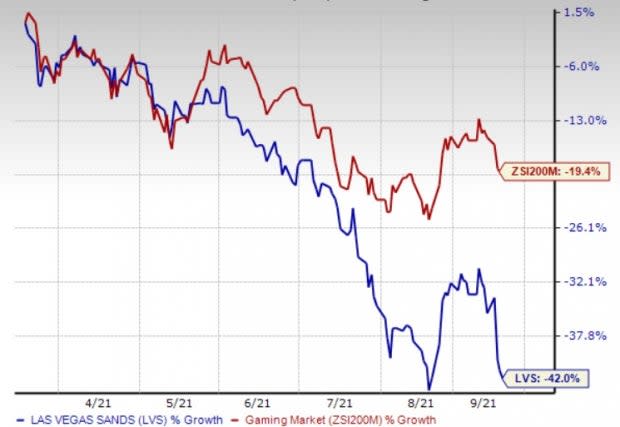

Las Vegas Sands (LVS) Falls 42% in 6 Months: What's Hurting It?

Are you still holding shares of Las Vegas Sands Corp. LVS and waiting for a miracle to take the stock higher in the near term? If yes, then you might lose more money as chances are very slim that the stock, which has lost its value by 42% in the past six months, will take a U-turn in the near term. In the same time, the Zacks Gaming industry declined 19.4%. Let’s delve deeper and analyze the factors that are hurting this Zacks Rank #4 (Sell) company.

Primary Concerns

The gaming industry has been grappling with traffic and sales woes due to the coronavirus pandemic for nearly two years now. Although casinos in Macau and Las Vegas are now open, visitation is still very low in comparison to the pre-pandemic level. Meanwhile, visitations in Singapore are unlikely to increase rapidly as resolution of air travel issues are likely to take time. The Delta variant of coronavirus remains a concern for the industry as well. Consequently, recovery in Macau and Singapore remains slow, and it is still not clear as to when the market will return to pre-pandemic level.

The company’s quarterly results have raised investors’ apprehensions further. It reported weak second-quarter 2021 results, wherein both earnings and revenues missed the Zacks Consensus Estimate. Although top and bottom lines improved year over year, it is still well below the pre-pandemic level. During second-quarter 2021, the company reported an adjusted loss per share of 26 cents, wider than the Zacks Consensus Estimate of a loss of 19 cents.

Las Vegas Sands’ woes have intensified due to a fresh surge of coronavirus cases and the news that China is mulling tougher Macau casino rules. Per a macaubusiness.com DDDreport, the public consultation for a fresh gaming law will run from Sep 15 to Oct 29. General public will have five sessions, while members of the sector will have one session. Issues including the number and duration of casino licenses, and supervision requirements will be discussed. It is worth mentioning that the current licenses will expire in June 2022.

The revised gaming law suggests removal of the current sub-concession system. Other suggestions include choosing of government representatives to oversee gaming operators and the creation of a new illegal deposit crime. Notably, gambling generates nearly 80% of the Macau government’s revenues and accounts for 55.5% of its GDP.

China's health authorities announced that fresh COVID-19 infections have increased by more than double in the southeastern Fujian province. Officials are enforcing measures like travel restrictions to curb the spread of the virus. We believe tougher Macau casino rules and coronavirus woes will continue to hurt the company.

Image Source: Zacks Investment Research

Growth Projections

The Zacks Consensus Estimate for 2021 bottom line 2021 has widened to a loss of 75 cents from a loss of 12 cents in the last 60 days. The consensus mark for 2022 earnings has moved downward by 16.3% in the past 60 days to $1.85 per share.

3 Picks You Can’t Miss Out On

Boyd Gaming Corporation BYD has a projected long-term earnings growth rate of 40.8% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Golden Entertainment, Inc. GDEN has a Zacks Rank #1 and a projected 2021 earnings growth rate of 226.4%.

Monarch Casino & Resort, Inc. MCRI carries a Zacks Rank #2 (Buy). Its bottom line has surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 53.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Boyd Gaming Corporation (BYD) : Free Stock Analysis Report

Monarch Casino & Resort, Inc. (MCRI) : Free Stock Analysis Report

Golden Entertainment, Inc. (GDEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance