Key Highlights From Williams' (WMB) Latest Presentation

At a recent presentation, The Williams Companies WMB discussed its current business and growth prospects.

Here’s a rundown of what the company had to say at the Barclays CEO Energy-Power Conference:

The diversified midstream giant has a strong fundamental position in natural gas infrastructure in the United States, handling around 30% of the nation’s total volumes. Williams’ operations include the company’s crown jewel and the nation’s largest and fastest growing natural gas pipeline system, Transco. Williams has a market capitalization of more than $30 billion at a Sep 20 closing stock price of $24.97 per share.

The adjusted EPS guidance range provided by the company suggests a roughly 14% CAGR from 2018 through 2021 (at the midpoint). Besides, it expects adjusted EBITDA at a CAGR of approximately 5% over that time. This provided some support to its leverage metrics, with debt to adjusted EBITDA set to come down from 4.80X in 2018 to below 4.20X by the end of this year. During the read-through of the presentation, it was quite clear that Williams’ adjusted EBITDA has increased in line with the volume of natural gas that it transmits and gathers. As it is, the stable fee-based business model allows the company to generate a relatively stable EBITDA hardly affected by the gyrations of commodity prices.

Williams, which carries investment grade ratings from the major credit agencies such as the S&P, Moody's and Fitch, is working on a number of new infrastructure projects that are slated to come online over the next few years. This will help the company meet its growth objectives apart from providing long-term cash flow visibility.

With an attractive yield of 6.6%, the Tulsa, OK-based company is also a favourite in the dividend investing community. Williams currently pays a quarterly dividend of 41 cents per share. That's after the company increased its payout by 2.5% earlier this year.

On top of its improving financial position and focus on shareholder value, the company has strong 2021 guidance. Management predicts adjusted EBITDA to increase 3.8% compared to 2020, while available funds from operations (“AFFO”) is expected to witness a year-over-year rise of 5.6%. This robust AFFO should provide Williams with a strong dividend coverage ratio of 1.9 and assure investors about the safety of the payout.

Zacks Rank & Stock Picks

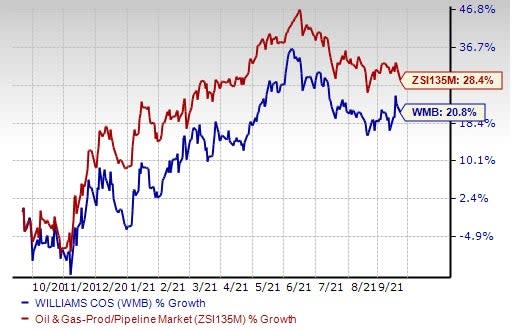

Notwithstanding these rafts of positive updates, Williams currently carries a Zacks Rank #4 (Sell) and its shares are only meant for the brave-of-heart. The stock has largely underperformed the industry in a year’s time (+20.8% versus +28.4%). The reason for the unfavourable rank stems from a growing debt burden, which is a concern for investors and restricts its credit profile. The company's debt-to-capitalization as of the end of the second quarter was 62%, not only quite high but also deteriorating from 61.6% three months ago.

Image Source: Zacks Investment Research

Earrings estimates have moved lower too. The Zacks Consensus Estimate for Williams’ 2021 earnings has come down from $1.20 to $1.18 over the past 60 days while next year’s number is off from $1.19 to $1.16.

Some better-ranked players in the energy space are Continental Resources CLR, Imperial Oil IMO and Northern Oil and Gas NOG, each presently flaunting a Zacks Rank of 1.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Continental Resources has an expected earnings growth rate of 436.75% for the current year.

Imperial Oil has an expected earnings growth rate of 421.95% for the current year.

Northern Oil and Gas has an expected earnings growth rate of 70.88% for the current year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

Imperial Oil Limited (IMO) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance