Macerich's (MAC) Q1 FFO and Revenues Surpass Estimates

The Macerich Company MAC reported first-quarter 2020 adjusted funds from operations (FFO) per share of 81 cents, surpassing the Zacks Consensus Estimate of 79 cents. The figure remained flat year over year. Adjusted FFO per share for the quarter excludes financing expense in relation to Chandler Freehold and loss on extinguishment of debt.

The company generated revenues of roughly $227 million in the quarter. The figure inched up 0.2% year over year and beat the Zacks Consensus Estimate of $223.9 million.

However, amid the coronavirus pandemic, management noted that “all but a few of the Company's malls had shuttered, except for the continued operation of essential retail and services, and approximately 74% of the gross leasable area, which was previously occupied prior to the COVID-19 closures, had closed.” Also, a number of those stores that remained open did on a limited-hour basis.

Nevertheless, in the past two weeks, 13 assets in Texas, Colorado, Missouri, Iowa, Indiana and Arizona have re-opened. Further, the company anticipates being able to open, as permitted, roughly 35 properties by the end of May.

In March, the company had withdrawn its previously-issued guidance. It has not issued any updated outlook as of now.

Behind the Headlines

As of Mar 31, 2020, the mall portfolio occupancy shrunk 160 basis points year over year to 93.1%.

Mall tenant annual sales for the 12-month period ended Feb 29, 2020 increased 7.4% to $801 per square feet. Notably, in March, there were widespread closures of a bulk of the company's tenants. Leasing volumes remained healthy in the first quarter. Nearly 200 leases were signed for 739,000 square feet, aggregating $38 million of rent.

Average rent per square foot rose 2.8% to $62.44 from $60.74 as of Mar 31, 2019. For the 12-month period ended Mar 31, 2020, re-leasing spreads were up 6.5%, indicating a sequential improvement compared to re-leasing spreads for the 12-month period ended Dec 31, 2019, which were up 4.7%.

Also, same-center net operating income (excluding lease termination revenues) inched up 1.03% to $209.6 million from the prior-year number.

Balance Sheet Position

Macerich has rolled out measures to preserve its liquidity in light of the coronavirus pandemic, the resultant uncertainty and a disrupted rent-collection environment. Particularly, the company has drawn bulk of the remaining capacity on its $1.5-billion revolving line of credit. It exited first-quarter 2020 with $735 million of cash on its balance sheet, including joint ventures at the company's share.

Furthermore, the redevelopment pipeline has been considerably reduced for the rest of the current year. In fact, for the remaining three quarters of 2020, the company expects spending $60 million on redevelopment. This marks a 60% reduction in the previously-estimated 2020 redevelopment expenditures for the same period. However, the joint-venture owned project at One Westside, Google's new Class A creative office campus in West Los Angeles, is excluded from this reduction. This project is entirely funded by a non-recourse construction facility.

Apart from these, the company has lowered its controllable shopping center expenses by roughly 45% during the period. Properties were significantly closed, excluding essential retail and services.

Earlier, the company had announced a reduction of quarterly dividend to 50 cents per share, payable 20% in cash and 80% in common stock, for the upcoming dividend. This cut in dividend helps in preserving roughly $150 million of cash annually. Moreover, the company noted an additional $60 million in cash will be preserved for each quarter the board chooses to pay the dividend in stock.

Currently, Macerich carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

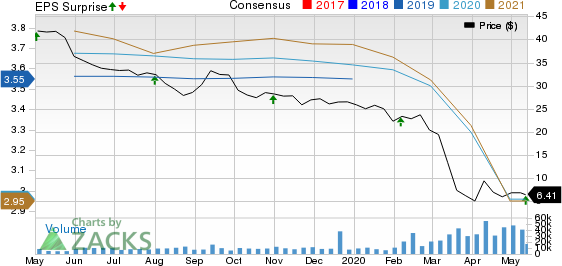

Macerich Company The Price, Consensus and EPS Surprise

Macerich Company The price-consensus-eps-surprise-chart | Macerich Company The Quote

We now look forward to the earnings releases of other REITs like Cedar Realty Trust CDR, CBL Properties CBL, and Vereit, Inc. VER, slated to release first-quarter numbers on May 14, May 18 and May 20, respectively.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Macerich Company The (MAC) : Free Stock Analysis Report

CBL Associates Properties Inc (CBL) : Free Stock Analysis Report

Cedar Realty Trust Inc (CDR) : Free Stock Analysis Report

VEREIT Inc (VER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance