ManpowerGroup's (MAN) Q2 Earnings Beat Estimates, Up Y/Y

ManpowerGroup Inc. MAN reported mixed second-quarter 2022 results, with earnings beating the Zacks Consensus Estimate but revenues missing the same. The earnings beat failed to impress the market as the stock declined 6.3% since the earnings release on Jul 19.

Quarterly adjusted earnings of $2.33 per share beat the consensus mark by a slight margin and improved 15.4% year over year. The bottom line benefited from robust demand for higher margin offerings.

Revenues of $5.07 billion missed the consensus mark by 3.8% and decreased 3.9% year over year on a reported basis. Revenues increased 6% on a constant-currency (cc) basis and 3% on an organic constant currency basis.

Continued supply chain disruptions in certain European markets offset the positive impacts of the strong performance of higher-margin brands and revenue growth in Experis and Talent Solutions in the quarter. Experis and Talent Solutions grew 10% and 13% year over year, respectively. Manpower brand increased 1% year over year.

ManpowerGroup stock has declined 22.7% year to date compared with 20.9% fall of the industry it belongs to.

Segmental Revenues

Revenues from America totaled $1.26 billion, up 20.9% year over year on a reported basis and 22.7% at cc. In the United States, revenues came in at $903.9 million, up 43.7% year over year. In the Other Americas subgroup, revenues of $358.8 million declined 13.6 % on a reported basis and 9% at cc.

Revenues from Southern Europe were down 9.1% on a reported basis but up 2.2% at cc to $2.2 billion. Revenues from France came in at $1.24 billion, down 8.1% on a reported basis but up 4.1% at cc. Revenues from Italy amounted to $454.3 million, down 3.2% on a reported basis but up 9.7% at cc. The Other Southern Europe sub-segment generated revenues of $508.9 million, down 16.1% on a reported basis and 7.8% at cc.

Northern Europe revenues moved down 13.7% on a reported basis and 2.4% at cc to $1.03 billion. APME revenues totaled $603.7 million, down 2.6% on a reported basis but up 9.7% at cc.

Operating Performance

The company incurred an operating profit of $180.7 million, up 6.3% year over year on a reported basis and 18.1% at cc. The operating profit margin of 3.6% increased 34 basis points year over year.

Balance Sheet and Cash Flow

ManpowerGroupexited the quarter with cash and cash equivalents balance of $886.2 million compared with the prior quarter’s $777.3 million. Long-term debt at the end of the quarter was $942.2 million compared with $551.3 million reported in the preceding quarter.

The company used $49.3 million of cash in operating activities while Capex was $22.3 million in the quarter. It paid $100 million in repurchasing common stock in the quarter.

Q2 Outlook

ManpowerGroup expects second-quarter 2022 earnings per share in the range of $2.19-$2.27, the midpoint ($2.23) of which is slightly below the current Zacks Consensus Estimate of $2.24 per share.

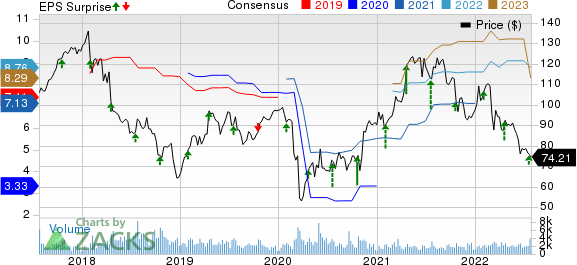

ManpowerGroup Inc. Price, Consensus and EPS Surprise

ManpowerGroup Inc. price-consensus-eps-surprise-chart | ManpowerGroup Inc. Quote

Zacks Rank and Stocks to Consider

Manpower Group currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Recent Performance of Some Other Business Services Companies

Equifax EFX reported mixed second-quarter 2022 results, wherein earnings beat estimates but revenues missed the same.

EFX’s adjusted earnings of $2.09 per share beat the Zacks Consensus Estimate by 3% and improved 5.6% on a year-over-year basis. Revenues of $1.32 billion missed the consensus estimate marginally but improved 6.6% year over year.

IQVIA Holdings IQV reported solid second-quarter 2022 results, wherein its earnings and revenues surpassed the Zacks Consensus Estimate.

IQV’s adjusted earnings per share of $2.44 beat the consensus mark by 2.1% and improved 15% on a year-over-year basis. Total revenues of $3.54 billion outpaced the consensus estimate by 1.2% and increased 3% year over year.

Omnicom Group OMC reported impressive second-quarter 2022 results, wherein the company’s earnings and revenues surpassed the Zacks Consensus Estimate.

OMC’s earnings of $1.68 per share beat the consensus mark by 7.7% and increased 15.1% year over year, driven by strong margin performance. Total revenues of $3.6 billion surpassed the consensus estimate by 4.4% but declined slightly year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance