Is Macy’s Dividend Sustainable?

Macy's (NYSE: M) is a controversial stock. Some view the company as troubled because it operates mall-based stores that have seen foot traffic decline in recent years. The mall focus has meant Macy's financial performance has suffered as shopping has increasingly moved online. Macy's stock price has declined from over $70 per share a few years ago to below $30 today.

At the same time, the company has increased its per-share dividend payments, making it more attractive to investors looking for a paycheck from their stocks. The combination of a lower stock price and increased dividend payment has resulted in the stock's dividend yield -- calculated by dividing the annual dividend payment by the stock's current price -- rising to over 6%. A 6% dividend yield is no small potatoes for income-focused investors, but is the dividend sustainable?

Macy's financial results are stabilizing

Macy's has built much of its store base at suburban malls, and the company has seen its revenue decline as mall traffic has fallen. In response, the company has closed many of its underperforming mall-based stores. Macy's turnaround plan also involves making deep cuts to corporate staff and selling real estate to raise cash.

The turnaround efforts appear to be paying off. This past fiscal year, which ended in early February, the company saw comparable-store sales grow for the first time in five years. Comps, which measure sales at stores open for at least one year and exclude sales from closed stores, are the best apples-to-apples measurement of retail store performance. Therefore, it is encouraging that Macy's is starting to show progress on this front.

Sector | Comps Growth FY 2015 | Comps Growth FY 2016 | Comps Growth FY 2017 | Comps Growth FY 2018 | Comps Growth FY 2019 |

|---|---|---|---|---|---|

Owned | 0.7% | (3%) | (3.5%) | (2.2%) | 1.7% |

Owned plus licensed | 1.4% | (2.5%) | (2.9%) | (1.9%) | 2% |

Data source: Macy's financial reports. Macy's "licenses third parties to operate certain departments in its stores and online and receives commissions from these third parties based on a percentage of their net sales."

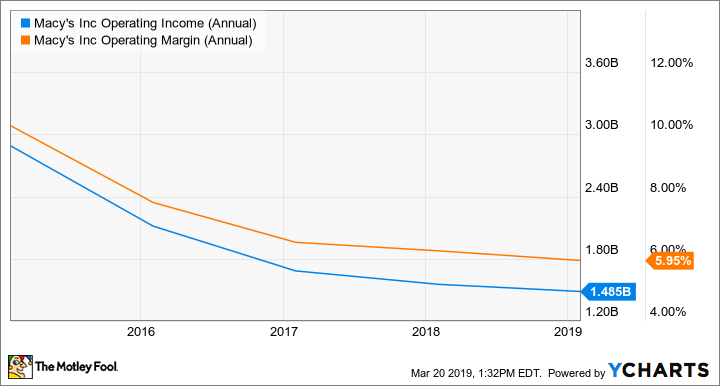

Operating income has been nearly halved over the past five years because of a steep drop in margins and fewer stores. However, it is encouraging that operating income saw a much smaller decline in the most recent fiscal year. Operating income is a measure of earnings that excludes non-recurring expenses and the impact from interest and taxes. Operating income is a good indicator of the health of a business and its ability to service debt and pay dividends.

M Operating Income (Annual) data by YCharts

Macy's has no doubt faced several difficult years, but the company's improving financial results show that there may be a light at the end of the tunnel. The company has been working hard to restructure and turn around its business and evidence is building that its strategy is working.

Image source: Getty Images.

Macy's cash flow covers its dividend payments

For investors who own Macy's stock for the dividend, the most pressing question is whether the current dividend payments are sustainable. The most effective way to determine how sustainable dividend payments are is to judge if a company will have enough cash flow to continue making the payments.

Free cash flow is a measure of the cash a company collects after all expenses, including taxes, interest payments, and capital investments, have been accounted for.

Check out some free cash flow and dividend numbers.

Metrics | FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 |

|---|---|---|---|---|---|

Free cash flow | $1,939 million | $1,207 million | $1,205 million | $1,457 million | $1,078 million |

Dividends paid | $421 million | $456 million | $459 million | $461 million | $463 million |

Data source: Macy's financial reports.

As you can see in the table above, Macy's generates enough cash flow to cover its dividend payments by a wide margin. Free cash flow has declined in recent years, but the company generates more than twice the amount of cash flow needed to make its dividend payments. This trend should continue as financial performance has started to stabilize. This is strong evidence suggesting the dividend is safe.

Macy's has improved its balance sheet

When judging if a dividend is safe, investors should also look at the company's debt load. There is more good news for Macy's investors on this front as the company has gone from over $7 billion in debt in 2015 to under $4 billion today.

If the company had not massively paid down its debt load, there is a good chance that Macy's could have hit serious financial trouble as it would have had a high debt load along with the spectacular decline in profits. Management deserves immense credit for improving the company's financial position while keeping its dividend intact.

Macy's dividend looks good

Macy's shareholders have been through a roller coaster of volatility over the past several years. The company has worked hard to address the operational challenges in its business and improve the health of its balance sheet. Earnings and cash flow have declined, but there are indications that the situation has stabilized and may even begin to improve.

One silver lining for investors who have stuck with the company has been the dividend payments. The company has increased its dividend despite the halving of its stock price. The stock now boasts a dividend yield in excess of 6% and based on an analysis of the company's cash flow and balance sheet, the dividend appears quite safe.

More From The Motley Fool

Luis Sanchez has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance