Key Factors to Impact Prologis (PLD) This Earnings Season

Prologis, Inc. PLD is slated to report first-quarter 2023 earnings on Apr 18 before the bell. The company’s quarterly results are likely to reflect growth in revenues and funds from operations (FFO) per share.

In the last reported quarter, this industrial real estate investment trust (REIT) delivered a surprise of 2.48% in terms of FFO per share. Results reflected better-than-anticipated revenues, driven by healthy leasing activity and solid rent growth.

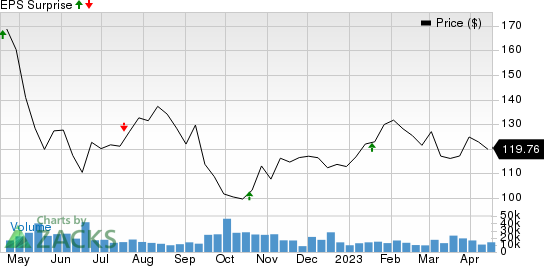

Over the trailing four quarters, Prologis beat the Zacks Consensus Estimate in terms of FFO per share on three occasions and missed the same on the other, the average beat being 1.53%. This is depicted in the graph below:

Prologis, Inc. Price and EPS Surprise

Prologis, Inc. price-eps-surprise | Prologis, Inc. Quote

Let’s see how things have shaped up before this announcement.

Factors at Play

Per a Cushman & Wakefield CWK report, in the first quarter, industrial demand has moved back to “normalized levels”, but it “still powers forward”. Amid high inflation and high-interest rates, slowing consumer demand and uncertainty in the economy, U.S. leasing totals witnessed a 9.4% decline from the prior quarter, with 136.9 million square feet (msf) of deals being signed in the first quarter. However, this total was in sync with the quarterly average achieved pre-pandemic.

There has been a flight to quality by logistic tenants, with tenants executing 59.1 msf of deals in industrial facilities built since 2020 during the quarter, marking 46.4% of the total. First-quarter net absorption came in at 62.5 msf. Although moderating, it was still comparable to quarterly totals recorded earlier in the expansion cycle, i.e., from 2016 to 2019.

Amid the normalization of demand and the spate of speculative deliveries, there has been an uptick in the overall U.S. industrial vacancy rate, which moved higher by 40 basis points (bps) in the first quarter to 3.6%. However, it is still lower than the 10-year historical average of 5.3%.

Moreover, asking rental rate growth remained high during the quarter. The same increased 3.5% sequentially, reaching another new high of $9.19 per square foot (psf) and surpassing the $9.00-psf mark for the first time.

Amid these, PLD is well-poised to benefit from this favorable trend, given its capacity to offer modern logistics facilities at strategic in-fill locations. Moreover, with global supply chains transforming for faster fulfillment and resilience, Prologis is likely to have captured favorable fundamentals with its differentiated customer offerings and solid investment activity in the to-be-reported quarter.

Prologis’ expansion efforts through acquisitions and developments in recent years are likely to have boosted the top line in the to-be-reported quarter. In addition, PLD is likely to have gained from its industry-leading cost structure.

Moreover, Prologis has decent balance sheet strength to fuel its growth endeavors. A market leader, this industrial REIT has the ability to raise capital at favorable rates. It is likely to have maintained financial strength with liquidity during the period in discussion.

The Zacks Consensus Estimate for first-quarter revenues is currently pegged at $1.63 billion, suggesting a nearly 51% year-over-year jump. The Zacks Consensus Estimate for the quarterly FFO per share of $1.21 calls for an 11.01% increase year over year.

Our estimate for development management and other revenues is presently pegged at $5.2 million for the first quarter. Our estimate for first-quarter average occupancy is 97.5%, suggesting a 30-basis point decline from the prior quarter.

Here Is What Our Quantitative Model Predicts:

Our proven model does not conclusively predict a surprise in terms of FFO per share for Prologis this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an FFO beat, which is not the case here.

Prologis currently carries a Zacks Rank of 3 and has an Earnings ESP of -1.37%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks That Warrant a Look

Here are three stocks from the broader REIT sector — Host Hotels & Resorts, Inc. HST, Boston Properties, Inc. BXP and SL Green Realty Corp. SLG — you may want to consider as our model shows that these have the right combination of elements to report a surprise this quarter.

Host Hotels & Resorts is slated to report quarterly numbers on May 3. HST has an Earnings ESP of +2.71% and carries a Zacks Rank of 3 presently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Boston Properties, scheduled to report quarterly numbers on Apr 25, has an Earnings ESP of +7.13% and carries a Zacks Rank of 3.

SL Green Realty Corp. is slated to report quarterly numbers on Apr 19. SLG has an Earnings ESP of +0.44% and a Zacks Rank of 3 presently.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Boston Properties, Inc. (BXP) : Free Stock Analysis Report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

Cushman & Wakefield PLC (CWK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance