Lennar (LEN) Stock Rises 31% Year to Date Amid Supply Woes

Indeed, unprecedented supply chain disruptions, delayed delivery of certain building materials and a tight labor market have been taking a toll on the Zacks Building Products - Home Builders industry of late. Nonetheless, the U.S. housing market remains hot, courtesy of higher demand on the back of historically low mortgage rates. Also, an increased desire for spacious homes to work from home amid the pandemic has been driving growth of Lennar Corporation LEN and others such as D.R. Horton, Inc. DHI, PulteGroup, Inc. PHM as well as KB Home KBH.

Lennar, being one of the nation's leading homebuilders, is well positioned to gain from solid housing market fundamentals, improving SG&A leverage as well as strategic land investments. Also, its dynamic pricing model, asset light strategy and solid backlog level bode well.

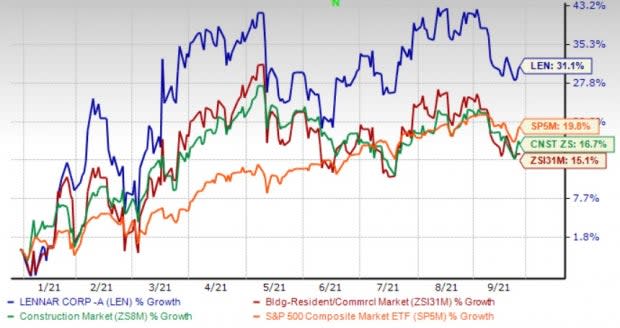

Image Source: Zacks Investment Research

Backed by these tailwinds, shares of this homebuilder have climbed 31.1% year to date, outperforming the industry’s 15.1% rally. The price performance was also backed by the company’s robust earnings surprise history, having surpassed the Zacks Consensus Estimate in 13 of the trailing 14 quarters. Earnings estimates for 2021 have moved up 7.5% over the past seven days, depicting analysts’ optimism over its prospects despite concerns related to supply chain challenges, and rising land and labor costs.

Recently, the company reported third quarter-fiscal 2021 results, wherein earnings topped the Zacks Consensus Estimate. Although revenues missed the same due to significant supply chain challenges, both earnings and revenues increased 54.2% and 18.2% year over year, respectively.

Let’s delve deeper into the major growth drivers of this Zacks Rank #3 (Hold) company. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Strong Performance

Lennar, which has been continuously delivering strong performances since fiscal 2014, maintained growth momentum in the first three quarters of fiscal 2021 as well. For the first nine months of fiscal 2021, it reported impressive results, wherein total revenues and earnings per share grew 19.4% and 106% year over year, respectively. The quarterly results benefited from the solid execution of homebuilding and financial services businesses. Also, robust housing market conditions added to its bliss. Home deliveries and average selling price or ASP also improved 14% and 5%, respectively, from the year-ago level.

The company was successful in meeting the target of achieving a lower SG&A percentage through the last five years. Its first three quarters’ SG&A rate of 7.6% improved 80 basis points or bps year over year. The improvement was primarily due to a decrease in broker commissions and benefits from the company's technology efforts. It is focused on reducing operating costs in order to drive the bottom line and cash flow.

Asset Light Strategy

Lennar has maintained its relentless focus on a land lighter strategy. The company continues to migrate toward a significantly smaller land-owned inventory, driving business and cash flow. At fiscal third quarter-end, controlled homesites as a percentage of total owned and controlled homesites increased to 53% from 35% in the corresponding year-ago period. As a result, the year’s supply owned improved to 3.3 years from 3.8 years in the prior year. It reached the goal of 50% homesites controlled in the first half instead of fiscal 2021-end.

Solid Prospects

The company has solid prospects, as is evident from the Zacks Consensus Estimate for fiscal 2021 earnings of $14.56 per share, which indicates 85.5% year-over-year growth. Also, it has a solid VGM Score of B. Our VGM Score identifies stocks that have the most attractive value, growth and momentum characteristics.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance