Mario Gabelli's Top 5 Fourth-Quarter Stock Buys

Mario Gabelli (Trades, Portfolio)'s GAMCO Investors is in top form. The firm on Feb. 4 reported record assets under management at $47.0 billion, with a 93% increase in earnings per share and 24% increase in revenues in the fourth quarter compared to the previous year.

Gabelli holds that stocks ultimately rise or fall based on their fundamentals, thought he has a positive outlook on the economy entering 2014. In his fourth quarter Gabelli Asset Fund letter he wrote:

"We are optimistic, as it appears for the first time in many years that the world is poised for a synchronized recovery. Indeed, the U.S. is entering its fourth consecutive year of expansion. The housing market is rebounding, job growth is slowly improving, and government policy, which heretofore probably has not added to growth, is unlikely to hinder the rebound as pre-election gridlock sets in. Even the geopolitical stage seems free of major conflict, though flashpoints throughout the Middle East, between China and Japan, and between Russia and its neighbors remain concerning."

These days, he and his team are having to look harder for cheap stocks than they did five years. These are their top selections of the fourth quarter.

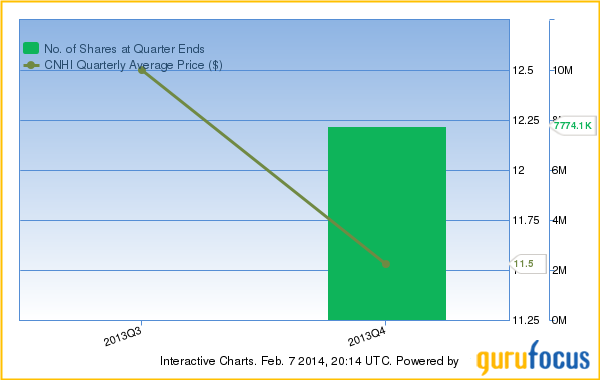

CNH Industrial NV (CNHI)

As his largest new holding, Gabelli purchased 7,774,050 shares of CNH Industrial, equating to 0.47% of his portfolio. The stock's share price averaged $12 in quarter four.

CNH Industrial NV has a market cap of $14.28 billion; its shares were traded at around $10.59 with and P/S ratio of 5.30.

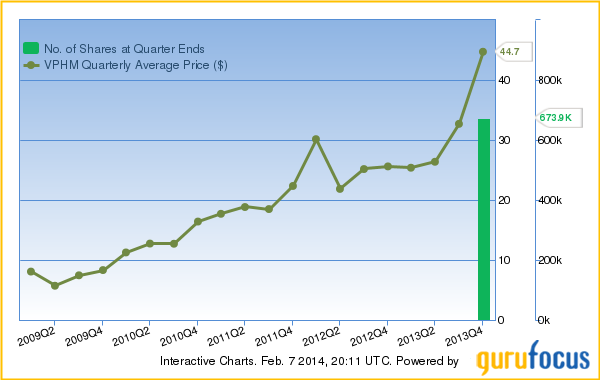

ViroPharma (VPHM)

Gabelli acquired 673,900 shares of ViroPharma in the fourth quarter, equating to 0.18% of the portfolio. The fourth quarter's share price averaged $45.

ViroPharma Inc. was incorporated in Delaware in September 1994 and commenced operations in December 1994. ViroPharma Inc. has a market cap of $3.29 billion; its shares were traded at around $49.96 with and P/S ratio of 8.02. ViroPharma Inc. had an annual average earnings growth of 12.50% over the past 10 years.

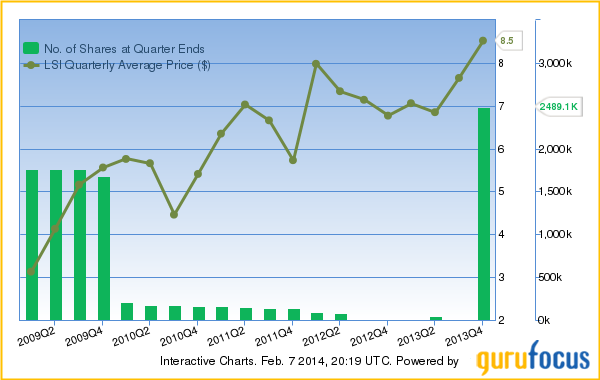

LSI Corporation (LSI)

Gabelli purchased 2,489,060 shares of LSI Corp., equating to 0.15% of the portfolio. The stock's fourth-quarter price averaged $9 per share.

LSI Corp. was incorporated in California on Nov. 6, 1980, and was reincorporated in Delaware on June 11, 1987. LSI Corp. has a market cap of $6.08 billion; its shares were traded at around $11.07 with a P/E ratio of 65.70 and P/S ratio of 2.60. The dividend yield of LSI Corp. stocks is 0.50%.

Provident New York Bancorp (PBNY)

Gabelli bought shares of Provident New York Bancorp totaling 997,404, a position reflecting 0.071% of the portfolio. His fourth quarter share price averaged $12.

Provident New York Bancorp, a Delaware corporation, is a unitary savings and loan holding company. Provident New York Bancorp has a market cap of $1.02 billion; its shares were traded at around $11.72 with a P/E ratio of 20.10 and P/S ratio of 3.81. The dividend yield of Provident New York Bancorp stocks is 1.97%. Provident New York Bancorp had an annual average earnings growth of 0.80% over the past 10 years.

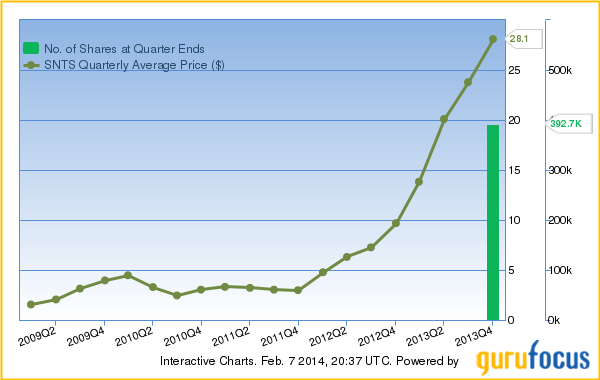

Santarus Inc. (SNTS)

Gabelli purchased 392,700 shares of Santarus Inc., equaling 0.067% of the portfolio. The stock's average share price was $28 in quarter four.

Santarus Inc. was incorporated on Dec. 6, 1996 as a California corporation and did not commence significant business activities until late 1998. Santarus Inc. has a market cap of $2.15 billion; its shares were traded at around $31.96 with a P/E ratio of 19.40 and P/S ratio of 7.28.

See the rest of Mario Gabelli (Trades, Portfolio)'s new buys in his portfolio here. Not a Premium Member of GuruFocus? Try it free for 7 days here!

This article first appeared on GuruFocus.

Related Articles

Yahoo Finance

Yahoo Finance