be wrong to conclude that inflation in the U.S. has peaked, bond market activity suggests.

Crypto Derivative Trading Volume Rose for First Time in 4 Months as Market Rallied in July: While leverage boosts returns, it exposes traders to forced liquidations, which injects volatility into the market.

A Crypto Bro Walked Into a Wall Street Bar, and It Went Just Fine: What do NYSE name tags and FTX hats have in common? People who wear them have a shared interest in the institutional adoption of crypto, extending far beyond a lower Manhattan bar.

Crypto Exchange Binance Recovers $450K Stolen From DeFi Protocol Curve.Finance: The world's largest exchange is working with law enforcement to return the funds.

Indian Authorities Freeze Nearly $46M in Assets of Crypto Lender Vauld: The Peter Thiel-backed project had filed for bankruptcy in Singapore last month.

Abrdn Buys Stake in Digital Exchange Archax: With the investment, the U.K. asset manager has become Archax's largest outside shareholder.

Hedge Fund Point72’s Steve Cohen Plans Crypto Asset Manager, Blockworks Reports: The billionaire's new vehicle will trade spot cryptocurrencies and crypto derivatives.

Crypto Mining Hosting Firm Applied Blockchain Adds $15M Loan to Pay Off Debt, Fund Growth: The company's North Dakota site was knocked offline in July due to an equipment failure in the substation feeding it power.

Crypto Entrepreneurs Bankman-Fried, Sun in Talks to Buy Majority of Huobi Global Exchange, Bloomberg Reports: The deal could be one of the biggest ever in the crypto industry.

Other markets

Biggest Gainers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

Solana | +3.3% | ||

Gala | +1.5% | ||

Ethereum | +1.4% |

Biggest Losers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

XRP | −1.3% | ||

Loopring | −1.1% | ||

Decentraland | −0.5% |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.

Yahoo Finance

Yahoo Finance