Limit Volatility With These 3 Low-Beta Tech Stocks

Investors love the technology sector, and for understandable reasons.

For starters, companies within the realm often operate in rapidly evolving industries with rising demand, allowing them to generate significant top and bottom line growth.

In addition, the sector is known for disrupting traditional business models and creating new markets, leading to substantial returns for investors who can ‘get in early.’

Still, the increased volatility many stocks in the sector carry spooks some investors, perhaps steering them away altogether. However, by targeting low-beta technology stocks, we can limit volatility.

While low-beta tech stocks may not experience the same rapid growth as higher-beta technology stocks, they can provide steady, long-term growth potential due to their stability.

Three low-beta tech stocks – NetEase NTES, Microsoft MSFT, and VMware VMW – could all be considerations for those seeking exposure to the sector paired with a more conservative approach.

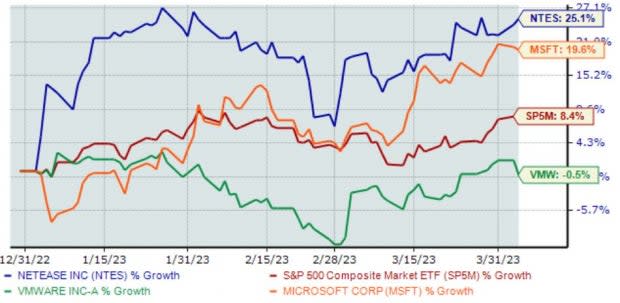

Below is a chart illustrating the performance of all three in 2023, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

NetEase

NetEase is an Internet technology company engaged in the development of applications, services, and other technologies for the Internet in China. Analysts have increased their earnings estimates across nearly all timeframes, helping land the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

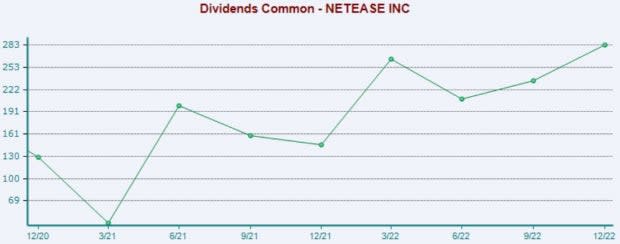

NetEase shares provide an income stream paired with exposure to technology; currently, NTES shares yield 1.2% annually, nicely above the Zacks Computer and Technology sector average of 0.8%.

Impressively, the company has grown its payout by more than 30% just over the last five years.

Image Source: Zacks Investment Research

Microsoft

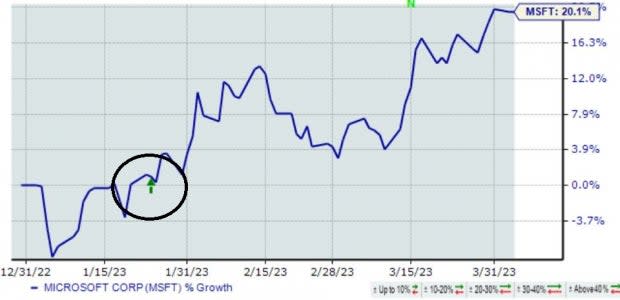

Microsoft shares have been hot in 2023 as investors flock to large-cap technology companies with established operations. Currently, the technology titan is a Zacks Rank #3 (Hold).

The technology titan posted mixed results in its latest release, falling short of revenue expectations modestly but delivering a 2.2% bottom line beat. The market appreciated the results, with MSFT shares climbing nicely post-earnings.

Image Source: Zacks Investment Research

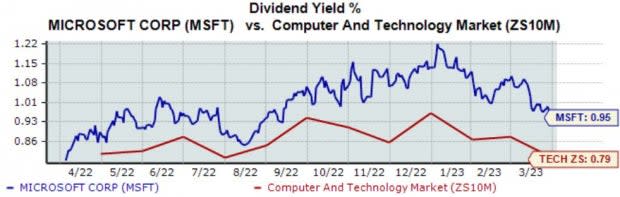

Microsoft also rewards its shareholders via its annual dividend, currently yielding a sector-beating 1%. And just over the last year, the company’s payout has grown by an impressive 10%.

Image Source: Zacks Investment Research

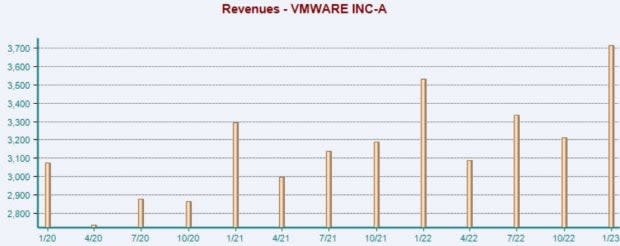

VMWare

VMware is the pioneer in developing core x86 server virtualization software solutions with the goal of helping businesses in their digital transformation journey.

The company posted better-than-expected results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 7%. Quarterly revenue totaled $3.7 billion, 2% ahead of expectations and improving 5% year-over-year.

Image Source: Zacks Investment Research

In addition, VMW shares are cheap on a relative basis, with the current 17.2X forward earnings multiple sitting nowhere near the 31.5X five-year median or Zacks sector average.

Image Source: Zacks Investment Research

Bottom Line

Everybody loves tech stocks for their breakneck growth. Still, some may be intimidated by the increased volatility the sector has become known for, perhaps steering them away.

However, targeting low-beta technology stocks, such as – NetEase NTES, Microsoft MSFT, and VMware VMW – provide exposure to the sector paired with a more conservative approach.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

VMware, Inc. (VMW) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance