LabCorp (LH) Focuses on High-Growth Areas Amid Currency Woe

Laboratory Corporation of America Holdings or LabCorp’s LH continued efforts to expand to high-growth opportunity areas and net savings from the ongoing LaunchPad initiative buoy optimism. Yet, the current economic uncertainty, including a challenging volume environment, is a headwind. The stock carries a Zacks Rank #3 (Hold).

LabCorp ended the fourth quarter of 2022 with better-than-expected earnings. The base business remains strong. Excluding COVID testing revenues, enterprise base business revenues grew 6% in the fourth quarter at a constant exchange rate or CER. Growth in diagnostics-based business revenues in the fourth quarter was strong due to both routine and esoteric testing and revenues from the Ascension partnership.

Within Drug Development, fourth-quarter early development and clinical development both grew at CER. Drug Development ended the fourth quarter with a strong trailing 12-month book-to-bill of 1.27. LabCorp expects the momentum to continue in drug development orders.

In its efforts to expand further, LabCorp is focusing more on high-growth opportunity areas such as neurodegenerative, autoimmune and liver disease as well as cell and gene therapy. In 2022, the team supported more than 5,000 clinical trials, worked on over 90% of new FDA approvals and launched 130 plus new tests. The company anticipates more launches in the high-growth space in 2023.

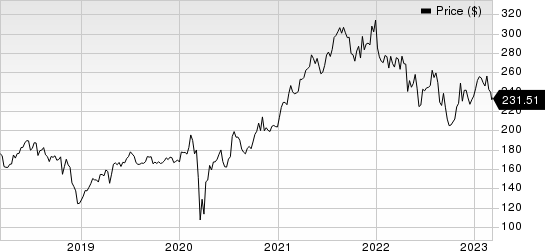

Laboratory Corporation of America Holdings Price

Laboratory Corporation of America Holdings price | Laboratory Corporation of America Holdings Quote

Meanwhile, the company is accelerating the planned spin-off of its Clinical Development business (announced in July) and expects it to be completed in mid-2023.

On the flip side, LabCorp ended the fourth quarter of 2022 with a revenue miss. On a year-over-year basis, fourth-quarter revenues and adjusted EPS declined significantly. Organic revenues declined mainly due to a major decrease in COVID-19 PCR and antibody testing sales. Significant contraction of both margins is discouraging. Gross margin contracted 750 basis points (bps) to 26.4% in the fourth quarter. Adjusted operating margin contracted 870 bps from the year-ago quarter to 11.8%.

The severe foreign exchange headwind, inflationary pressure and the ongoing Ukraine/Russia crisis continue to impact business performance. We note that revenues in the fourth quarter of 2022 registered a 1.3% decline due to adverse foreign currency translation.

Over the past year, LabCorp has underperformed its industry. Shares of LabCorp have declined 10.3% compared with the industry’s 5.7% decline.

Key Picks

A few better-ranked stocks in the broader Medical sector include Haemonetics Corporation HAE, TerrAscend Corp. TRSSF and Akerna Corp. KERN. Haemonetics and TerrAscend both sport a Zacks Rank #1 (Strong Buy), while Akerna carries a Zack Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 42.1% in the past year. Earnings estimates for Haemonetics have increased from $2.87 per share to 2.91 for 2023 and from $3.02 per share to $3.28 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 10.98%. In the last reported quarter, it reported an earnings surprise of 7.59%.

Estimates for TerrAscend in 2023 have remained constant at a loss of 10 cents per share in the past 30 days. Shares of TerrAscend have declined 70.6% in the past year.

TerrAscend’s earnings beat estimates in one of the last three quarters and missed the mark in the other two, the average negative surprise being 136.11%. In the last reported quarter, TRSSF delivered an earnings surprise of 216.67%.

Akerna’s stock has declined 95.7% in the past year. Its estimates for 2023 have remained constant at a loss of $1.91 per share over the past 30 days.

Akerna missed earnings estimates in each of the last four quarters, delivering a negative earnings surprise of 15.49%, on average. In the last reported quarter, KERN delivered a negative earnings surprise of 13.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Akerna Corp. (KERN) : Free Stock Analysis Report

TerrAscend Corp. (TRSSF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance