L3Harris (LHX) Q1 Earnings Miss Estimates, Sales Up Y/Y

L3Harris Technologies, Inc.’s LHX first-quarter 2023 adjusted earnings from continuing operations came in at $2.86 per share, which missed the Zacks Consensus Estimate of $2.87 by 0.3%. The bottom line also declined 8.9% from the year-ago quarter’s reported figure.

Excluding one-time items, the company reported GAAP earnings of $1.76 per share compared with $2.44 in the prior-year period.

Total Revenues

L3Harris’ revenues came in at $4,471 million, which beat the Zacks Consensus Estimate of $4,241 million by 5.4%. Revenues also rose 9% from the year-ago quarter’s $4,130 million.

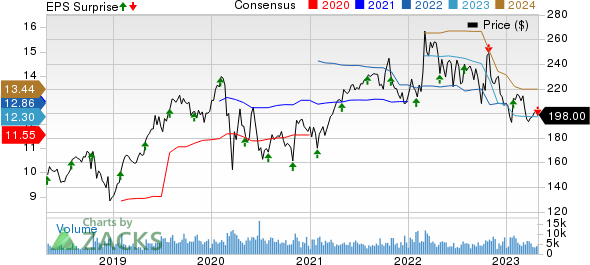

L3Harris Technologies Inc Price, Consensus and EPS Surprise

L3Harris Technologies Inc price-consensus-eps-surprise-chart | L3Harris Technologies Inc Quote

Segmental Performance

Integrated Mission Systems: Net revenues in the segment came in at $1,700 million, down 2.5% year over year. This was driven by higher revenues from the Intelligence, Surveillance, Reconnaissance (ISR) and higher volume from the Electro Optical and Commercial aviation business.

Operating income totaled $185 million, up 26.3% from the prior-year quarter. Operating margin was 11.3%.

Space and Airborne Systems: The segment recorded net revenues of $1,655 million, up 9.1% year over year. This upside was largely driven by the ramp up in production revenues, higher revenues from mission avionics, mission networks, intel and cyber businesses.

Operating income increased 5.6% to $187 million. Operating margin was 11.3%.

Communication Systems: Net revenues in the segment increased 20.8% to $1,163 million due to higher volumes from Broadband Communications and Tactical Communication.

Operating income increased 16.2% to $266 million from that reported in the year-ago quarter. Operating margin was 22.9%.

Financial Position

As of Mar 31, 2023, L3Harris had $545 million in cash and cash equivalents compared with $880 million as of Dec 31, 2022.

Long-term debt as of Mar 31, 2023, was $8,220 million compared with $6,225 million as of Dec 31, 2022.

Net cash inflow from operating activities amounted to $350 million compared with $39 million in the year-ago period.

2023 View

L3Harris reiterated its 2023 outlook. It still expects to generate revenues in the range of $17.40-$17.80 billion. The Zacks Consensus Estimate for revenues is pegged at $17.68 billion, higher than the midpoint of the guided figure.

The company still projects 2023 earnings in the range of $12.00-$12.50 per share. The Zacks Consensus Estimate for the same is pegged at $12.30 per share, higher than the midpoint of the guided range.

LHX continues to expect to generate more than $2.0 billion in adjusted free cash flow.

Zacks Rank

L3Harris currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Lockheed Martin Corporation LMT reported first-quarter 2023 adjusted earnings of $6.43 per share, which beat the Zacks Consensus Estimate of $6.07 by 5.9%. However, the bottom line was in line with the year-ago quarter's reported figure.

Net sales amounted to $15.13 billion, which beat the Zacks Consensus Estimate of $14.87 billion by 1.9%. The top line rose 1.1% from $14.96 billion recorded in the year-ago quarter.

Hexcel Corporation HXL reported first-quarter 2023 adjusted earnings of 50 cents per share, which beat the Zacks Consensus Estimate of 39 cents by 28.2%. The bottom line improved massively from the year-ago quarter’s reported figure of 22 cents per share, highlighting solid growth of 127.3%.

Net sales totaled $458 million, which beat the Zacks Consensus Estimate of $428 million by 6.8%. Also, the top line witnessed a 17.2% improvement from the year-ago quarter’s $391 million.

Raytheon Technologies Corporation’s RTX first-quarter 2023 adjusted earnings of $1.22 per share beat the Zacks Consensus Estimate of $1.11 by 9.9%. The bottom line also improved 6% from the year-ago quarter’s reported figure of $1.15 per share.

Raytheon Technologies’ sales of $17,214 million beat the Zacks Consensus Estimate of $16,857 million by 2.1%. The figure also rose 9.5% from $15,716 million recorded in the year-ago quarter

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance