Manulife Financial (MFC) Q1 Earnings Top, Premiums Fall Y/Y

Manulife Financial Corporation MFC delivered first-quarter 2023 core earnings of 58 cents per share, which beat the Zacks Consensus Estimate of 57 cents. The bottom line declined 4.9% year over year.

Core earnings of $1.1 billion (C$1.5 billion) increased 6% year over year. The improvement was driven by the non-recurrence of excess mortality claims related to COVID-19 in the year-ago quarter in the U.S. life insurance business, an increase in expected investment earnings related to business growth and higher reinvestment yields, higher returns on surplus assets net of higher cost of debt financing and lower new insurance business losses related to onerous contracts driven by pricing actions.

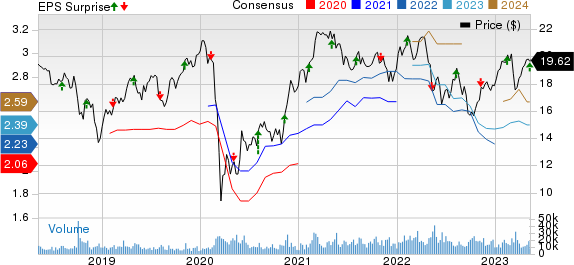

Manulife Financial Corp Price, Consensus and EPS Surprise

Manulife Financial Corp price-consensus-eps-surprise-chart | Manulife Financial Corp Quote

New business value (NBV) in the reported quarter was $376 million (C$509 million), down 5% year over year, attributable to lower sales volumes in Canada and the U.S.

Annualized premium equivalent (APE) sales decreased 3% year over year to $1.2 billion (C$1.6 billion), attributable to lower sales in Asia, Canada and U.S. segments.

The expense efficiency ratio increased 70 basis points (bps) to 47%.

Wealth and asset management assets under management and administration were $601 billion (C$814.5 billion), up 0.5% year over year. The Wealth and Asset Management business generated net outflows of $3.3 billion (C$4.4 billion), down 35.2%. This was due to net outflows at Retirement and Retail.

Core return on equity, measuring the company’s profitability, expanded 80 bps year over year to 14.8%. Financial leverage ratio deteriorated 110 basis points to 26% at quarter end.

Life Insurance Capital Adequacy Test ratio was 138% as of Mar 31, 2023, up from 131% as of Dec 31, 2022.

Segmental Performance

Global Wealth and Asset Management division’s core earnings came in at $212 million (C$287 million), down 16.6% year over year.

Asia division’s core earnings totaled $362 million (C$489 million), up 2.1% year over year. In Asia, NBV decreased 4%, attributable to less favorable product mix, partially offset by higher sales volumes.

APE sales increased 5% driven by growth in Hong Kong.

Manulife Financial’s Canada division’s core earnings of $261 million (C$350 million) were up 5.7% year over year. In Canada, NBV decreased 12% due to lower volumes in Annuities and Group Insurance, partially offset by higher margins in Individual Insurance and Annuities.

APE sales decreased 19%, primarily due to the impact of market volatility on demand for segregated fund products and variability in the large-case group insurance market, partially offset by higher participating life insurance sales.

The U.S. division reported core earnings of $285 million (C$385 million), up 31.4% year over year. NBV increased 6% due to pricing actions and a favorable mix, partially offset by lower sales volumes.

APE sales decreased 22% due to the adverse impact of higher short-term interest rates and equity market volatility on consumer sentiment.

Zacks Rank

Manulife Financial currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Life Insurers

Reinsurance Group of America, Incorporated RGA reported first-quarter 2023 adjusted operating earnings of $5.16 per share, which beat the Zacks Consensus Estimate by 53%. The bottom line, however, increased 23.4% from the year-ago quarter. Operating revenues of $4.3 billion beat the Zacks Consensus Estimate by 2.4%. The top line also improved 6.7% year over year driven by higher net premiums and investment income and net of related expenses.

Net premiums of $3.4 billion rose 7.3% year over year. Investment income and net of related expenses increased 5.6% from the prior-year quarter to $856 million. The average investment yield was down 58 basis points (bps) to 4.71% due to lower variable investment income, partially offset by higher yields.

Voya Financial VOYA reported first-quarter 2023 adjusted operating earnings of $1.69 per share, which missed the Zacks Consensus Estimate by 1.7%. The bottom line however increased 15% year over year. Our estimate was $1.71. Adjusted operating revenues amounted to $261 billion, which decreased 4.4% year over year. The top line also missed the Zacks Consensus Estimate by 9.4%. Our estimate was $274.1 million.

Net investment income declined 13.9% year over year to $545 million. Our estimate was $2519.2 million. As of Mar 31, 2023, VOYA’s assets under management, assets under administration and advisement totaled $771.2 million.

American Equity Investment Life Holding Company AEL reported first-quarter 2023 adjusted net earnings of $1.47 per share, which beat the Zacks Consensus Estimate by 27.8% and our estimate of $1.02. The bottom line however increased 34.8% on a year-over-year basis. Operating total revenues were $644.4 million, up 0.9% year over year on the back of higher annuity product charges and other revenues.

Premiums and other considerations decreased 58.9% year over year to $4.1 million. The figure was lower than our estimate of $11.2 million. Net investment income decreased 1.1% on a year-over-year basis to $561 million. The investment spread was 2.67%, up from 2.51% in the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Manulife Financial Corp (MFC) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Voya Financial, Inc. (VOYA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance