Major Drilling Group International (TSE:MDI) Seems To Use Debt Quite Sensibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Major Drilling Group International Inc. (TSE:MDI) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Major Drilling Group International

What Is Major Drilling Group International's Debt?

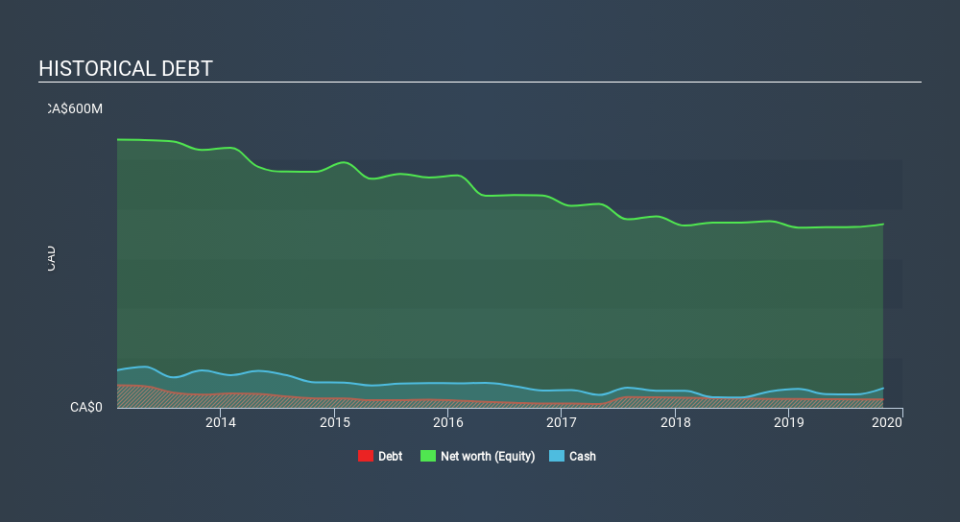

You can click the graphic below for the historical numbers, but it shows that Major Drilling Group International had CA$16.8m of debt in October 2019, down from CA$18.0m, one year before. But on the other hand it also has CA$39.4m in cash, leading to a CA$22.5m net cash position.

How Healthy Is Major Drilling Group International's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Major Drilling Group International had liabilities of CA$70.0m due within 12 months and liabilities of CA$34.5m due beyond that. Offsetting these obligations, it had cash of CA$39.4m as well as receivables valued at CA$93.9m due within 12 months. So it actually has CA$28.7m more liquid assets than total liabilities.

This short term liquidity is a sign that Major Drilling Group International could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Major Drilling Group International has more cash than debt is arguably a good indication that it can manage its debt safely.

It was also good to see that despite losing money on the EBIT line last year, Major Drilling Group International turned things around in the last 12 months, delivering and EBIT of CA$13m. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Major Drilling Group International's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Major Drilling Group International may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent year, Major Drilling Group International recorded free cash flow of 29% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Major Drilling Group International has net cash of CA$22.5m, as well as more liquid assets than liabilities. So we don't have any problem with Major Drilling Group International's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Major Drilling Group International you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance