Market set to notch ninth straight quarterly rise

Barring a dramatic development today, the S&P 500 (^GSPC) is going to end Q1 with a modest gain, and notch its ninth-straight quarterly rise.

Given all the headwinds of a strong dollar, downward earnings revisions, fear of a Fed rate hike (which come and go), oil volatility/MidEast unrest, the U.S. market has held up relatively well.

One explanation: The supply of stock is down as M&A heats up and the IPO market cools.

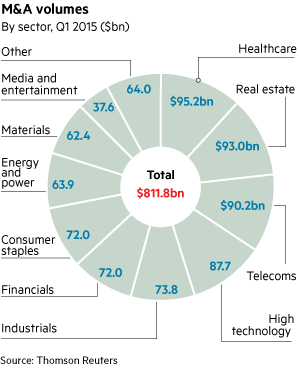

“Dealmaking is off to a running start this year,” The FT reports. “The value of mergers and acquisitions struck in the first three months is up 21 per cent on a year ago making this the fastest start to a year since 2007.”

Healthcare is driving the action with three more deals announced Monday: UNH buying Catamaran (CTRX) for $12.8B in cash, Horizon (HZNP) buying Hyperion Therapeutics (HPTX) for $1.1B and Teva Pharmaceuticals acquiring Auspex Pharmaceuticals (ASPX) for $3.2B.

“But it was U.S. ketchup maker Heinz that provided the highlight of the first quarter, with the biggest deal of 2015 so far. Its takeover of US consumer foods group Kraft,” the FT adds, noting US dealmaking was up 30% in Q1 to $399B -- almost half of all global M&A.

Meanwhile, "just 27 firms have priced IPO deals and raised $4.9 billion in the first quarter, down from 65 companies which raised $12 billion a year ago, according to Ipreo,” Yahoo Finance’s Aaron Pressman reports. “That would make the current quarter the slowest since 2010.”

Get the Latest Market Data and News with the Yahoo Finance App

Pressman’s post came out ahead of today’s Go Daddy (GDDY) IPO but the Internet domain registrant is looking to raise $418 million. That pales in comparison to the $104.3 BILLION of buybacks announced just in February, almost double year-ago levels.

In sum, the big picture story remains the same: Dealmaking and buybacks are removing more stock from the market than is being replaced by IPOs and secondaries. Assuming demand remains constant (and fund flows show no big changes to date), the drop in supply of stock helps explain the bullish resistance to “bad news” so far in 2015.

A few more data points to consider:

The last time buybacks reached a monthly record of $99.8 billion in July 2006, the S&P 500 advanced 23 percent in the next 14 months before hitting an all-time high, Bloomberg reports.

“Only three other times since WWII has the S&P 500 witnessed nine straight quarters of price gains. Each of these prior times recorded price increases in their 10th quarter averaging 8.1%.” - Sam Stovall, S&P Capital IQ

Photo credit: yooperann

Yahoo Finance

Yahoo Finance