LyondellBasell Grants Hostalen ACP Licenses to Sinopec Hainan

LyondellBasell Industries N.V. LYB announced that Sinopec Hainan Refining & Chemical Co., Ltd. will utilize its Hostalen ‘Advanced Cascade Process’ (Hostalen ACP) technology for a new facility.

Notably, the Hostalen ACP is a low-pressure slurry process technology that produces high-performance, multi-modal HDPE resins with an increased toughness balance, high stress-cracking resistance and impact resistance. The technology is used in pressure pipe, blow molding and film applications.

The technology is expected to be used for 300 kilo tons per annum (KTA) high-density polyethylene (“HDPE”) facility that will be built in Yangpu, Hainan Province, P.R. China. Notably, with the latest capacity additions, LyondellBasell has now provided license to more than 8500 KTA of benchmark multi-modal HDPE resins.

Per LyondellBasell, multi-modal HDPE resins play an important role in catering to the increasing demand for higher-value polyethylene products.

The Sinopec Hainan HDPE facility will begin operations using Avant Z501 and Avant Z509 catalysts to make an entire range of multi-modal HDPE products.

The new licensees are anticipated to gain from LyondellBasell’s in-house expertise of ongoing process, operating and product improvements by optionally joining the company’s Technical Service program.

Shares of LyondellBasell have lost 12.1% in the past year compared with the industry’s 17% decline.

The company’s adjusted earnings of $1.47 per share for the first quarter surpassed the Zacks Consensus Estimate of $1.36.

It generated revenues of $7,494 million, which declined 14.6% year over year. The figure also lagged the Zacks Consensus Estimate of $7,507.2 million.

LyondellBasell, on its first-quarter call, expected low crude oil pricing, the coronavirus pandemic and a slowing economy to affect its business in the second quarter. The company’s order books for April and May indicate strong ongoing demand for its polyolefins in medical and consumer packaging applications. The demand for industrial and durable product markets are expected to remain weak. Moreover, significantly lower demand for transportation fuels will likely impact the Refining and Oxyfuels & Related Products businesses.

The company is undertaking actions to manage risk by accelerating cost-saving initiatives, aggressively managing working capital and lowering capital expenditure for 2020 by $500 million.

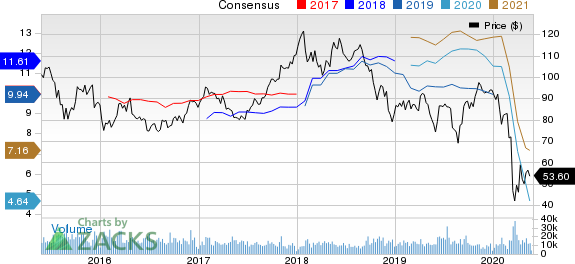

LyondellBasell Industries N.V. Price and Consensus

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic materials space are Agnico Eagle Mines Limited AEM, Equinox Gold Corp. EQX and Newmont Corporation NEM.

Agnico Eagle currently sports a Zacks Rank #1 (Strong Buy) and has a projected earnings growth rate of 75.3% for 2020. The company’s shares have gained 54.1% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Equinox Gold has a projected earnings growth rate of 65.5% for 2020. It currently carries a Zacks Rank #2 (Buy). The company’s shares have rallied 45.9% in a year.

Newmont has a projected earnings growth rate of 82.6% for the current year. The company’s shares have rallied around 87% in a year. It currently has a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newmont Corporation (NEM) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Equinox Gold Corp. (EQX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance