Kirby (KEX) Q1 Earnings Top Estimates, Fall on Low Revenues

Kirby Corporation’s KEX first-quarter 2020 earnings of 59 cents per share (excluding $4.74 from non-recurring items) surpassed the Zacks Consensus Estimate of 49 cents. The bottom line however declined 20.3% year over year.

Total revenues of $643.9 million lagged the Zacks Consensus Estimate of $654 million and also declined 13.5% year over year. The top line was hurt by reduced sales at the distribution and services division.

Segmental Performance

The company through its subsidiaries operates via the segments of marine transportation as well as distribution and services.

The marine transportation division is responsible for providing transportation services by tank barge to inland and coastal markets. Revenues at the marine transportation unit increased 9.6% year over year to $403.3 million. Segmental operating income also rose 43.2% to $50.7 million. Segmental operating margin too expanded to 12.6% from 9.6% a year ago.

Inland market revenues rose 13% year over year on contributions from the Cenac acquisition and favorable pricing. The operating margin for the inland business was in the mid-teens, reflecting negative impact from significant delay days.

Hurt by planned shipyard days on large capacity vessels, revenues at the coastal market were flat year over year. The coastal operating margin was in the low-single digits.

The distribution and services segment is responsible for selling replacement parts and focuses on oil and gas, and commercial and industrial markets. Segmental revenues dropped 36.1% to $240.7 million due to below-par performance in the oil and gas market. The already weak market conditions were worsened by the COVID-19 pandemic, which reduced business activity in the distribution and services segment. Moreover, operating margin at the segment was 1.5% in the first quarter compared with 10% in the year-ago quarter.

The oil and gas market was weak during the quarter under review due to reduction in oilfield activity. Operating margin for oil and gas was in the negative mid-single digits.

In the commercial and industrial market, revenues augmented year over year, benefiting from the Convoy Servicing Company acquisition. During the quarter under consideration, the commercial and industrial operating margin was in the mid-single digits.

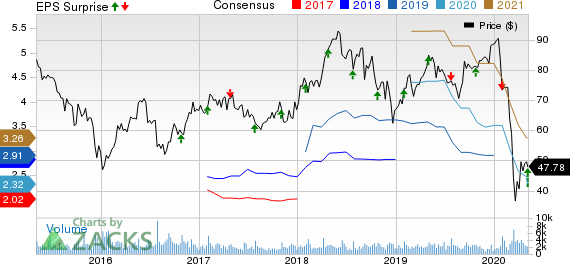

Kirby Corporation Price, Consensus and EPS Surprise

Kirby Corporation price-consensus-eps-surprise-chart | Kirby Corporation Quote

Balance Sheet Highlights

Long-term debt (including current portion) for this Zacks Rank #4 (Sell) company increased to $1.7 billion at the end of the first quarter from $1.67 billion at the end of March 2019. Debt-to-capitalization ratio at the end of first-quarter 2020 was 35.3% compared with 33.8% a year ago.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Outlook

With uncertainty looming over the duration of coronavirus and the extent of the global economic slowdown, Kirby has withdrawn its 2020 earnings guidance ($2.60-$3.40 per share).

In the inland marine business, activity and barge utilization levels have declined dramatically lately as a result of coronavirus-related headwinds and reduced consumer demand for certain commodities. Kirby anticipates the low volume scenario to persist until the economy revives.

Further, the company expects quarterly revenues and barge utilization at the coastal market to decline in the near term due to coronavirus woes. Additionally, expected reductions in the coal transportation business and the retirement of four of Kirby’s old coastal barges are expected to affect the company’s 2020 results.

With major customers limiting spending for 2020, oil and gas activity is expected to decline significantly, which in turn is anticipated to weigh on the distribution and services segment’s performance. In the commercial and industrial market too, reduced activity due to COVID-19 is predicted to weigh on Kirby’s core markets. Within commercial and industrial, the most severe impact is likely to be felt in the on-highway sector and in power generation with customers delaying maintenance spending and large capital projects. To mitigate the adversities in the distribution and services segment, the company is controlling costs through staff reductions, furloughs, lowering work hours and freezing pays. Additionally, the company plans to consolidate additional facilities and put a strict check on discretionary spending.

For 2020, capital spending is expected to be either at or below its previously guided range of $155-$175 million. This indicates a year-over-year reduction of approximately 40%. Further, the company will evaluate delaying new capital investments and non-essential purchases. Free cash flow is estimated between $250 million and $350 million for the current year.

Performance of Other Transportation Stocks

Within the broader Transportation sector, Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation WAB, Alaska Air Group, Inc. ALK and Trinity Industries, Inc. TRN recently reported earnings numbers.

Wabtec reported first-quarter 2020 earnings of 97 cents per share (excluding 39 cents from non-recurring items), falling short of the Zacks Consensus Estimate by a couple of cents. Moreover, the bottom line declined 8.5% year over year due to higher operating expenses. Also, total sales jumped 21.1% year over year to $1,929.9 million but missed the consensus estimate of $2,026.2 million.

Alaska Air incurred a loss of 82 cents per share (excluding $1.05 from non-recurring items) in the first quarter of 2020, narrower than the Zacks Consensus Estimate of a loss of $1.27. In the year-ago quarter, the company reported earnings of 17 cents. The downturn is due to an unprecedented drop in air travel demand in the wake of the coronavirus outbreak. Revenues came in at $1,636 million, missing the Zacks Consensus Estimate of $1,691.1 million. The top line also declined approximately 13% year over year.

Trinity’s first-quarter 2020 earnings of 11 cents per share (excluding $1.22 from non-recurring items) missed the Zacks Consensus Estimate of 14 cents. Moreover, the bottom line plunged 54.2% year over year. However, total revenues of $615.2 million surpassed the Zacks Consensus Estimate of $478.5 million. The top line also inched up 1.7% year over year on higher volume of railcars.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kirby Corporation (KEX) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

Alaska Air Group, Inc. (ALK) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance