Kirby's (KEX) Q4 Earnings Miss, Decline Y/Y on Low Revenues

Kirby Corporation’s KEX fourth-quarter 2019 earnings (excluding 53 cents from non-recurring items) of 58 cents missed the Zacks Consensus Estimate by a penny. The bottom line also declined 22.7% year over year.

Post this earnings lag and the year-over-year plunge, shares of the company fell 8.4% at the close of business on Jan 30.

Although total revenues of $655.9 million surpassed the Zacks Consensus Estimate of $642.1 million, it decreased 9.1% year over year. The top line was hurt by reduced sales at the distribution and services division.

Segmental Performance

The company through its subsidiaries operates via the following segments of marine transportation as well as distribution and services.

The marine transportation division is responsible for providing transportation services by tank barge to inland and coastal markets. Revenues at the marine transportation unit increased 5.1% to $402.01 million. Segmental operating income also ascended 22.5% to $54.5 million. Segmental operating margin too expanded to 13.6% from 11.6% a year ago.

Inland market revenues rose 7% year over year owing to contributions from the Cenac acquisition and favorable pricing. The operating margin for the inland business was in the mid-teens.

Revenues at the coastal market climbed modestly on account of favorable pricing and improved barge utilization. Additionally, the coastal operating margin was in mid-to-high single digits.

The distribution and services segment is responsible for selling replacement parts and focuses on oil and gas, and commercial and industrial markets. Segmental revenues dropped 25.1% to $253.9 million due to below-par performance in the oil and gas market. Moreover, operating margin at the distribution and services segment was a negative 1.1% against a positive 8.3% in the year-ago period.

The oil and gas market was weak during the quarter under review due to reduction in oilfield activity. Operating margin for oil and gas was in the negative mid-to-high single digits.

In the commercial and industrial market, revenues augmented year over year on the back of improved power generation, commercial marine and on-highway businesses. Operating income decreased slightly due to service and product sales mix. During the quarter under consideration, the commercial and industrial operating margin was in the mid-single digits.

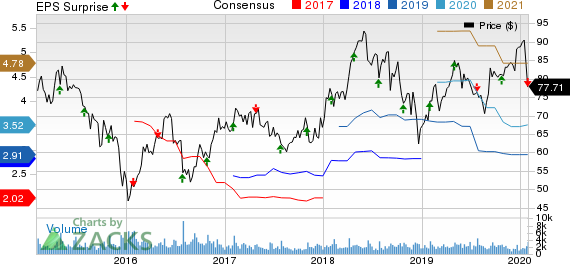

Kirby Corporation Price, Consensus and EPS Surprise

Kirby Corporation price-consensus-eps-surprise-chart | Kirby Corporation Quote

Balance Sheet Highlights

Long-term debt (including current portion) for this Zacks Rank #3 (Hold) company reduced to $1.37 billion at the end of the fourth quarter of 2019 from 1.41 billion at the end of 2018. Debt to capitalization ratio at the end of 2019 was 28.9% compared with 30.5% a year ago. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2020 Outlook

For the full year, earnings are anticipated to be $2.60-$3.40 per share. The Zacks Consensus Estimate for the same stands at $3.52.

Inland revenues are estimated to increase in the low double digits to mid-teens percentage range while inland operating margin is predicted in the high teens. The upside is owing to consistent rise in customer demand, higher volumes from new petrochemical plants and net new barge construction in the industry.

However, coastal revenues are expected to be either flat or up slightly year over year with operating margins in the low-to-mid single digits. While strong customer demand and tight industry capacity should aid the unit’s performance, reduced activity in coal transportation business is likely to weigh on results.

At the distribution and services segment, revenues are expected to decline 12-17% year over year due to near-term weaknesses in the oil and gas market. However, operating margin at the segment is expected to be positive in the low-to-mid single digits.

For 2020, capital expenditures are anticipated between $155 million and $175 million.

Important Developments

Kirby entered into a definitive agreement to acquire the inland tank barge fleet of Savage Inland Marine (“Savage”). The transaction is valued at approximately $278 million. Notably, Savage’s tank barge fleet comprises 90 inland tank barges with approximately 2.5 million barrels of capacity and 46 inland towboats. The buyout, subject to closing conditions and regulatory approval, is expected to close by the end of the first quarter of 2020.

Additionally, earlier this month, the company acquired Convoy Servicing Company (“Convoy”), a Thermo King refrigeration system sales, service and parts distributor. The $40-million acquisition expands the company’s geographic distribution area for Thermo King to extend its network to Colorado. The buyout is anticipated to be accretive to earnings in 2020.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting fourth-quarter earnings reports from key players, such as Old Dominion Freight Line, Inc. ODFL, Air Lease Corporation AL and Copa Holdings, S.A. CPA. While Old Dominion will release earnings numbers on Feb 6, Copa and Air Lease will announce the same on Feb 12 and Feb 14, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Air Lease Corporation (AL) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

Old Dominion Freight Line, Inc. (ODFL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance