LendingClub (LC) Stock Gains on Q3 Earnings & Revenue Beat

Shares of LendingClub Corporation LC rallied 11.6% following the release of third-quarter 2019 results. Adjusted earnings of 9 cents per share significantly surpassed the Zacks Consensus Estimate of a penny. Also, the figure reflects improvement from loss of 9 cents in the prior-year quarter.

Results reflect rise in revenues and lower expenses. Further, the quarter witnessed higher loan originations volume. Decline in loan balance was a concern.

After taking into consideration non-recurring items, consolidated net loss was $0.4 million or breakeven per share compared with net loss of $22.7 million or 27 cents in the year-ago quarter.

Revenues Improve, Costs Fall

Total net revenues grew 11% year over year to $204.9 million. This upside was driven by higher volume of loan originations. The top line beat the Zacks Consensus Estimate of $204 million.

Total operating expenses were $205.2 million, down 1% year over year. This decline was largely due to the absence of class action and regulatory litigation expenses.

Adjusted EBITDA was $40 million, up 43%.

In the September quarter, loan originations were $3.3 billion, up 16% year over year.

As of Sep 30, 2019, cash and cash equivalents were $200 million compared with $373 million on Dec 31, 2018. Loans held for investment at fair value were $1.24 billion, down from Dec 31, 2018 level of $1.88 billion. Total stockholders’ equity was $887.9 million, slightly up from $869.2 million recorded as of Dec 31, 2018.

Guidance

Concurrent with the results, management provided guidance for the fourth quarter and updated the same for 2019.

Fourth-Quarter 2019

Total net revenues of $190-$210 million

Adjusted EBITDA of $34-$396 million

GAAP and adjusted net income of $0-$5 million

2019

Total net revenues of $760-$770 million. This is lower than prior target range of $765-$795 million

Adjusted EBITDA of $130-$135 million. The lower end has been revised up from $120 million.

GAAP consolidated net loss of $31-$26 million. This has been revised from the prior guidance of loss of $38-$23 million. The updated guidance reflects $26 million year-to-date expenses regulatory, cost-structure simplification expense and other costs recorded during the first nine months of 2019.

Adjusted net loss of $5-$0 million, improving from the previous projection of loss of $20-$5 million.

Bottom Line

LendingClub’s revenue growth is commendable on the back of strong loan originations. However, declining loan balance is a headwind. Further, the company’s exposure to numerous legal hassles might keep expenses elevated in the near term.

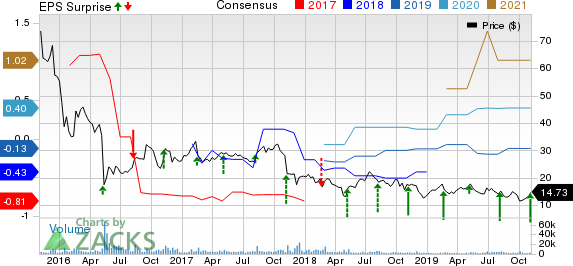

LendingClub Corporation Price, Consensus and EPS Surprise

LendingClub Corporation price-consensus-eps-surprise-chart | LendingClub Corporation Quote

LendingClub currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Companies

LendingTree TREE delivered a positive earnings surprise of 34.7% in third-quarter 2019. Adjusted net income per share of $2.25 outpaced the Zacks Consensus Estimate of $1.67. Further, the figure was higher than the prior-year quarter’s $1.92 per share.

Credit Acceptance Corporation’s CACC third-quarter 2019 earnings of $8.73 per share missed the Zacks Consensus Estimate of $9.13. However, the bottom line was up 12.6% year over year. Notably, the figure includes certain non-recurring items.

Hercules Capital Inc.’s HTGC third-quarter 2019 net investment income of 37 cents per share outpaced the Zacks Consensus Estimate of 34 cents. The bottom line grew 19.4% from the year-ago figure.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LendingClub Corporation (LC) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

Credit Acceptance Corporation (CACC) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance