M&S hails momentum in turnaround strategy as sales jump

Marks & Spencer has revealed a jump in sales in the face of pressure on customer finances but saw profits dip over the past year on the back of higher costs.

Profits were nevertheless better than expected and shares in the group shot up by as much as 13% in early trading as a result, hitting their highest for more than a year.

The high street chain said that sales grew in both its clothing and homeware, and food divisions over the year to April.

Bosses at M&S hailed the performance as evidence of progress from the retailer’s turnaround plan, which has seen it shut dozens of its larger stores amid an overhaul of its store portfolio.

This morning we announced our full year results for 22/23.

One year in, our strategy to reshape M&S for growth has driven sustained trading momentum, delivering growth in both sales & market share.

A huge thank you to our colleagues for their efforts.

Another big year ahead! pic.twitter.com/UhzwKQdj7V

— Stuart Machin (@MachinStuart1) May 24, 2023

It said better clothing ranges and refurbished stores played a significant part in the improvement in trading.

Total revenues for the business grew by 9.6% to £11.9 billion, compared with the previous year.

Clothing and home sales lifted by 11.5% to £3.72 billion, after a significant rise in store sales, with shoppers flocking back to the high street after the impact of Covid-19.

Meanwhile, sales in its food operation grew by 8.7% to £7.22 billion, against the year prior.

M&S also told shareholders it has witnessed a “good start” to the new financial year, despite an “uncertain” outlook for consumer spending.

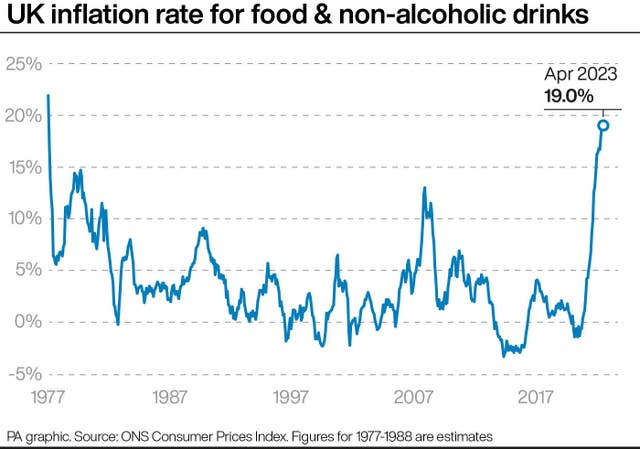

It comes amid continued high levels of inflation for British households.

Fresh figures from the Office for National Statistics on Wednesday showed that food CPI (Consumer Prices Index) inflation struck 19.3% last month, although this reflected a slight drop against March’s data.

Stuart Machin, M&S chief executive, said the company expects recent price increases “to soften” but stressed there is still inflationary pressure in its supply chain due to higher labour costs and some commodity price rises.

He said: “Yes, we do expect things to get a bit better and we have already been able to reduce the price of some items like milk.

“As soon as the cost of products comes down we will pass that on to the customer.

“We have some products coming down from peaks, but for other things like eggs they are still significantly higher than they were a year ago.

“I’m sure things will recede and get a bit better. There is still uncertainty but hopefully we will see more of this by autumn.”

It came as the London-listed company posted a profit before tax and adjusting items of £482 million for the year, down from £522.9 million last year.

The retailer said the figure, which was above analyst predictions, was partly lower due to the loss of pandemic-era business rates relief from the government.

It also highlighted continued cost inflation for both clothing and food divisions.

The company said it also expects to face over £50 million of energy cost rises and over £100 million in staff pay increases over the coming year, but stressed plans to offset this by its cost-cutting plan designed to secure a further £150 million a year.

Mr Machin added: “One year in, our strategy to reshape M&S for growth has driven sustained trading momentum, with both businesses continuing to grow sales and market share.

“Our Food and Clothing & Home businesses invested in value to protect customers from the full force of inflation which, whilst impacting margin, was the right thing to do, as serving our customers well is the only route to delivering for our shareholders.”

Yahoo Finance

Yahoo Finance