Lear (LEA) Beats Q1 Earnings Estimates on Seating Unit Strength

Lear Corp LEA reported first-quarter 2023 adjusted earnings of $2.78 per share, which surged from $1.80 recorded in the year-ago quarter. The bottom line also surpassed the Zacks Consensus Estimate of $2.55 per share. Higher-than-expected contribution from the Seating segment led to the outperformance. In the reported quarter, revenues increased 12% year over year to $5,845.5 million. The top line also beat the Zacks Consensus Estimate of $5,505 million.

Lear currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

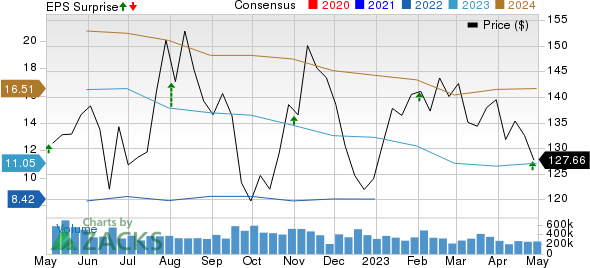

Lear Corporation Price, Consensus and EPS Surprise

Lear Corporation price-consensus-eps-surprise-chart | Lear Corporation Quote

Segment Performance

Sales of the Seating segment totaled $4,453 million in the reported quarter, reflecting a 13.8% increase from the year-ago quarter and surpassing the Zacks Consensus Estimate of $3,931 million. Adjusted segmental earnings came in at $300.4 million, up 37.9% from a year ago. The reported figure topped the consensus mark of $243 million. The segment recorded adjusted margins of 6.7% of sales, up from 5.6% in the previous-year quarter.

Sales in the E-Systems segment were $1,392.5 million, up 7.4% year over year. The figure also topped the consensus mark of $1,311 million. Adjusted segmental earnings amounted to $48.90 million, up from $41.90 in the corresponding quarter of 2022. The metric, however, lagged the consensus mark of $52 million. For the E-Systems segment, the adjusted margin was 3.5% of sales, up from 3.2% in the year-ago quarter.

Performance by Region

Sales in the North America region increased 8.3% year over year to $2,380 million in the quarter and topped the consensus mark of $2,231 million.

Sales in the South America region grew nearly 13.7% year over year to $215 million in the quarter. The metric lagged the consensus mark of $217 million.

Sales in the Europe and Africa region increased 24.5% year over year to $2,231 million in the quarter, topping the consensus mark of $1,718 million.

Sales in the Asia region fell 1% year over year to $1,019.5 million in the quarter, which also lagged the consensus mark of $1,054 million.

Financial Position

The company had $898.5 million in cash and cash equivalents at the quarter’s end versus $1,114.9 million recorded as of Dec 31, 2022. Lear had long-term debt of $2,591.6 million at the quarter end compared with a debt of $2,591.2 million as of 2022-end.

At the first quarter-end, net cash used in operating activities totaled $36 million, a noticeable decline from the $221 million cash inflow in the corresponding quarter of 2022. In the reported period, its capital expenditure amounted to $111.8 million, down from $130.3 million. The company registered a negative free cash flow of $147 million in the quarter under review compared with an FCF of $90 million in the previous-year quarter.

During the quarter, LEA repurchased 182,902 shares of its common stock for a total of $25.1 million. At the end of the quarter, Lear had a remaining share repurchase authorization of nearly $1.2 billion. In the first quarter of 2023, Lear returned $72 million to investors via buybacks and dividends.

2023 Guidance Reiterated

Lear projects its full-year net sales in the band of $21,200-$22,200 million, up from $20,891 million recorded in 2022. Core operating earnings are envisioned in the range of $875-$1,075 million, implying an uptick from $871 generated in 2022. Operating cash flow is projected within $1,075-$1,225 million. Lear anticipates FCF in the band of $375-$525 million. Capital spending is forecast to be $700 million. Adjusted EBITDA is envisioned within the range of $1,475-$1,675 million.

Key Releases From the Auto Space

Tesla TSLA reported first-quarter 2023 earnings of 85 cents per share, down from the year-ago figure of $1.07 but outpaced the Zacks Consensus Estimate of 83 cents. This marked an earnings beat for the electric vehicle behemoth for the ninth time in a row. Higher-than-expected revenues from its Energy Generation/Storage and Services/Other segments resulted in this outperformance.

Total revenues came in at $23,329 million, witnessing year-over-year growth of 24%. However, the top line missed the consensus mark of $23,472 million. Tesla reported an overall gross margin of 19.3% for the reported quarter. The operating margin came in at 11.4%. Management stuck to its target of around 50% growth in deliveries in the foreseeable future. For 2023, it expects deliveries to reach 1.8 million units.

General Motors GM reported first-quarter 2023 adjusted earnings of $2.21 per share, surpassing the Zacks Consensus Estimate of $1.64. Higher-than-expected operating profits from GMNA, GMI and Financial segments led to the outperformance. The bottom line also rose from the year-ago quarter’s earnings of $2.09 per share.

Revenues of $39,985 million beat the Zacks Consensus Estimate of $38,677.9 million and increased from $35,979 million recorded in the year-ago period. However, the company recorded an adjusted EBIT of $3,803 million, lower than $4,044 million in the prior-year quarter. The automaker’s share in the GM market was 8.6% in the reported quarter, down from the year-ago quarter’s 9%.

PACCAR’s PCAR earnings of $2.25 per share for first-quarter 2023 beat the Zacks Consensus Estimate of $1.82 and rocketed 95.6% from the year-ago figure. Higher-than-expected pretax income from Trucks, Parts and Financial Services segments resulted in the outperformance. Consolidated revenues (including trucks and financial services) came in at $8,473.3 billion, up from $6,472.6 million recorded in the corresponding quarter of 2022.

PACCAR’s cash and marketable debt securities amounted to $5,922.2 million as of Mar 31, 2023, compared with $6,158.9 million on Dec 31, 2022. The company paid cash dividends of 25 cents per share during the reported quarter. Capex and R&D expenses for 2023 are envisioned in the band of $600-$650 million and $380-$420 million, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Lear Corporation (LEA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance