Madison Square Garden's (MSG) Q1 Loss Wider Than Expected

The Madison Square Garden Company MSG reported first-quarter fiscal 2020 results, with earnings and revenues lagging the Zacks Consensus Estimate. The bottom line fell short of the Zacks Consensus Estimate for the second consecutive quarter, whereas the top line lagged the same for the third straight quarter.

In the quarter under review, the company incurred a loss of $3.36 per share, wider than the Zacks Consensus Estimate of a loss of $2.29. In the prior-year quarter, Madison Square Garden had incurred a loss of $1.36 per share. Net revenues totaled $214.8 million, which missed the consensus mark of $234 million and dipped 1.5% year over year.

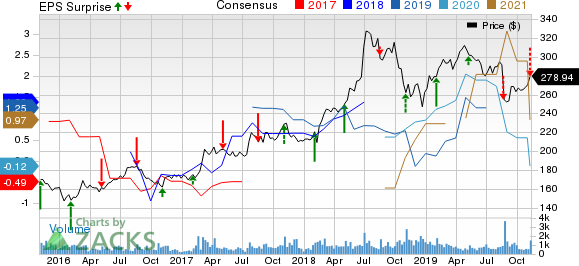

The Madison Square Garden Company Price, Consensus and EPS Surprise

The Madison Square Garden Company price-consensus-eps-surprise-chart | The Madison Square Garden Company Quote

Segmental Performance

Madison Square Garden operates under two segments — MSG Entertainment and MSG Sports.

Revenues from the Entertainment segment totaled $159 million, down 2% year over year. The downside was caused by decline in event-related revenues at the company's venues. The winding down of Obscura Digital’s third-party business impacted the segment’s revenues.

The segment’s adjusted operating income came in at $6.2 million compared with operating income of $9 million in the prior-year quarter. The metric fell primarily due to a sharp decline in revenues.

Revenues in the Sports segment inched up 1% to $56 million, courtesy of robust revenues from other live sporting events. However, the gain was partially overshadowed by decline in ticket-related revenues.

The segment’s adjusted operating loss came in at $13.7 million compared with operating income of $0.6 million in the prior-year quarter. The loss was caused by higher direct operating expenses and selling, general and administrative expenses.

Operating Income

In the quarter under review, Madison Square Garden incurred adjusted operating loss of $41.1 million compared with operating loss of $9.9 million in the year-ago quarter.

Balance Sheet

Cash and cash equivalents totaled $952.2 million as of Sep 30, 2019 compared with $1.1 billion as of Jun 30, 2019. The company ended the fiscal first quarter with long-term debt of nearly $47.4 million compared with $48.6 million at the end of Jun 30, 2019.

Zacks Rank & Stocks to Consider

Madison Square Garden has a Zacks Rank #5 (Strong Sell).

Better-ranked stocks worth considering in the same space include WW International, Inc WW, Twin River Worldwide Holdings, Inc TRWH and Callaway Golf Company ELY. All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

WW International has an impressive long-term earnings growth rate of 15%.

Shares of Twin River Worldwide Holdings have gained 11.8% in the past month.

Callaway Golf has reported better-than-expected earnings in three of trailing four quarters, the average being 33.3%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Callaway Golf Company (ELY) : Free Stock Analysis Report

The Madison Square Garden Company (MSG) : Free Stock Analysis Report

Twin River Worldwide Holdings, Inc. (TRWH) : Free Stock Analysis Report

WW International, Inc. (WW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance